The sale of Pepe’s whale, which is the third largest in the market value, left question marks about the direction of Memecoin. 325.48 billion pepes sold over Binance were worth $ 5 million. This whale has accumulated tokens in a 10 -month period and achieved $ 1 million.

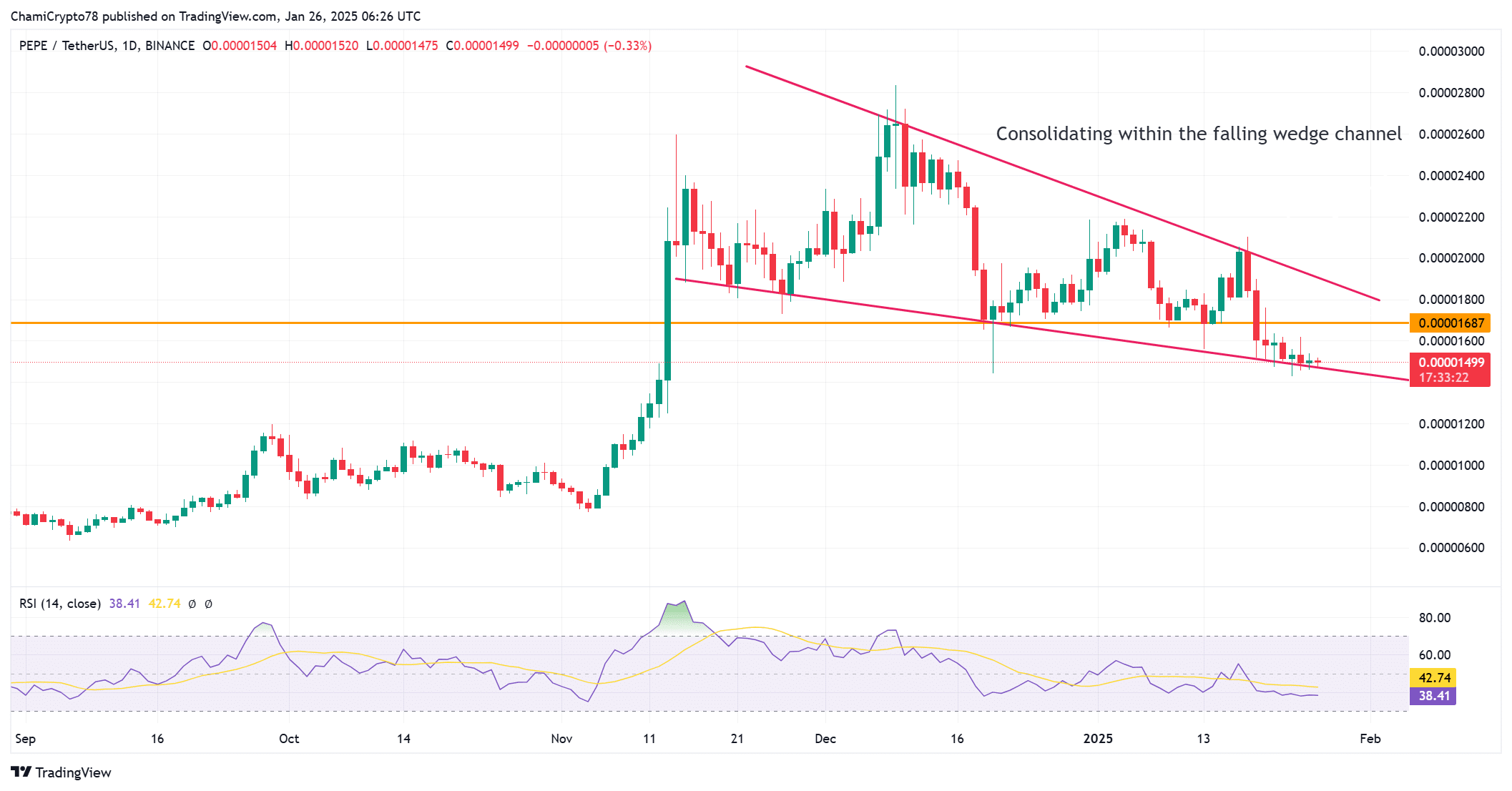

Is it possible to exit from the falling wedge formation?

Pepe’s price is currently consolidated in the falling wedge formation. This type of structure usually points to a turn in the direction of rise. However, popular Memecoin is difficult to overcome the critical resistance of $ 0.00001687, which limits the upward momentum.

In addition, the relative power index (RSI) is 38,41, which shows that it is approaching the over -selling zone. This may attract potential buyers. However, the ongoing sales pressure must be absorbed for the recovery of the price.

How did Trump’s Memecoin output affect Pepe?

Donald Trump’s increasing interest in Memecoin initiatives played an important role in the performance of beings such as Pepe. Elon Musk, who increased the interest in Dogecoin, also brought my momentum to the sector.

Social media data showed that Pepe was mentioned 31,000 times last week. This reveals Pepe’s powerful existence among the Memecoins. However, these macro trends and supports can form a basis for the future growth of token despite market uncertainty.

