A lot of the buzz in blockchain tech circles this year has been over the push toward secondary “layer-2” networks atop Ethereum being built on “zero-knowledge” cryptography, or ZK – seen by many experts as superior to the “optimistic rollups” that currently dominate. So the question is why the U.S. crypto exchange Coinbase and venture capital firm Andreessen Horowitz are choosing OP Stack, modeled after Optimism’s optimistic rollup, to build their new networks. Margaux Nijkerk dives into the question in this week’s feature.

We’re also covering:

You’re reading The Protocol, CoinDesk’s weekly newsletter that explores the tech behind crypto, one block at a time. Subscribe here to get it every week.

Network news

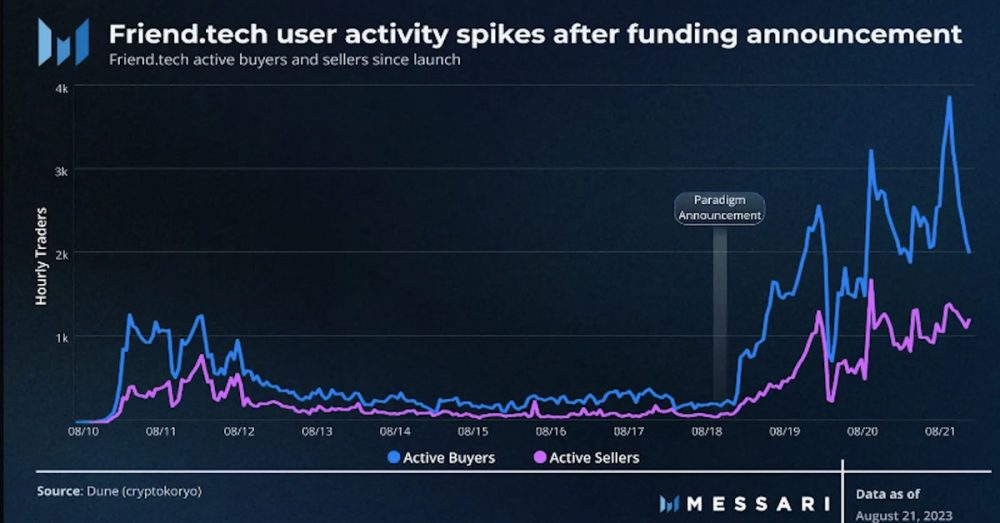

PRICE OF POPULARITY: Coinbase, the big U.S. crypto exchange, is getting a fast education, as one of the first big publicly traded companies to run its own blockchain. Its new Base project, a layer-2 network atop Ethereum, just launched this month, and already one of its new applications, Friend.tech, has gone viral, quickly attracting more than 100,000 users and generating more than $25 million in fees. Friend.tech, which allows users to purchase shares of X (Twitter) influencers, saw a rapid spike in activity (see chart above) after announcing on Aug. 18 that it had scored seed funding earlier this year from the crypto-focused venture-capital firm Paradigm. Friend.tech’s early success has helped drive up key metrics on the Base network, driving its total value locked (TVL) past $200 million and at one point pushing transactions per second above those of Ethereum as well as rival layer-2 projects Arbitrum and Optimism. According to FundStrat, Base has accrued nearly $4 million in fees, $2.5 million of which is retained by Coinbase; it works out to $30 million extra revenue on an annual basis. One question is whether Base can retain the growth once this hot ball of money bounces to the next crypto craze. “Friend.Tech’s speculative nature,” writes Galaxy Research, “highlights ongoing questions over Coinbase’s role in moderating a chain that today is ‘decentralized’ in name only.”

TAKING PROFITS? Blockchain data shows that Ethereum co-founder Vitalik Buterin withdrew 1,000 ether (ETH) (worth $1.67 million) from the DeFi lender Maker and then deposited 600 ETH ($1 million) on Coinbase, the crypto exchange, according to the X account @Lookonchain. It’s not clear why Buterin transferred the ether, but typically such moves are seen by analysts as a precursor to a sale. The price of ETH is up 39% year-to-date, after a recent market slide. According to CryptoSlate, “the wallet known as “vitalik.eth” was created seven years ago and contained 3,993 ETH (worth $6.5 million) as of press time.”

BINANCE BLUES. The world’s largest crypto exchangesowed confusion after mistakenly announcing on social media that euro transactions were no longer available. Its banking partner in Europe, Paysafe Payment Solutions, subsequently cleared up that withdrawals and deposits would still be available until Sept. 25. But Binance has not provided a timeframe for what happens after that. The exchange faces investigations and regulatory suits in several jurisdictions, including France and the U.S. Separately, Binance.US struck a deal with the payment startup MoonPay to restore customers’ ability to deposit dollars, suspended in June after the company lost ties with various banking partners.

ALSO:

Protocol Village

Highlighting blockchain tech upgrades and developments.

Money Center

Deals and grants

Data and tokens

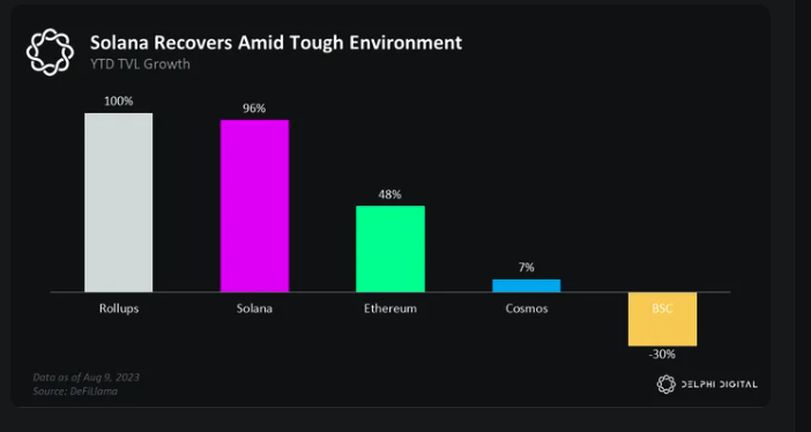

Solana claws back in DeFi

Solana – one of the hardest hit blockchain projects in 2022 partly due to its reputation as one of the “Sam coins” with ties to Sam Bankman-Fried’s trading firm, not to mention the revelation by CoinDesk that much of the activity in the ecosystem was faked – might have regained some of its footing. According to a recent report from the analysis firm Delphi Digital, Solana’s “developer ecosystem has consolidated but remained resilient, and the core protocol has shipped meaningful code.” This year, Solana’s total value locked (TVL) has jumped 96%, according to the report, with improving prospects for fast adoption of applications built on the network.

(Delphi Digital)

EigenLayer postcript

Loyal readers will recall that last week’s feature in The Protocol, by Sage D. Young and yours truly, highlighted the growing conversations over EigenLayer, a project focused on “restaking” – essentially a way of repurposing ether (ETH) staked on Ethereum’s proof-of-stake network to secure additional projects. The story noted that EigenLayer keeps raising its capacity, and the limits keep getting maxxed out immediately – seen as a sign of demand (or at least speculation). The story noted that another capacity increase was due on Aug. 22. Well, that happened, and the project immediately hit the new caps, as reported Wednesday by our Oliver Knight.

Calendar