The trader robot, which is famous for giving better predictions from the markets, has published its new altcoin selections. According to the available data, most cryptocurrencies are trying to heal the wounds of the fall that occurred over the weekend. However, investors continue to replenish their portfolios with some altcoins. However, portfolio savings differ in cold wallets and exchanges. Here are the details…

Trader robot: “Investors are accumulating these altcoin projects”

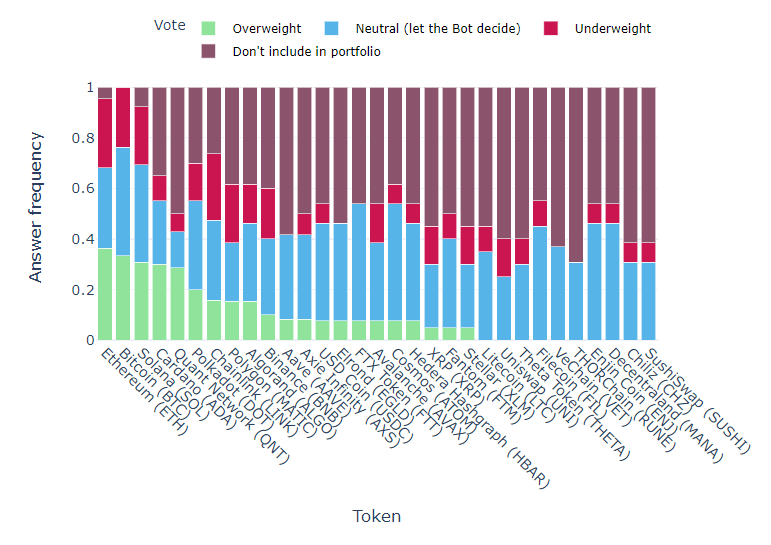

The famous robot named Real Vision Bot compiles algorithmic portfolio reviews every week. For this, he conducts various researches. Thus, it reveals a “hive mind” consensus. In this context, the robot has published new data. The data indicates that there is a decline in investors’ appetite for risk. So last week, investors were much more willing to take risks. Now most investors are voting to overfill their wallets with ETH, BTC and 19 altcoins. Of the respondents, 36% state that they have accumulated too much in Ethereum and 33% in Bitcoin. Layer-1 networks are in the third place after BTC and ETH. In all three of these networks, investors voted to save 30% for each. These networks; Solana consists of Cardano and Quant Network. Solana and Cardano describe themselves as the “Ethereum killer”. They are trying to replace the leading altcoin Ether. Quant, on the other hand, stands out as a project that focuses on interoperability.

Polkadot, one of the leading altcoin projects, ranks 6th with 20% more weight. It is followed by the decentralized oracle network Chainlink in 7th place. The Ethereum layer-2 solution Polygon and the Algorand network are ranked 8th and 9th with 15% backlog. Last in the top ten is the local token of the world’s largest cryptocurrency exchange, Binance. Accordingly, BNB is the 10th most popular cryptocurrency in portfolios. DeFi loan project Aave and play-to-win Metaverse game Axie Infinity received 8% savings vote. After these altcoin assets, a total of 10 cryptocurrencies have a weight of 7% in the survey. These include USDC, Elrond, FTX Token, Avalanche, ATOM and Hedera. Each is present with a portfolio over-accumulation vote of 7% in the survey. Altcoins with only 5% of the votes are Fantom, Stellar and XLM. However, all cryptocurrencies that do not have a green share in the chart above constitute the asset class that is not over-accumulated.

“These altcoins are popular in exchange wallets”

The survey data also includes the latest exchange wallet accumulation distribution. Accordingly, Cardano is the leader in stock market savings with 18.9% of the votes. Quant Network comes next with 17.7%. In the third and fourth places are Bitcoin with 11.8% and FTX Token with 10.1%. Finally, Ethereum ranks 5th in the list with 9.45%. Solana, Aave and Elrond have the same rate of 8.86%. These are at number 6 of the list. However, Polkadot is also on the list. DOT has a 5.45% stake.

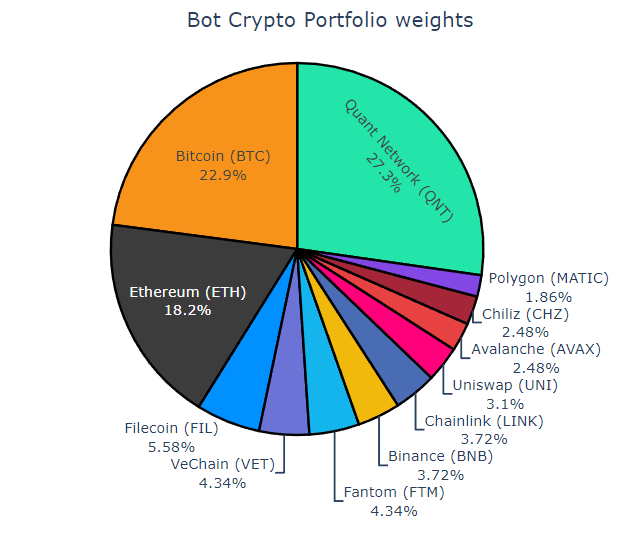

The bot also shared a portfolio of its own data. Accordingly, the Real Vision robot said that BTC, SOL and ETH are slowly falling. Then, he spoke positively about Cardano and Quant Network. According to the robot, the two altcoins are among the big lucrative assets of the week. cryptocoin.comAs we reported, Real Vision Bot outperforms the general market in prediction accuracy.