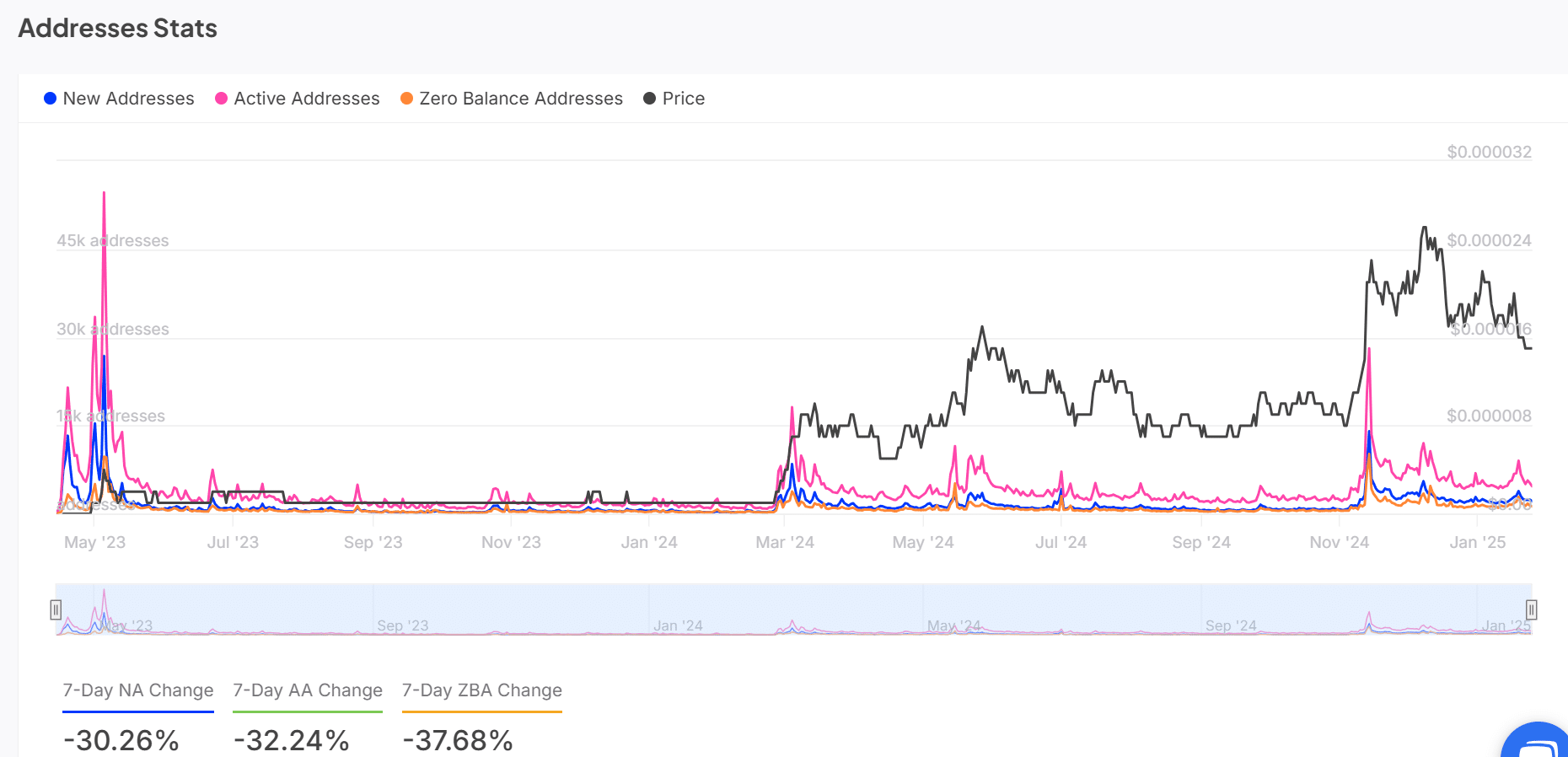

The decline in active addresses is concerned

Pepe’s last address statistics revealed that there was a significant decrease in participation. Active addresses decreased by 32.24 %last week, while new addresses decreased by 30.26 %. This trend reveals that individual investors have decreased and weakened liquidity.

However, with the increase in the number of individual investors, it can enter the rise trend and strengthen the market’s market position. Pepe’s social media and marketing strategies are effectively using more investors and users.

Does big memecoin procedures give hope?

Despite the decrease in general activity, large transactions tended to increase by 3.50 %. This reflects that whales maintain their confidence in Token. However, excessive dependence on the whales poses a risk that can destabilize the market.

Therefore, Pepe needs to increase the adoption rate for sustainable growth and expand retail participation. A market structure based on whale processes may not be sufficient for long -term stability.

Will Pepe be recovered or will the decline continue?

Pepe’s recovery potential depends on the combination of basic factors, such as the exit from the falling wedge formation and the re -gaining retail interest. However, the decrease in active addresses and the dependence on whale activities create question marks about the sustainability of momentum.

As a result, Pepe’s future depends on the ability to solve the difficulties of utilizing and participating in macro trends. If these changes do not take place, the token may remain under downward pressure.