Jason Pizzino posted a video titled ‘History shows 6 Months to End of Bitcoin’ discussing the Bitcoin MVRV pivotal moment on Jan.

Crypto winter for Bitcoin could be prolonged

The analyst begins by looking at the S&P 500 index, emphasizing that the S&P is still holding above the 50% level since December 16, 2022. However, the analyst expects an upward movement. It is also holding the support level at $3,800 in case the up move does not occur. Pizzino emphasizes that he focuses on the macroeconomics of the market rather than a 2% improvement or loss. Still, he claims that $3,600 is still a safe range and there is room to continue moving forward.

It then shifts to the BTCUSD index, where in the past it has observed that Bitcoin has experienced 400 days of decline and 363 days of decline before recovering to the upside. Currently, Bitcoin has been down for 376 days, and Pizzoni shares that this could go even further.

In the period from 2018 to 2020, when the pandemic hit the market, the price of Bitcoin fell 817 days to about $3,800. Pizzoni adds that during this time, investors saw the opportunity and bought BTC, keeping the price in the range of about $8,000 to $10,000. cryptocoin.comAs we mentioned, Bitcoin is instantly traded at $ 19,921.

Price below value

Simultaneously, he explains that MVRV understands that the Exchange-traded price is below the “far value” and shows the ratio between market value and actual value, which is used to identify the market’s highs and lows.

He emphasizes that the last cycle, which was low in November 2018 and peaked in April 2021, can help create a good plan when buying Bitcoin from a macro perspective as we enter 2023. According to previous data, it forecasts low from June 2022. It will most likely be exhausted by June 2023 and will begin to recover in about 6 months.

Bitcoin forms checkpoint below $17,000

Bitcoin has been consistently trading below $17,000 for a very long time as volatility remains at its lowest level, which has enraged market participants and debated about the possible breakout zone and the period in which it could occur.

Unable to hold above $16,900, the star crypto found a new support level at $16,800 and greatly strengthened it. Since the FTX saga, BTC price has been respecting the resistance zone and thus it is assumed to form a ‘Checkpoint’ at $17,000.

According to Trend Rider, a well-known analyst, the 100-week checkpoint (POC) is framed at $16,800, where a large volume is produced in a given period. The longer the volume, the stronger the PoC resistance or support levels can be.

Owners sell at a loss

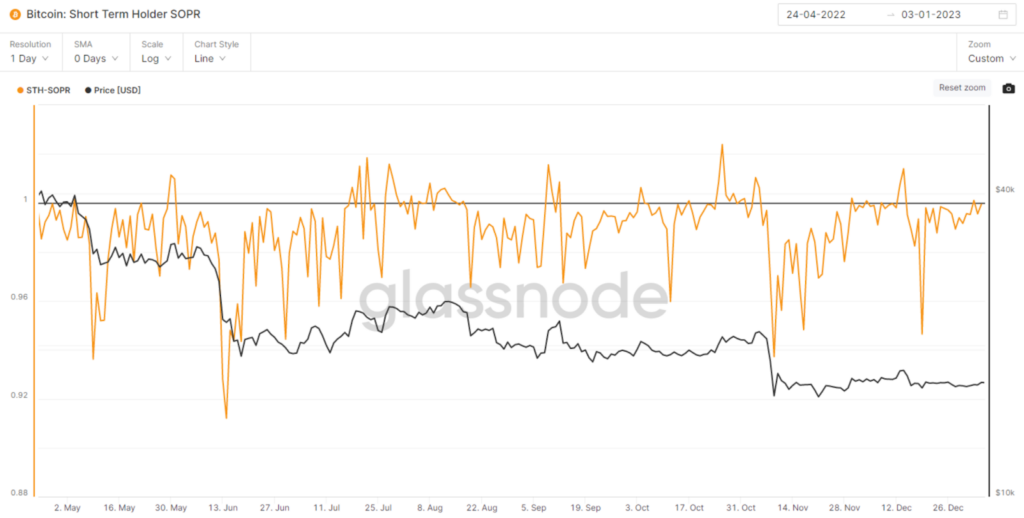

With Bitcoin prices trading in congested areas, on-chain indicators show that short-term Bitcoin holders are making small profits, while long-term holders continue to suffer huge losses. STH-SOPR and LTH-SOPR are quite prominent.

STH-SOPR compares the price sold with the price paid for Bitcoin in the last 155 days or about 5 months. A decrease in selling levels indicates that the trade ended at a loss. However, it is worth noting that traders were not in profit before the market crashed due to the collapse of Terra in May 2022.

Also, LTH-SOPR has fallen well below average levels, indicating that long-term holders are at a deep loss. SOPR levels have been on a downward trend since the start of 2022, marking the year as a strong bear market.

Collectively, Bitcoin looks to be on a beat as market participants eagerly anticipate some volatility regardless of the direction of the rally. Therefore, the longer the star stays away from crypto major price movements, the less interested traders may be in following the BTC price rally.