Zcash, horizen and stellar might be securities, according to new regulatory filings. We’re starting to get even more clarity about the U.S. Securities and Exchange Commission’s efforts to bring the cryptocurrency sector in line with its existing regulations.

For those of you who received the trial daily newsletter last week and want to provide feedback, I fixed the form! Also, I should clarify: That’s a separate product that the CoinDesk regulation team may publish, but it would not replace this newsletter, which would remain a weekly offering.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Whither securities law?

The narrative

Grayscale Investments, a subsidiary of CoinDesk parent company Digital Currency Group, disclosed in regulatory filings that the SEC has been asking about its analysis of zcash (ZEC), horizen (ZEN) and stellar (XLM). Moreover, the regulator appears to have suggested that those three cryptocurrencies might be securities under federal law.

Why it matters

The SEC has yet to begin any kind of formal effort to issue rules directing crypto exchanges to register as securities exchanges. In the absence of that formal rulemaking effort, we’re left looking at how the SEC seems to be approaching cryptocurrencies it sees as securities. News that it identified more cryptocurrencies as securities this year sheds (a tiny bit) more light on that question.

Breaking it down

ZEC, ZEN and XLM may be securities, Grayscale said in regulatory filings for its trust products based on those three cryptocurrencies.

The SEC’s Divisions of Corporation Finance and Enforcement contacted Grayscale earlier this year, CoinDesk’s Danny Nelson reported over the weekend, asking about the trust products tied to those three cryptocurrencies.

What’s more, reading between the lines, it would appear the SEC has said those cryptocurrencies might be securities.

“The SEC staff has not provided any guidance as to the security status of ZEC and the sponsor has been contacted by staff from the SEC’s Divisions of Corporation Finance and Enforcement concerning the sponsor’s securities law analysis of ZEC,” the filing for Zcash said in June.

The filing in August said Grayscale received a memorandum from its “external securities lawyer,” which led the company to feel comfortable in saying those three cryptocurrencies aren’t securities, but nevertheless, based on what the SEC has said, Grayscale “acknowledges that ZEC [etc.] may currently be a security, based on the facts as they exist today, or may in the future be found by the SEC or a federal court to by a security under the federal securities laws.”

An observer can couple that report with the SEC’s previous claims that nine other cryptocurrencies are securities under federal law to get hints on how the agency is approaching the issue.

There’s two things that strike me about the SEC’s thinking.

First, the SEC is really ramping up. We still don’t have any kind of formal rulemaking process directing crypto trading platforms to register as securities exchanges, but the agency is clearly building up a set of precedents. Remember, the SEC’s inquiry to Grayscale comes alongside the SEC calling nine other cryptocurrencies securities just a few months ago.

The other thing is just which cryptocurrencies are listed. Grayscale offers trusts with exposure to all sorts of cryptos: basic attention token (BAT), bitcoin cash (BCH), Decentraland’s MANA token, ethereum classic (ETC) and so on. The SEC specified ZEC, ZEN and XLM.

XLM is an easy one. It’s fairly similar to XRP, and the SEC is now 20 months into a legal fight over whether XRP sales were securities sales. The agency treating XLM similarly makes sense.

ZEN … I’ve got to be honest, I completely forgot that this token even existed. I remember it getting some attention in like 2018 and haven’t heard anything about or from it since. That being said, it’s supported by Horizen Labs, i.e. a centralized entity. And Digital Currency Group founder Barry Silbert seems to have implied that the token’s value would increase, citing a Horizen Labs’ press release after a recent fundraising round. So, sure, I can see the argument here.

Zcash is the one that’s raising alarm. It did have a “premine” (albeit paid out differently from Ethereum) and it has a “dev tax” (a percent of mined ZEC goes to Electric Coin Co.) – two reasons why the token would be deemed to be a security. But we don’t know that for sure yet.

