Bitcoin sales ended around $21,000. Now analysts fear the negative news feed and future US interest rate hikes will drive the price down. Here is what veteran market analysts Rekt Capital, Francis HunT, Whalemap and Tone Vays have to say about Bitcoin drop…

Bitcoin support is at $23,000, but analysts warn of a dire drop to $8,000

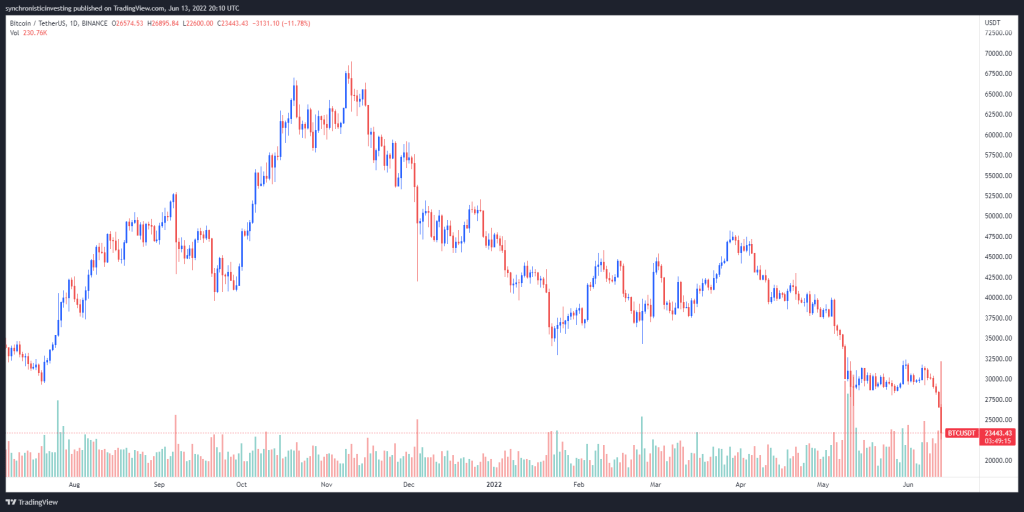

Bitcoin’s one-month price action ended on June 13 as deep market selling broke the 29,000 support. The move came as equity markets also sold sharply, hitting year lows. TradingView data shows that Bitcoin sales started late in the day on June 12. Then BTC dropped to $22,592 and rose to midday on June 13

Is there solid support at $23,000?

Market analyst “Rekt Capital” shared the chart below. Accordingly, previous bear market capitulations have seen a solid support level at the 200-week MA.

Based on the trend over the past two cycles, Rekt Capital suggested that BTC could see a “macro double bottom at 200-week moving average” if price action occurs in a similar fashion. Rekt Capital, whose analysis we have shared as Cryptokoin.com , says:

So then BTC is very close to forming the first macro bottom at $23,000 in the 200-week MA. The second macro bottom is at a price point of around $41,000 in about two years.

Analysts say “maximum pain” for Bitcoin is $13,330

If Bitcoin continues to drop below support levels, Idea of where it could potentially head. provided by data provided by pseudonymous analyst “Whalemap”, who posted the chart below highlighting previously established support levels that could now turn into resistance.

Whalemap says:

Bitcoin (BTC) has broken key price supports where they will likely become our new resistances. $13,331 is the ultimate maximum pain base.

In another case, Bitcoin under threat of $8,000

According to market analyst Francis Hunt, Bitcoin is at $8,000 before hitting the real bottom. The analyst, nicknamed The Market Sniper, has revealed a dire scenario for BTC bulls.

Francis Hunt says:

Savings will be between $17,000 and $18,000. That $15,000 pops up out of nowhere. That would be a pretty bad fall. It also has a bear flag target. A slightly less strong and full round trip at the $12,000 bear flag target would put you in the $8,000-10,000 range.

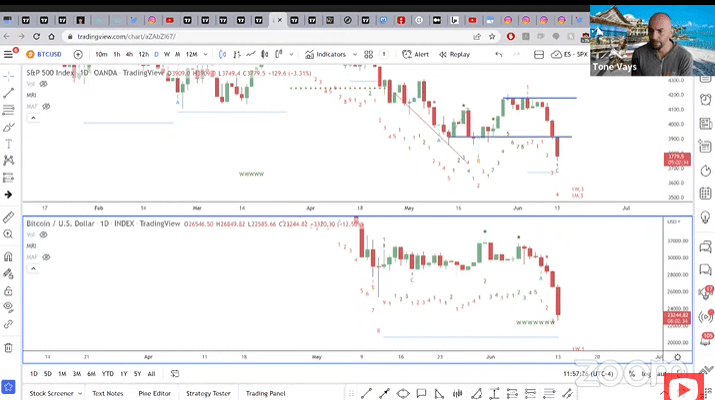

Experienced analyst Tone Vays says capitulation is imminent

In a recent livestream, Tone Vays says there isn’t enough volume to say we’re in capitulation in the Bitcoin markets:

We’re not there yet. But we’re almost there… The other problem is that on a daily scale it’s telling you it’s not over. The voice tells you it’s not over. This volume has to be significantly higher than this volume for us to accept that this is a capitulation.

Vays then looks at Bitcoin’s momentum reversal indicator (MRI), an advanced technical analysis metric that predicts trend lifecycles based on an asset’s momentum. The analyst says that the MRI of BTC shows that it is bearish for a few more days before a reversal occurs in the market.

According to Vays, BTC will probably not fall below $19,000. The analyst explains this situation as follows:

There are signs of reversal in the candle here. According to MR, we may be at a disadvantage here for another four or five days. Can we go down to $17,180k? Yes. In fact, if we go as high as $19,000, we will pull back perfectly to the previous high, after that, if we go even lower, the next level could drop as low as $14,000.

MRI predicts $14,000 in Bitcoin. However, Vays thinks that Bitcoin will not see these levels:

Personally, I don’t think we will go that low. But I think we will reach $19,000. I always said between $21,000-22,000, start selling kidneys and get into Bitcoin…