Bitcoin funds have been the main factor influencing cryptocurrency asset flows since March, with a weekly outflow of $111 million.

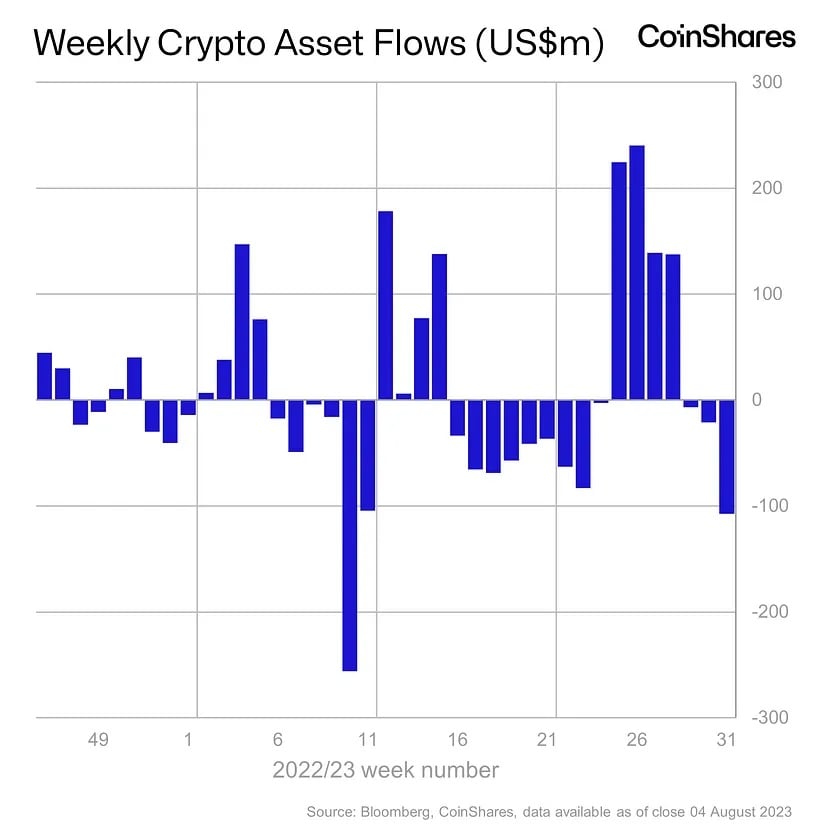

For the week ending Aug. 4, weekly crypto asset flows trended negatively with $107 million outflows. This negative trend, which continued for three weeks in total, totaled 134.8 million dollars.

Bitcoin funds have been out since March

Since March, there has been an outflow of $ 111 million in Bitcoin funds. Most of these outflows belonged to Bitcoin. Bitcoin funds, which had an outflow of $ 111 million during the week, had an impact on the general trend. According to CoinShares’ Digital Asset Fund Flows weekly report, these outflows reflect a trend towards “making profits” after the previous cycle’s gains. Over the past month, there has been $742 million inflows into crypto funds, of which 99 percent came from Bitcoin.

The report showed that weekly trading volumes in investment products have remained below average since the beginning of the year, and in-exchange market volumes have fallen by a relative 62 percent.

Regionally, only Australia and the United States recorded entries, with the largest exits coming from Canada ($70.8 million) and Germany ($28.5 million).

Despite Bitcoin’s takeoffs, Solana broke the trend with a $9.5 million entry last week. Additionally, XRP investment products also saw $0.5 million in inflows.

On the other hand, Ethereum funds had an outflow of $1.9 million in the previous week, thus continuing the negative trend with an outflow of $5.9 million.

In 2022, due to the uncertainties in FTX and other exchanges, it was observed that there was a tendency for investors to increase their cash and exits from crypto funds. There are also reports that bitcoin hodlers outperformed crypto funds by 69 percent in the first half of 2023.