A widely followed crypto analyst drew attention to an altcoin project that has been on the agenda with a large investment recently. He thinks the investment of a $47 billion asset manager will provide momentum to this cryptocurrency. Here are the details…

Analyst drew attention to popular altcoin SUSHI

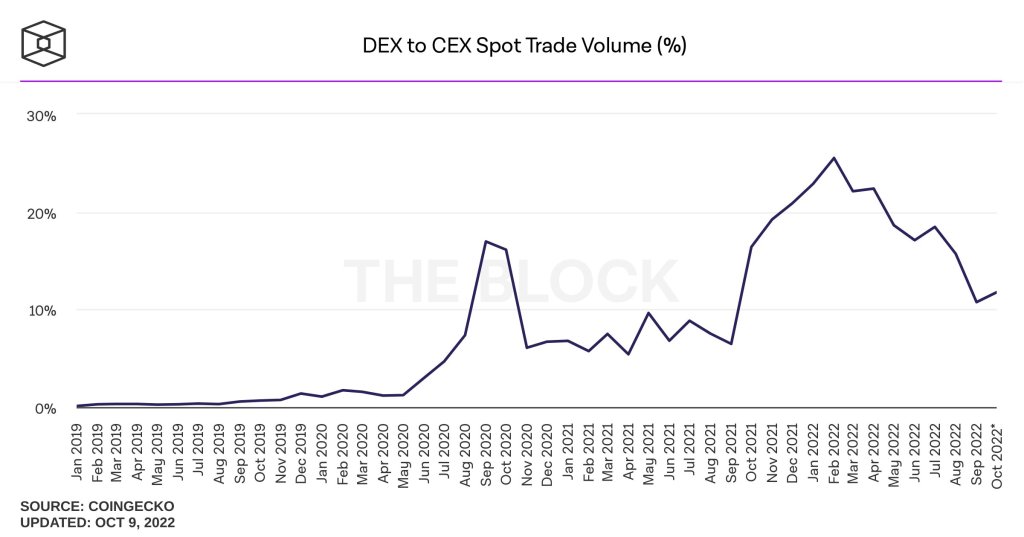

Will Clemente talks to his 660,800 Twitter followers about consistent use cases for crypto. First, he says, it enables market participants to trade illiquid altcoins on decentralized exchanges. “In fact, the ratio of DEX volume to central exchange spot volume is higher than last bull season,” the analyst says. He clearly states that there is a basic demand. Even amid the growing demand from crypto traders, Clemente underlines that the trading volume on SushiSwap has dropped drastically this year. The analyst uses the following statements:

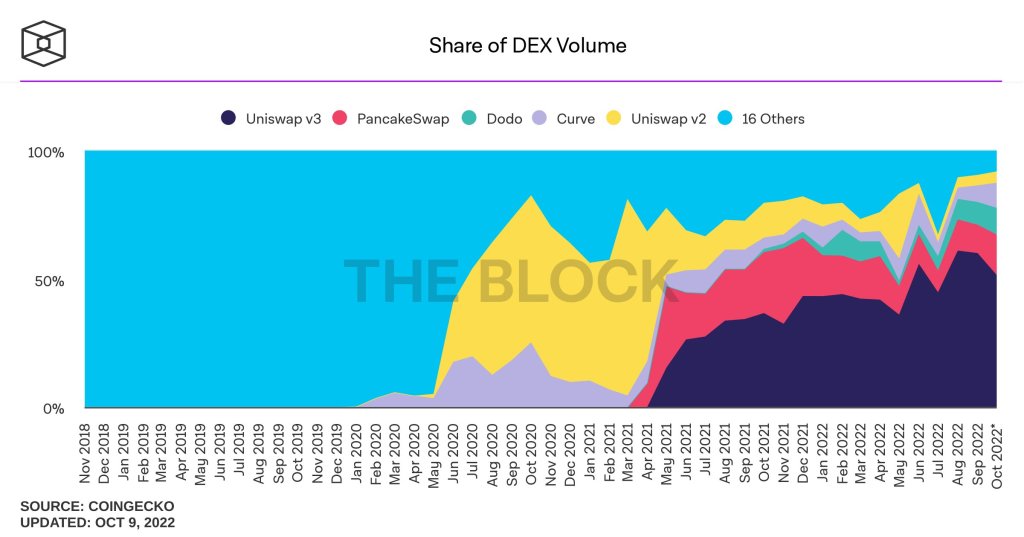

Due to leadership issues, among other things, SushiSwap’s volumes have dropped an estimated 89 percent to date. This put DEX significantly behind competitors like Uniswap.

However, Clemente thinks that SushiSwap’s hiring of Jared Gray as an executive will turn out well. Gray, the former CEO of former crypto exchange Bitfineon, has previously said that he plans to return Sushi to “his rightful status among others.” However, cryptocoin.com As we have reported, there are some negative feelings about SUSHI due to Gray’s background. Clemente also highlights that New York-based asset manager GoldenTree has taken up a relatively minor position at SUSHI.

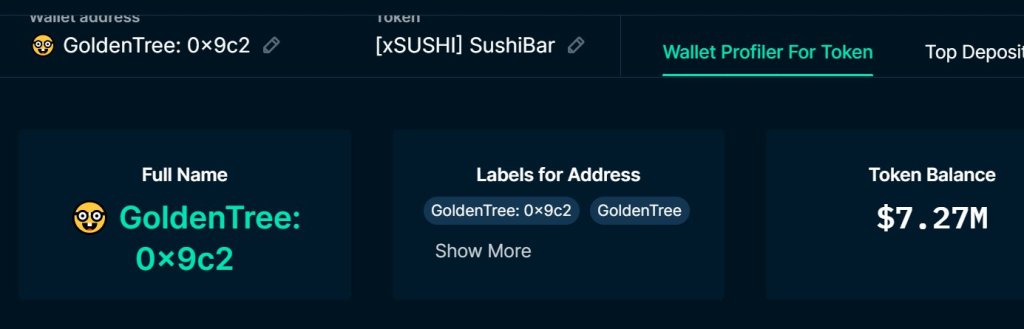

Clemente points to GoldenTree investment

GoldenTree, the $47 billion asset manager, took a $7.27 million position in Sushi. He showed his commitments by publicly sharing his wallets. He also expressed his intentions to support the protocol with a post on the Sushi forum. Clemente says GoldenTree’s investment in decentralized exchange (DEX) protocol SushiSwap (SUSHI) could provide a much-needed shot. According to Clemente, the public disclosure of GoldenTree’s entry and location could change SUSHI’s fate. The analyst uses the following statements:

Aside from the assumption that Avi Felman and GoldenTree will do everything in their power to not let their first major public crypto positions collapse, I think this presents an interesting asymmetrical opportunity for SUSHI. If GoldenTree makes positive changes, more will follow. After two changes are made, the market will make even more predictions. This can create a reflexive effect for the SUSHI return.

The analyst thinks that “similar to Alameda’s bet on DOGE, Avi, GoldenTree and the resources behind them will implement at least a few positive structural changes.” Therefore, he believes that the asymmetry is positive. According to the analyst, this is all the market needs to set more positive expectations.