Economists at TD Securities say gold points to additional downside on the horizon. Strategists also explain two reasons that keep the gold price high. Strategists at Commerzbank say gold will remain under pressure after strong US jobs data.

Gold points to additional downside on the horizon

Gold expanded its defense trade around $1,850 as we reported on cryptokoin.com . Economists at TD Securities underline that the yellow metal is close to entering a bear market trading regime. Economists assess

The war-related price action in Ukraine likely saved the consensus from additional purges in the face of a hawkish Fed. That’s why asset-holding traders keep this indifferent position. This group represents the biggest risk for a liquidation gap in the yellow metal. But with the next few sure-fire increases, traders may have to rely on post-September Fed prices to catalyze the tightness.

Economists say the margin of safety continues to decrease for gold to continue its uptrend. Economists continue their assessment:

This leaves only a narrow window for the yellow metal to avoid entering a bear market trading regime. Despite this, return-to-average signals are now outperforming below. Therefore, gold points to additional downsides on the horizon.

Two reasons that keep the gold price high

What triggers this gap between gold and real interest rates? The DKW model helps address this issue. Strategists at TD Securities attribute the difference between gold and real interest rates to an excessive increase in real interest rates, given the quantitative tightening. In addition, strategists attribute this situation to the huge amount of content still held under it, explaining:

Quantitative expansion is probably creating a shortage of these assets. The DKW model therefore highlights that the TIPS liquidity premium may have overwhelmingly driven real interest rates in recent months. Today, the market is left to absorb additional supply. Therefore, quantitative tightening puts pressure on this liquidity premium. Conversely, given gold prices, it can be partially attributed to quantitative tightening.

“Yellow metal to remain under pressure after strong US jobs data”

Gold remains under pressure. Strategists at Commerzbank say Friday’s strong Nonfarm Payrolls report amplifies the yellow metal’s downside potential. Strategists say:

Gold is held in check by the US dollar and rising bond yields. Yields on ten-year U.S. Treasuries are now still above 3%. This causes real interest rates to rise again. This situation made gold not attractive as an interest-free alternative investment.

Gold has found itself under pressure since last Friday, possibly thanks in part to the strong US labor market, strategists say. Strategists point to more new job creation than expected in the US in May as the reason. In addition, he explains the issue as follows:

Labor demand remained unchanged at a high level. Therefore, there is still the risk of a wage-price spiral. Therefore, we believe that further rate hikes by the US Fed are likely.

Pablo Piovano: Gold hovered around $1,850

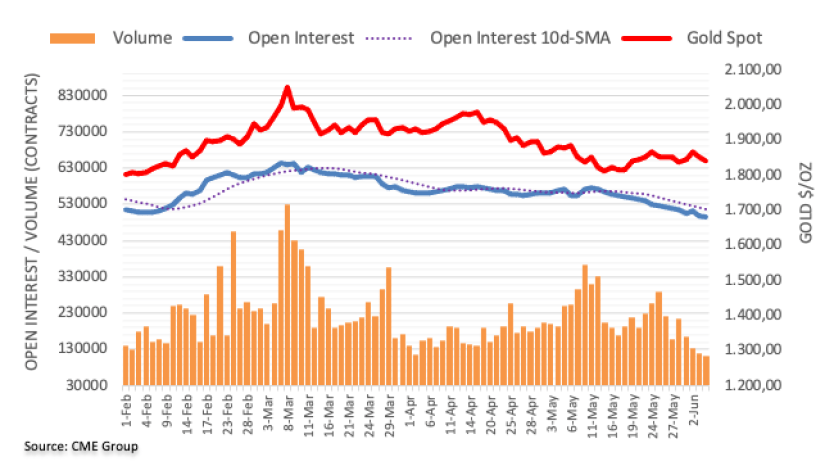

CME Group’s latest data for gold futures markets has been released. The data shows that traders shrank their last positions on Tuesday, this time with more than 1.1k contracts. It also notes that they have reached their third consecutive daily decline. Instead, volume reversed four consecutive daily pullbacks. Volume rose nearly 17,000 contracts.

The analyst says that the rise in gold prices on Tuesday accompanied the contraction in open interest. It also left the short-term price action to the downside. Meanwhile, the precious metal continues to hover around the $1,840/50 region for now.