Crypto winter continues to be dogged by regulatory attacks and court drama. Most notably, the U.S. Commodity Futures Trading Commission placed a trio of decentralized crypto platforms into its crosshairs last week. An aggressive set of charges from the CFTC – which zeroed in on how the trading platforms handle certain kinds of third-party token swaps – contrasted with the regulator’s more lenient image. Tech developments have not abated, however: Consensys announced a pair of upgrades for MetaMask, its crypto wallet, and Infura, its crypto infrastructure platform. Ethereum co-founder Vitalik Buterin also got the crypto community talking with a research proposal for regulation-friendly privacy mixers.

Today’s feature from Margaux Nijkerk is about Ethereum’s plan to phase out its biggest testnet, Goerli, in favor of a new one, Holesky. Like its predecessor, Holesky will look like a clone of the main Ethereum network, but it will allow developers to test their programs with lower financial stakes. If all goes to plan, the new testnet will be operated by a larger network of validators than Ethereum itself, which should make it better than Goerli for testing applications and upgrades under realistic network conditions.

You’re reading The Protocol, CoinDesk’s weekly newsletter that explores the tech behind crypto, one block at a time. Subscribe here to get it every week.

Network news

RIPPLE REVIEW: Riding high after its partial court victory over the U.S. Securities and Exchange Commission in July, Ripple Labs, the blockchain developer that uses the XRP token in its payments network, may now have to defend the decision before a U.S. appeals court. In a filing last week, the SEC argued that an appeals court should decide the question of whether Ripple violated securities law in making XRP available to retail investors by putting it on crypto exchanges. “The Defendants themselves say that the issues have industry-wide significance and are of special consequence,” the SEC wrote. Separately, Ripple is plowing forward on the business side, announcing last week that it has acquired Fortress Trust, a Nevada-based chartered trust company with a crypto and Web3 focus. Ripple declined to disclose further details when contacted by CoinDesk, though a person with knowledge of the matter said the price tag was less than the $250 million it paid for custody firm Metaco in May.

DEXES DINGED! Last week, the Commodity Futures Trading Commission charged three decentralized finance (DeFi) platforms – Opyn, Inc., ZeroEx (0x), Inc. and Deridex, Inc. – with operating illegal derivatives trading services. Notably, the CFTC reprimanded the smart-contract based trading platforms for supporting tokens that were issued by third-parties. Just a week earlier, a New York court dismissed similar claims against Uniswap in a class action case, with a judge arguing that the decentralized exchange platform was not accountable for third-party “scam tokens” listed to its platform. The CFTC charges were significant in the context of the wider U.S. regulatory landscape. For several years now, the CFTC and Securities and Exchange Commission have been in a jurisdictional turf war over who should regulate the U.S. crypto industry. The industry has generally lobbied in favor of oversight by the CFTC, which holds a reputation as the less strict agency, but last week’s aggressive CFTC actions drew long-standing assumptions about the regulator into doubt. On the other hand, CFTC Commissioner Caroline Pham did pitch a relatively crypto-friendly, “time-limited” program last week to pave the way for regulated crypto markets and tokenization.

TOKENIZATION TALK: The market for tokenized assets could mushroom to $16 trillion by 2030 according to a 2022 report from the Boston Consulting Group, and a wide slate of financial firms – traditional and crypto-focused alike – are positioning themselves to bite out a piece of the tokenization pie. Mirae Asset Securities, a South Korean financial group with over $500 billion in assets under management, said last week that it had partnered with Polygon Labs to develop a tokenized securities network. Meanwhile, a group of crypto industry heavyweights including Coinbase, Circle and Aave formed the Token Advocacy Coalition to foster the adoption of public blockchains and DeFi, and to bring the “next trillion dollars of assets” on-chain. The tokenization hype hasn’t gone unnoticed on Wall Street: JP Morgan is reportedly considering its own blockchain-based token for settling payments.

Also:

Vitalik Buterin’s X account was hacked last week and used to promote phishing links. Scammers reportedly managed to loot $691,000 from unwitting followers of the Ethereum co-founder.

Founder of collapsed Turkish crypto exchange Thodex was sentenced to 11,196 years in prison, according to local media.

NounsDAO barrels toward treasury split after NFT holders rally for “rage quit.”

Protocol Village

Highlighting blockchain tech upgrades and developments.

Fireblocks CEO Michael Shaulov (Fireblocks)

Money Center

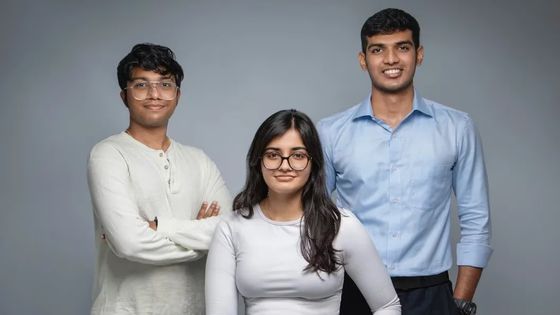

Brine Fi founders from left to right: Shaaran Lakshminarayanan, Ritumbhara Bhatnagar and Bhavesh Praveen (Brine Fi)

Fundraisings

Deals and grants

Data and tokens

Regulatory, Policy and Legal

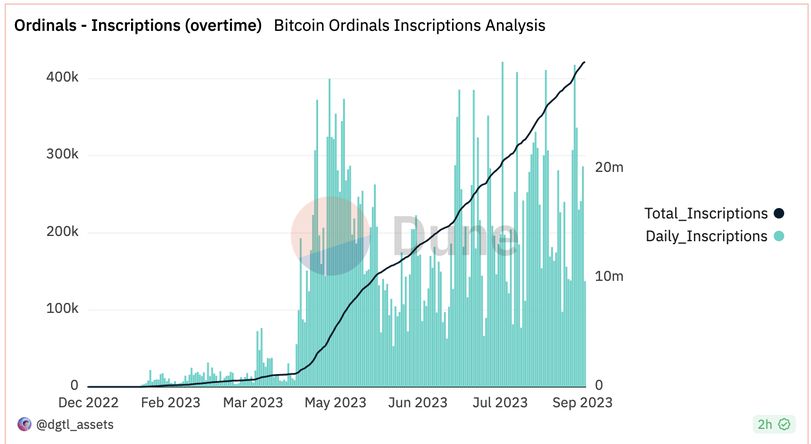

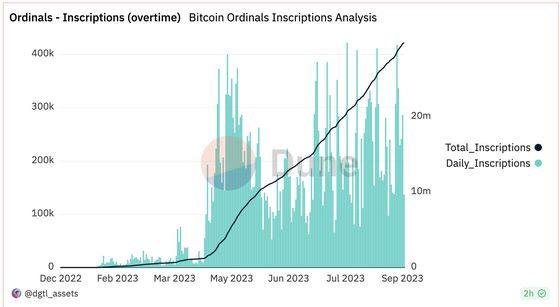

Bitcoin Ordinals Inscriptions Aren’t Going Away

Bitcoin NFT sales have declined but Ordinals inscriptions continue rising, according to TokenInsight. A record 418,240 inscriptions were minted on Sept. 3, the second highest daily mint to date, the research outlet reported last week.

(Dune Analytics/TokenInsight)

Calendar