Global crypto investment products attracted net inflows of $1.9 billion last week, according to asset manager CoinShares. This entry was likely also influenced by Donald Trump’s recent pro-crypto executive orders. Unusually, CoinShares noted that no digital asset investment products, including Bitcoin, saw net outflows last week.

Cryptocurrency investment products saw net entry without wastage!

Global crypto funds managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares recorded net inflows of $1.9 billion last week, driven by Trump’s crypto executive orders, according to CoinShares. Executive orders build trust among investors, CoinShares Research Manager James Butterfill said in a report published Monday. He also noted that no global digital asset investment products witnessed net outflows last week.

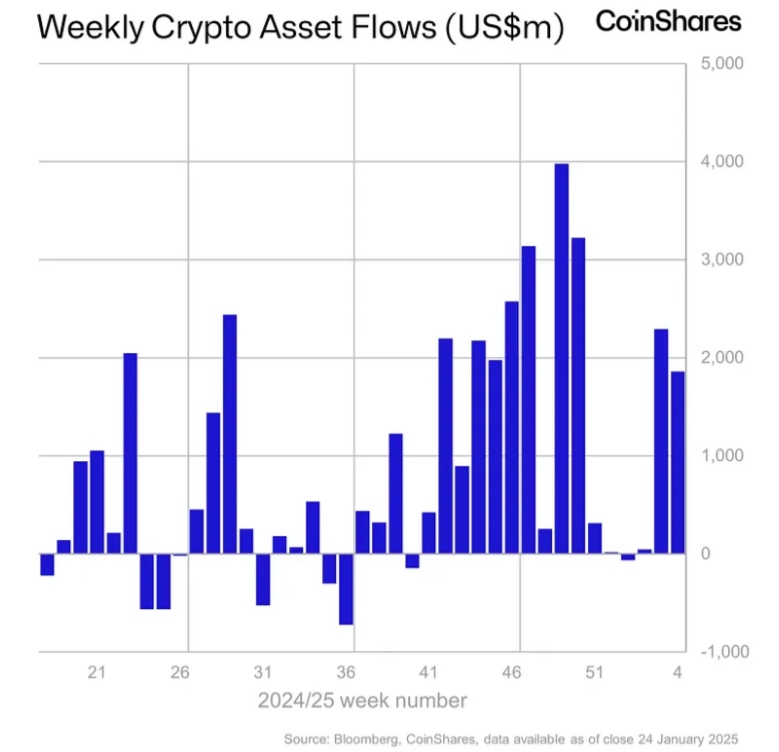

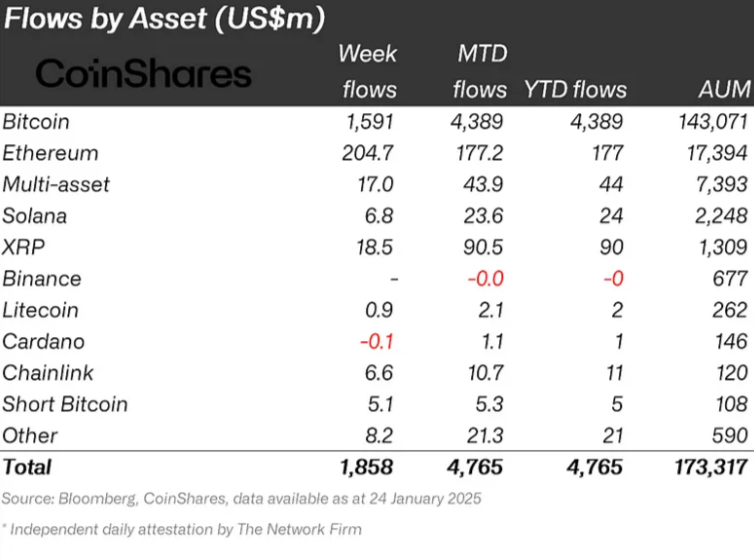

Weekly crypto asset flows. Images: CoinShares.

Weekly crypto asset flows. Images: CoinShares.President Donald Trump on Thursday signed an executive order creating a “Presidential Working Group on Digital Asset Markets” to develop a federal regulatory framework for digital assets, including stablecoins, and consider the creation of a “strategic national digital asset stockpile.” Trump also signed a full and unconditional pardon on Tuesday for Silk Road creator Ross Ulbricht, who is integral to the early history of Bitcoin.

US and Bitcoin-based funds dominate

Unsurprisingly, US-based crypto funds accounted for $1.7 billion of weekly net inflows. Thus, the USA achieved regional leadership. Digital asset investment products in Switzerland, Canada and Germany also witnessed net inflows of $35 million, $31 million and $23 million respectively.

Bitcoin-based investment products again led the world in last week’s net inflows with $1.6 billion. They remain the best-performing crypto funds this year, accounting for $4.4 billion, or 92% of all net inflows to date. According to the latest data, US spot Bitcoin ETFs represented $1.8 billion of total net inflows.

Along with Bitcoin, 5 altcoins also recorded entries!

Ethereum-based funds also continued to recover, attracting total net inflows of $205 million. US spot Ethereum ETFs accounted for $139.4 million of net inflows last week. XRP investment products added $18.5 million to its inflow streak of over $500 million since mid-November. Meanwhile, Solana (SOL), Chainlink (LINK) and Polkadot (DOT) funds also generated significant net inflows of $6.9 million, $6.6 million and $2.6 million, respectively.

Source: CoinShares

Source: CoinSharesButterfill said price action has been relatively flat over the past seven days. However, he stated that transaction volumes remained high at $25 billion. It also noted that it accounts for 37% of all transaction activity on reliable cryptocurrency exchanges.

To be instantly informed about the latest developments, contact us Twitter ‘ in, Facebook in and Instagram Follow on and Telegram And YouTube Join our channel!