We Found Efewith, US-based bank company Silicon Valley Bank‘s downfall, stablecoin service of USDCcollapse and the accompanying We compiled the crypto market.

The moves of the USA to fight inflation sharply bring with it interest rate hikes. The USA, which has been increasing interest rates regularly for a long time, has not yet signed a sharp decrease in inflation. In addition, this situation fueled the concern of recession by global markets. As a matter of fact, the first product of fears created a bomb effect on the agenda. one of the major banks in the USA Silicon Valley Bank went bankrupt . This bankruptcy is also the result of Circle, the parent company of stablecoin service USDC. Caused him to lose $3.3 billionand the collapse of traditional finance has spilled over into the crypto industry.

The Collapse of Silicon Valley Bank, a Regulated Bank in the USA

USA based Silicon Valley Bank stands out as a bank preferred mostly by venture capitalists due to its regulation. The bank’s largest funds, Venture Capital ( VC) And start-up stands out as. These organizations stand out as companies that grow with the investment funds they collect or the support they receive. Therefore, a great asset silicone valley Benchthey’re holding on.

According to several documents that have emerged, Silicon Valley BankAmong the funds on $2.85 billion of a16z, Paradigm’s $1.72 billionAnd Pantera Capital’s $560 million draws attention. Prepares a detailed report on the subject We Found Efe, Silicon Valley Bank’s He stated that he has $186 billion in assets. . We also found that the bank He also stated that he has a debt of 190 billion dollars.

👨⚕️ SVB – OTOPSİ RAPORU

Silicon Valley Bank'ın finansal durumunu anlamak Circle ve dolayısıyla USDC'nin kaderini anlamak olduğundan sizler için bankanın otopsisini yapmaya karar verdim.Merak etmeyin lafı uzatmadan kısa ve öz sonucu yazacağım.

— Efe Bulduk (@TheBullduck) March 11, 2023

As a coin, We Found Efewith the collapse of Silicon Valley Bank, its spillover to decentralized financial products, We evaluated its impact on stablecoins specific to USDC.

Why Did the Collapse of Traditional Finance Affect Decentralized Finance Products? What Role Does the Circle Play Here?

Although the cryptocurrency market stands out as the golden pearl of the digital age with its decentralized term, it moves in parallel with traditional financial products in a way. The US interest rate hike, recession concerns, various bankruptcies and collapses can therefore also affect the cryptocurrency market.

To Efe Buldukwhy decentralized financial products were affected in the collapse of traditional finance and here We asked what role USDC issuer Circle plays.

We found, referring to the cryptocurrency market, which does not act independently of global finance, The second largest bank failure after Lehmann Brothers. conveyed. The occurrence of such a situation, large investors, corporate companies and big players. “risk off”causes it to go into mode. to found According to this, these actors try to avoid risk by closing their positions. This, on the other hand, causes prices to fall.

Silicon Valley Bank served as Circle’s reserve bank. This situation stands out as one of the biggest reasons why Circle could not save its $ 3.3 billion asset inside. We found, USDCissuer Circle He stated that due to such a situation, small investors may be afraid and leave the market. This view of Bulduk also reveals the falling crypto money market and stablecoin outflows with the reflection of the news flow on the agenda.

We Found Efe, Silicon Valley BankAnother reason in the crypto money market, which fell with the collapse of . Venture Capitaland start-upHe thinks they are. We foundReferring to the fact that these organizations have their money stuck in the bank, he suggested that they could start selling cryptocurrencies to cover their operating expenses. We foundstated that these crypto sales can be tracked on-chain, and this tracking feature also leads to sales pressure in the general cryptocurrency market.

What Awaits Us In The Crypto Market After Crypto Exchanges And Stablecoins?

The crypto industry has been under the influence of negative news and negative developments for almost a year. The $40 billion lost with the eruption of the Terra crisis, the trust and confidence lost with the bankruptcy of FTX. The turmoil that emerged with the collapse of Silicon Valley Bank has gripped the entire crypto industry.

Many negative events that occur almost every month have also mobilized the regulators of the countries. In particular, US regulators began to put intense pressure on cryptocurrency exchanges and DeFi projects. The ongoing legal processes of FTX, Bitzlato facing money laundering charges, Binance going through various investigations, and finally the lawsuit against KuCoin have gained a heavy spot on the agenda. These pressures, which tightened after FTX’s bankruptcy, cause crypto exchanges to act on their toes. Binance CEO Changpeng Zhao ( CZ), started posting “4” almost every day.

Pressures on cryptocurrency exchanges are now starting to bounce on stablecoins. It was one of the recent stablecoin developments that Paxos was investigated regarding BUSD and Binance was directly at the center of the events and exposed to FUDs. This development revealed the pessimistic atmosphere in the crypto money market, and the markets went down by pricing the Fed interest rate hike. The final blow to the crypto money market, which is starting to breathe, USDC being depegand dragging all the stablecoins with it.

