We’ve compiled the most prominent price predictions of recent days, from popular Twitter analysts Justin Bennett and Van de Poppe to market strategist Gareth Soloway, who is expecting $3,500 in Bitcoin price.

Benjamin Cowan warns of new lows as Bitcoin stagnates

According to Cowan, we shouldn’t rule out another correction as we approach the bottoms of a new bear market. The popular Youtube analyst suggested in a new video that if the one-year ROI continues to decline, BTC could capitulate. The cryptocurrency analyst predicts that if BTC enters the price range between $13,000 and $14,000, it could head towards a capitulation event.

According to Cowan’s thesis, Bitcoin tends to form a bear market bottom when the one-year ROI metric reaches 0.2. If BTC investors capitulate, we will see an unexpected drop and then another, according to Cowen. The analyst sums up his expectations in a new video:

If we see some kind of capitulation, we’ll see some kind of strong rally after that because all things considered, that would be a typical bottom for Bitcoin. You go down about 70% for months and months and you finally see the ultimate surrender. This would be your typical bear market base for Bitcoin.

Edward Moya says the latest rally of Bitcoin and traditional markets will be short-lived

In a recent note, the senior market analyst summed up the gains of Nasdaq futures of 1.3% and S&P 500 futures of 0.8%, saying “stocks rose on strong earnings and mixed economic data pointing to a slowdown in the economy.” Regarding Bitcoin, which is highly correlated with these markets, Moya:

Bitcoin was running to almost $20,000 but most investors remained skeptical that this week’s risk rally would be short-lived.

Moya also in an analysis on new cryptocurrencies:

Crypto is locked in consolidation mode and will continue until investors are convinced of the risks the Fed tightens and plunges the economy into a serious recession.

Michaël van de Poppe draws attention to volatile markets

The Twitter analyst pointed to volatile markets in his analysis on Tuesday. “Everything we gained yesterday, we lost today,” she wrote on Twitter. In a separate tweet, Poppe added that the economy is “weakening”. In support of his claim, he pointed to the slowdown of companies’ production and Apple’s cutting of iPhone 14 Plus production.

Economy is getting weaker.

Corporates are slowing down production.

1. NY Empire Manufacturing Index way worse than expected.

2. $AAPL cutting iPhone 14 Plus production two weeks after it got announced.

— Michaël van de Poppe (@CryptoMichNL) October 18, 2022

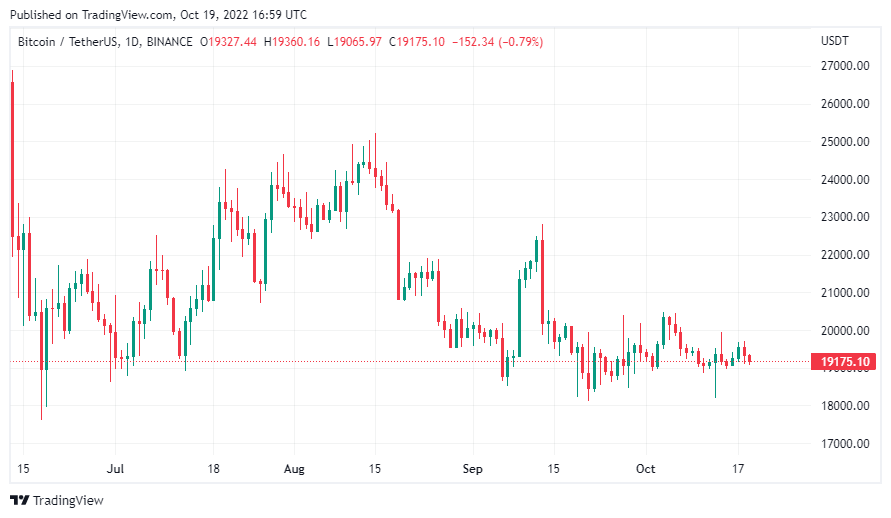

Bitcoin struggles with $19,370

Justin Bennett says Bitcoin is “struggling” to stay above the $19,370 support level. The analyst also noted that he looked “relatively weak” during this time:

Most will try to offer $19k, but I think we’ll go a little lower. There seems to be some unfinished business under $19k. Let’s see.

