Filbfilb, an analyst at crypto data provider Decentrader, announced the bottom targets of Bitcoin price in his Youtube post on November 24.

Worst case scenario for Bitcoin: $6,000

Known for his accurate forecasts, Filbfilb says that sales in the bear market could send BTC price back to the bottom of the 2018 bear market floor. He said that in his worst case scenario, Bitcoin could break $7,000. Filbfilb says the $6,500 region will be a strong support:

In my worst case scenario, I think it’ll probably be our end-point like old-fashioned, very hard support.

Noting that this level is about double the 2018 bear market and the March 2020 COVID-19 crash, the analyst adds that this is where buyers “probably start to refill their wallets.” However, he argued that while not “conclusive” under current circumstances, the more significant repercussions from the FTX collapse could push bid support higher up the order book and open the door for such a capitulation event:

Until we have more information, this looks highly unlikely and as I said, it’s a good sign for the bulls that we didn’t dump more than we really could,

Bitcoin is more resilient to its previous ATHs

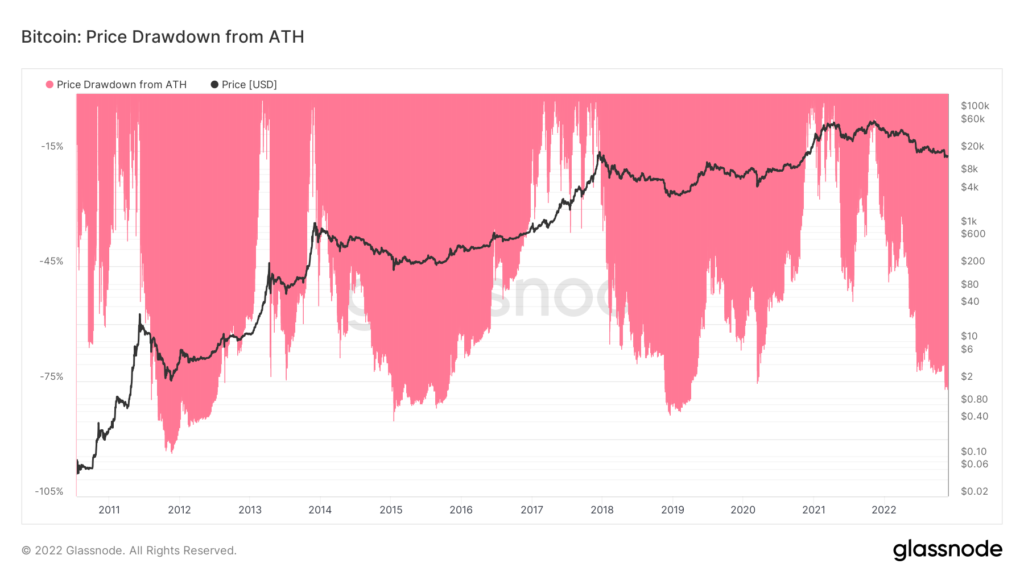

Meanwhile, the BTC/USD pair managed to drop less than previous bear markets compared to previous ATH levels. Discussions on this topic revolve around whether another correction is necessary to put an end to the current downtrend. Filbfilb says that as Bitcoin hits bottom, it needs to “dodge some bullets” from FTX. He also commented that macro markets should remain strong during this time.

BTC price hovers in bear market troughs

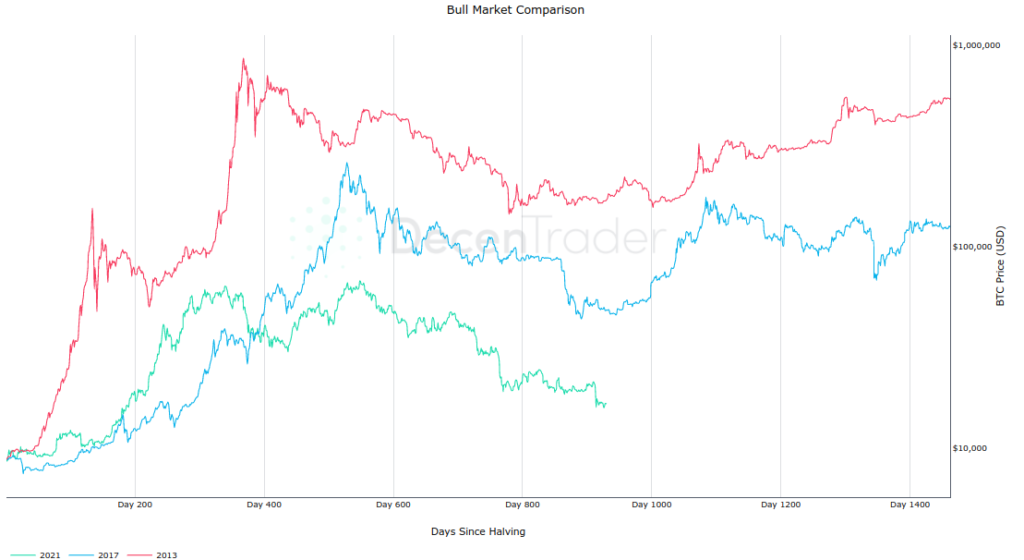

On the side, Decentrader co-founder Philip Swift has released other new graphics. Among them was a growing number of Bitcoin wallets that currently contain at least 1 BTC. The number is poised to exceed one million for the first time in a short time. Swift says this is a direct result of currency withdrawals in light of FTX. Although still far away, the next halving in 2024 will also become a major event going forward. This, in turn, “will have some positive effects on the price in terms of prospects.” A comparative chart shows that the BTC/USD pair is currently operating at the lowest part of its four-year cycle. It also reveals a strong correlation between 2014 and 2018.

Bitcoin is now struggling to recover due to declining investor confidence. Investors are afraid to buy back only for the price to drop. Additionally, most buyers are still on the sidelines for fear of post-FTX risk. Institutional demand is another segment that has been hit hard.

cryptocoin.com As you follow, BTC is currently spending time above $16,500. Institutional investors such as Purpose Bitcoin ETF Holdings are not yet choosing to buy the horse, despite the discount.