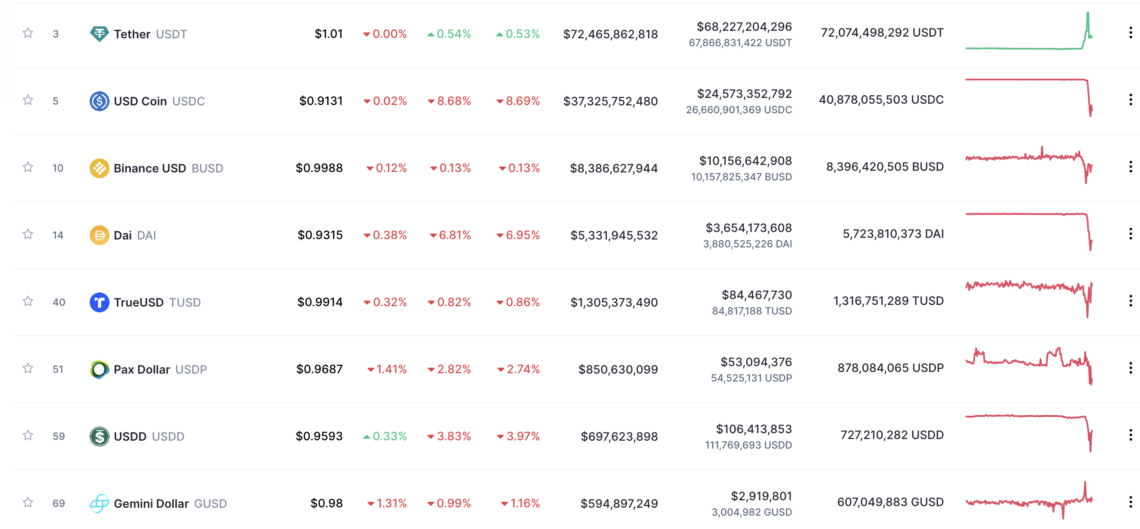

Dollar-based stablecoins, which provide the exact use of the US dollar in the crypto money market, are below 1 dollar, except for USDT.

Recession concerns intensified and the US’s determination to raise interest rates, Silicon Valley Bank suggests that such events may increase. In this case, the collapse of traditional financial products and banks will also affect the crypto markets in parallel, as Bulduk said. Financial products toppled by the effect of dominoes, It acts in a uniform way, without distinguishing between risky assets or risk-free assets. The losses incurred by investors holding money in the bank are in a position to cause the crypto money market to be mobilized by the institutions of the banks.

Looking ahead, it is clear that as a result of these events, more regulators will enter the sector. We found, in his published report and Coinkolik interview, that the events were more “bank run” He said he came here as a result. Such situations are likely to be scrutinized by regulators, as they will impact entire markets and frustrate investors.

The impact of all these processes on the cryptocurrency market We asked Efe Bulduk. We founda US crypto “Witch hunt”stated that it was started. We found , underlined that with the bankruptcy of FTX, all perceptions towards the crypto industry have changed. justifying this We found stated that FTX was a funder in the US elections. The fact that Sam Bankman-Fried later committed crimes with the term theft and the involvement of US athletes and famous economists in these processes led the USA to turn to crypto. We found, US regulators S ilvergate and Signature BankHe stated that he preferred the way of detonating. We found, FDIC, DoJ, NEC, OCC, FedAnd White Housestated that a coordinated printing environment was created.

that these pressures will continue. We found, said:

“This repressive approach to banks that it is better not to provide crypto services will continue until a law is passed. They want to put pressure on this place. Silicon Valley Bank has sunk, and Signature Bank will likely follow. It is a very planned and programmed progress. Here, Lael Brainard and Elizabeth Warren will continue to squeeze these markets until regulation arrives in crypto. Stablecoin regulation will be a priority in regulations with a high probability. Because they’re going to go their own way to make a CBDC. They made a complete scissor separation, they did not give such a signal. They seemed to keep up with the rest of the world. Perhaps in parallel, they could submit crypto regulations (other than Bitcoin) to the CFTC or SEC. This is how it will be regulated. Then the DAOs will be regulated. It looks like the US side will continue to pressurize until all this happens.”

Efe Bulduk: They Touch Everywhere Dollars Are Included

Ephesus We founda priority in stablecoins regulation can be seenAfter specifying USDC, BUSD and also touched on the progress on other stablecoins. We found that until regulation comes to stablecoins, pressure and price volatility can be seen as much as possible.

We found, US regulators priority target in Paxos investigation BUSD He stated that he focused on the issue and thus gave a signal to Binance. Stating that there are new jumps in USDC, Bulduk told Tether ( USDT ) stated that they could not do much, but that they interfered with everything that included dollars. Specifically, we found it, he said;

“Consolidate first…They are consolidating now. First they blocked BUSD and now they are heading towards USDC. In this way, the dollar is collected in USDT. The USA can somehow touch anything that puts dollars in it. Therefore, it is aimed to tighten and weaken stablecoins as much as possible until regulation comes.”

We found noted that the people writing stories here will want the US to be more dominant if crypto stays. However, he stated that if crypto is not left, they will approach it with the logic of “thank you”.