The striking CZ resignation, which sent shockwaves throughout the altcoin community, attracted attention. Risk-loving traders, often referred to as “derangers,” wasted no time in taking advantage of the recent resignation and subsequent guilty plea of Binance CEO Changpeng Zhao (CZ). Amid the uncertainty surrounding CZ’s departure, these traders quickly introduced a new token called “CZ” on the Ethereum-based decentralized exchange Uniswap, creating a flurry of activity in the crypto markets. Here are the details…

Anonymous developers created an altcoin with CZ’s resignation

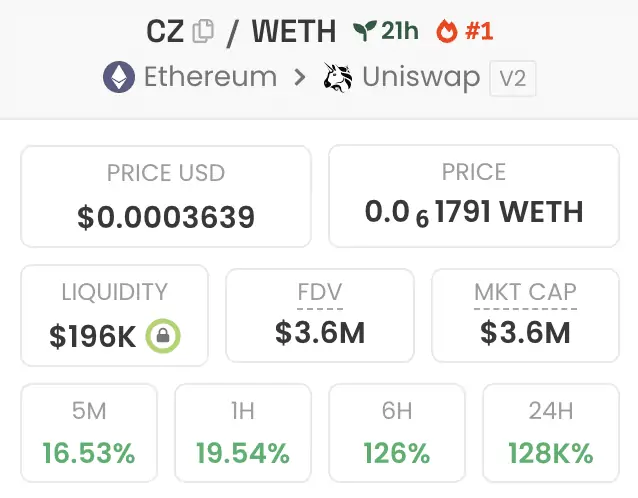

Launched by an anonymous developer and with no official ties to Binance or CZ, the CZ token has witnessed an astronomical rise, surpassing a staggering 100,000 percent increase in just a few hours of launch, according to data from dexscreener.com. The rapid and unprecedented rise of the CZ token has captured the attention of market participants and observers, highlighting the unpredictable nature of the cryptocurrency space.

Remarkably, in a short period of approximately 24 hours since its inception, the CZ token has achieved a staggering market cap of $3.7 million. This rapid rise underscores the growing interest and enthusiasm surrounding this new crypto asset, although there are questions about the potential effects of CZ’s resignation on the industry at large. Meanwhile, it is worth noting that CZ is up 4,000 percent at the time of writing.

TENG also experienced an increase

Simultaneously, another player entered the scene in the form of TENG token. The TENG token, named after Richard Teng, who replaced CZ as Binance CEO, has gained a more modest but notable 10,000% since its debut on Tuesday. Like its CZ counterpart, the TENG token does not carry official endorsements from Binance, Richard Teng, or CZ, leading investors to be cautious about potential risks such as rug pull.

The launch of these tokens comes against the backdrop of CZ announcing his resignation and subsequent admission of federal charges. Binance Holdings Limited, the organization behind leading cryptocurrency exchange Binance.com, has agreed to an unprecedented $4.3 billion settlement to settle the United States Department of Justice’s investigation into alleged violations. The charges against CZ include failure to implement an adequate anti-money laundering (AML) program, as required by the Bank Secrecy Act (BSA).

Investors need to be careful

CZ’s departure paved the way for the elevation of Richard Teng, who previously oversaw Binance’s global regional markets, to the position of Chief Executive Officer. This transition, combined with the emergence of CZ and TENG tokens, added an extra layer of complexity and intrigue to the emergence story of Binance’s leadership dynamics. As market participants grapple with the implications of these developments, it is crucial to pay attention to the cautionary advice being given to investors and enthusiasts. Although CZ and TENG tokens have made significant gains, they are not risk-free. Concerns about low liquidity and significant volatility associated with these new tokens underscore the need for careful evaluation and due diligence.