$BTC is struggling to stay above $19,370 support and looks relatively weak here. Wouldn't be surprised to see longs get taken out below this area.

Most will try to bid $19k, but I think we go a bit lower. Seems there's unfinished business sub $19k. Let's see.#Bitcoin pic.twitter.com/x5mleUxm2G

— Justin Bennett (@JustinBennettFX) October 18, 2022

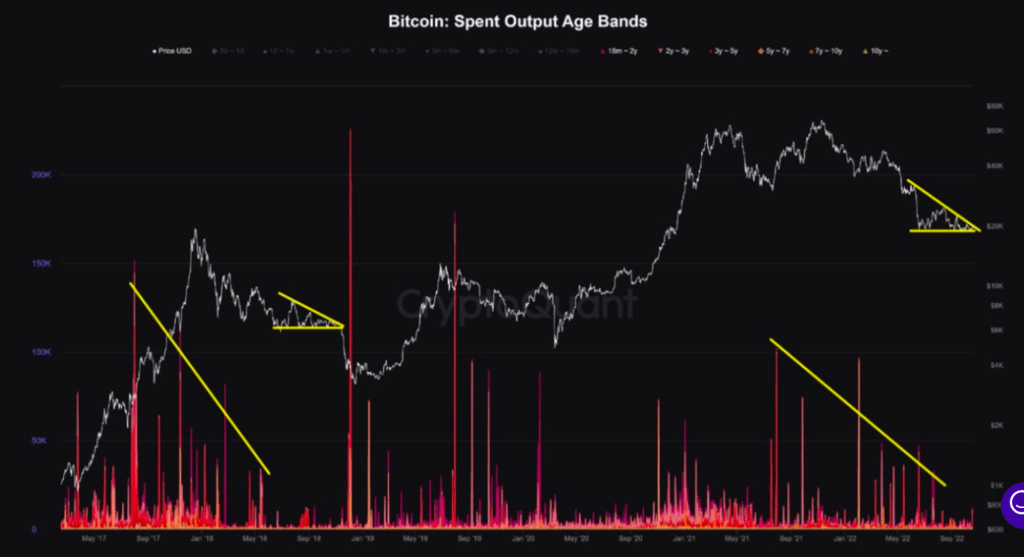

Elsewhere, a CryptoQuant analyst said that “there is the possibility of a final collapse in the bear market” in a note pointing to the current descending triangle pattern on the Bitcoin Spent Output Age Bands chart. The pattern was described by the analyst on the community-focused platform as similar to the last crash in the bear market in 2018.

The analyst noted that the movement of long-term investors has decreased and price volatility is very low.

“Bitcoin may drop to $3,500”

This forecast is from InTheMoneyStocks.com Chief Market Strategist Gareth Soloway. The technical analyst predicts that Bitcoin, which is currently trading below $20,000, will fall as low as $3,500:

Initial support is $12,000 – $13,000. And then I’m worried that under $10,000 you’re going to go to $8,000 and maybe in the worst-case scenario, $3.5k.

The analyst also emphasizes that a recession is approaching and the stock markets will go bad:

The problem is that the money consumers save will run out by the middle of next year. Once they run out of money and the Fed has just started to act, there will be a rift for the economy.

The $15,000 region represents more ideal lows.

Caleb Franzen, senior market analyst at Cubic Analytics, gave insight into what level a pullback could be in the event of another pullback, posting the tweet below that predicts a possible drop to the $15,300-15,900 region.

At the very least, I expect #Bitcoin to retest the AVWAP from the 2015 lows, based on Coinbase trading volume.

This AVWAP band is roughly priced at $15.3k-$15.9k.

The 2018 & 2020 lows both fell to this range, even dipping below it briefly. pic.twitter.com/X7vKrnxgBm

— Caleb Franzen (@CalebFranzen) October 18, 2022

The analyst wrote in a tweet that provided a reading of how likely Franzen expected such a decline to occur:

I can place a new limit order at $18.2k. For what it’s worth, every time I tweet about placing a limit order for BTC, it expires in a week.

cryptocoin.comAs you follow, BTC is currently trading at $19,200.