Regardless, in the absence of that formal rulemaking process, we’re left to look at what the SEC has done so far to try to understand how the SEC is defining “securities” as they pertain to digital assets – and this is more specific than just SEC Chairman Gary Gensler saying every crypto he sees looks like a security.

Biden’s rule

Changing of the guard

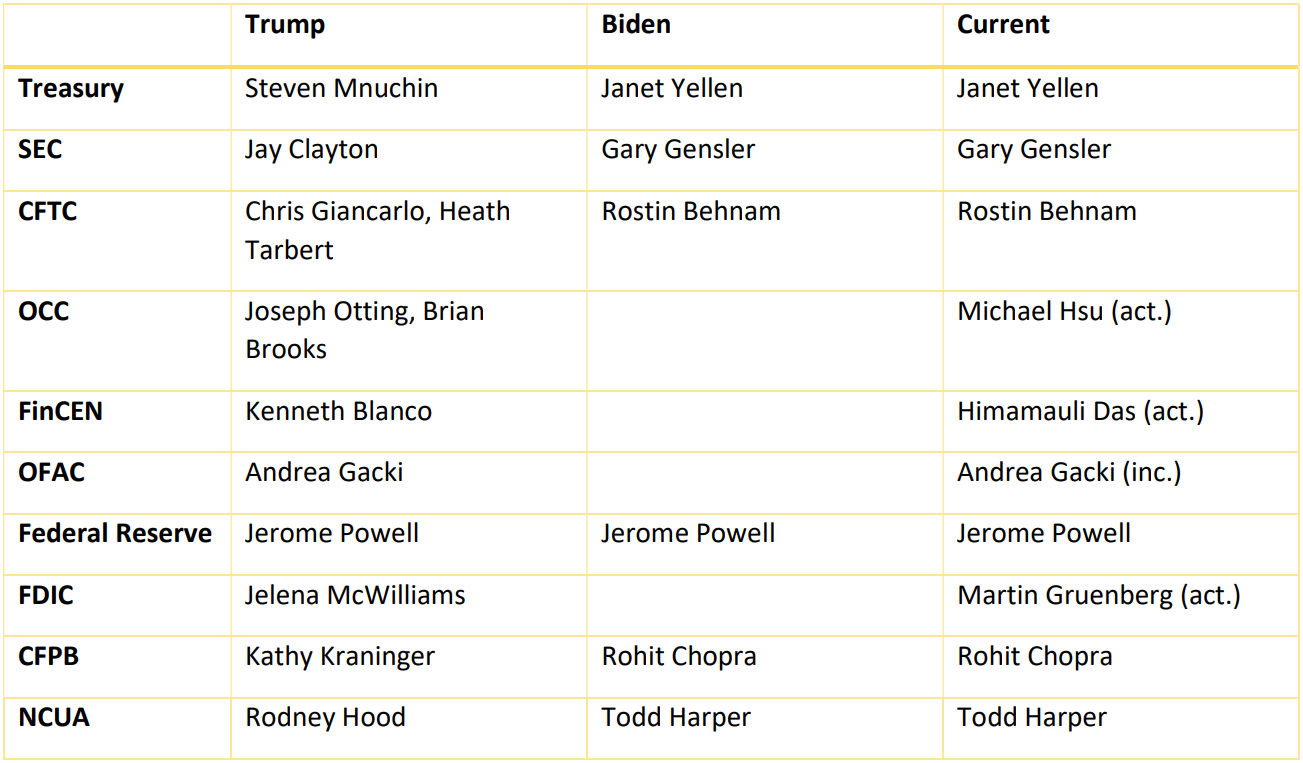

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

Nothing new to report, move along now.

Outside CoinDesk:

-

(The Washington Post) Peiter Zatko, Twitter’s former chief of security, has alleged major issues with how Twitter protects its systems from spam and hackers.

-

(Rolling Stone) Rolling Stone takes a look at El Salvador’s bitcoin law and the impact on El Salvadorians since its rollout.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!