One of the main factors that determine the course of the cryptocurrency market ETFs , shook the industry as of last night. Many companies that have recently applied for ETFs one after the other are using Bitcoin ( BTC ) He took it from the rope and sort of carried it on his back. BTC, which was in a very critical price zone at that time and could not overcome the resistance, broke $ 25,200 in volume with the power of ETF news and tested $ 31,800.

Today, this momentum has almost completely disappeared. Although BTC, which has been pricing in a downward trend since $ 31,800, caught a bit of a positive atmosphere with Grayscale defeating the SEC, this situation was very short-lived. Yesterday evening WisdomTree, Invesco, Galaxy, Valkyrie, Fidelity, VanEck, BitWise and BlackRockAnnouncing that it postponed ETF applications, the SEC said, ‘I am here no matter what.’

BTC, which recently rose to $ 28,150 with the strength it received from the SEC’s defeat against Grayscale, turned its course downwards again due to the influence of the SEC. Even though it is not yet considered to have won completely, the SEC took a step forward in the ETF issue and brought with it the pessimistic atmosphere in BTC.

The decline in Bitcoin was inevitable

If we include the selling pressure starting at $ 28,150, this decision of the SEC shook many data about the crypto industry. BTC, which saw volume sales at $ 27,500, dropped 7.02 percent in just a few hours, dropping to $ 25,650. The leader of cryptocurrencies, currently traded at $26,000, has not yet decided which price structure it will display. So, what are the expert opinions about the latest events in the industry? Kyrr.io founder, who stands out with crypto currency analysis Karasuand from our Coinkolik writers Ekin Albayrak,He shared his views with us.

Kyrr.io founder Karasu expressed his opinion on the postponement of ETF applications based on the technical outlook of BTC. Although ETFs have been postponed, the phenomenon based on the $ 24,800 – $ 31,000 range that has been going on since April is on the side of not panicking as long as $ 24,800 is maintained.

Stating that he focused more on price movements in the long time period, Karasu stated that price movements in the range of 24,000 – 24,800 dollars could pose a great danger. In addition, he stated that as long as it remains below $ 24,000, sharp sales may occur:

On the BTC side, the price structure from April maintains the band of 31,000 and 24,800 dollars. On the Bitcoin side, the band range of 31,000 to 24,800 of the price from April still continues. The range I specifically base on is HTF. Pricing on HFT below $24,000 will set the stage for sharp selling fluctuations in the market. The part that will turn the market back to a positive state is $ 29,800, as I mentioned in the chart below. Exceeding this level will breathe new life into the market.

Karasu’s 1-day BTC/USDT chart:

Ekin Albayrak, one of the authors of Coinkolik, evaluated the recent turmoil of the market. He stated that the power sought by the cryptocurrency market was hit by the SEC’s postponement of the spot BTC ETF application decision of 6 companies. Albayrak said that analysts increased the possibility of approval of ETF applications, especially after the decision of the Grayscale SEC case, and stated that what was expected did not happen:

Apparently, Gensler does not want the dollar to get out of control yet, that is, to flow into the cryptocurrency markets. Gensler is set to testify twice, on Sept. 2 before the Senate Banking Committee and then before the House Financial Services Committee on Sept. 27. Patrick McHenry, the top representative on the House Financial Services Committee, criticized Gensler’s approach to digital asset regulation as overly aggressive, highlighting Gensler’s lack of guidelines on which digital assets fall under the SEC’s jurisdiction. We will keep our eyes on these two meetings in September.

Evaluating the reflection of the problematic process on the fundamental analysis side to the technical side, Albayrak expressed his views on Bitcoin.

After Grayscale’s SEC victory, BTC, which showed a daily closing above $ 26,858, which I indicated with the blue line, had reached the level of $ 28,000. However, yesterday, Bitcoin returned to $25,700 levels as the SEC postponed all pending spot ETF filings. For a positive sign, we must see daily candle closes at the $26,858 level again, otherwise our direction is blinking downwards. BTC should not lose the $25,560 – $25,720 support level on the daily. If the region is lost, it could move towards the lower levels of $21,900 – $23,550.

Ekin Albayrak’s 1-day BTC/USDT chart:

Social metrics skyrocketed

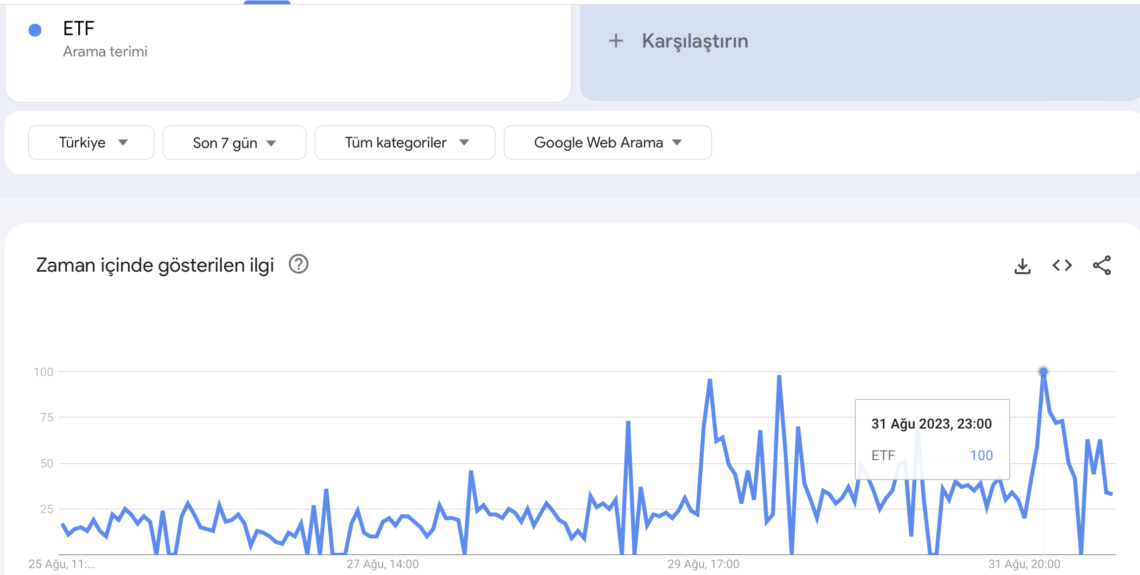

As the SEC postponed ETFs one by one, many social metrics peaked. According to data obtained from Google Trends, the word “ETF” searched in Turkey during the news flow hour reached the highest value, reaching 100 points. ETF Google search, which has been increasing since August 25, reached a very large value on August 29, but reached its peak due to the ETF bombardment last night.

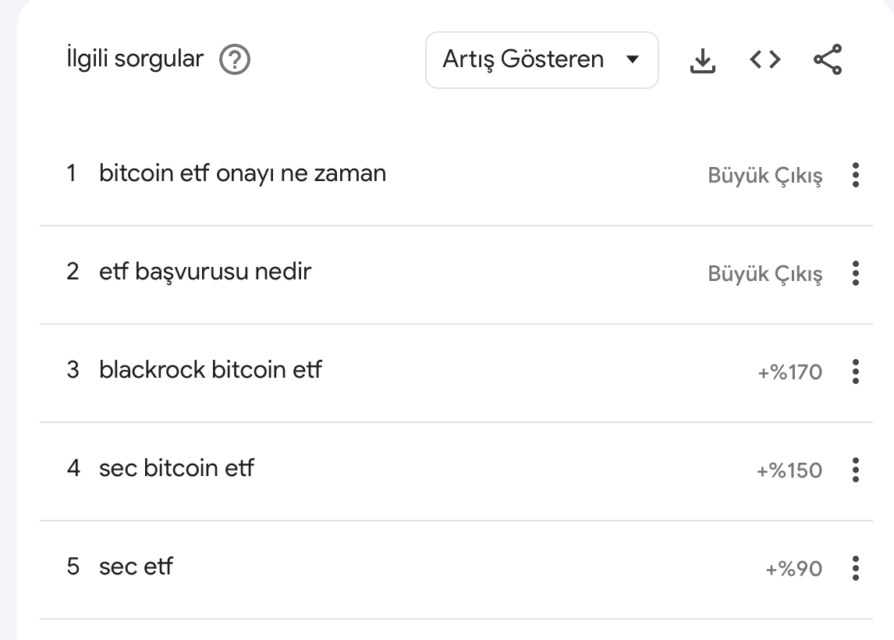

In addition, not only the word ETF, but also many related words were included in the “Increasing” category in Google Trends. Turkey Google-wide trends most clearly included in the phrase “when bitcoin etf approval” was. Then came the question “What is an ETF application?” Likewise, Google searches for the ETF topic increased from 90 percent to 170 percent.