The giant cryptocurrency exchange Binance caused two altcoin projects in particular to collapse today. The exchange announced that it will begin offering up to 50x leverage option for Ontology Gas (ONG). Additionally, Binance Labs, the investment arm of the stock exchange, attracted attention with its Open Campus (EDU) investment. Here are the details…

Binance Labs invested in Open Campus

Taking an important step to increase the adoption of Web3 and encourage educational content creators, Binance Labs announced a strategic investment of $ 3.15 million in Open Campus. Community-driven Web3 education platform is set to capitalize on this influx of funding by launching the innovative Publisher NFT, which aims to attract more users into the decentralized education space. Open Campus fosters a collaborative environment by enabling creators to tokenize their educational content and allow them to monetize their contributions. The investment aims to increase local participation in education, thereby increasing the income potential of content creators and fostering a shared economy within the platform.

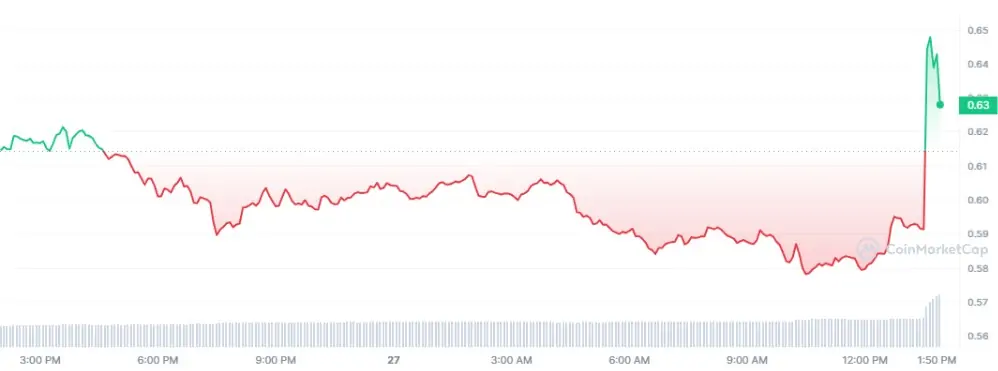

The impact of Binance Labs’ investment was quickly reflected in the market, and the Open Campus token EDU experienced a significant increase. As of the latest data, EDU has increased by approximately 10 percent in the last hour to $0.663. This increase is attributed to the crypto community’s positive response to the investment and signals a potential shift in focus towards decentralized education.

Perpetual futures contract for altcoin ONG enters the market

In another groundbreaking development, Binance Futures is set to launch the USDⓈ-M ONG perpetual futures contract with an impressive leverage of up to 50x on November 27, 2023 at 16:00 UTC. The new perpetual contract, under the ticker ONGUSDT, is designed to offer investors enhanced flexibility and opportunities in the crypto derivatives market. Details of the contract are as follows:

- Underlying Asset: ONG

- Settlement Asset: USDT

- Tick Size: 0.0001

- Cap Funding Rate: +2.00% / -2.00%

- Funding Fee Settlement Frequency: Every Four Hours

- Maximum Leverage: 50x

- Trading Hours: 7/24

- Multi-Entity Mode: Supported

In addition, Binance Futures announced a maker fee discount program for qualified USDⓈ margin futures liquidity providers, offering a 0.005% discount for trades on the ONGUSDT contract for approximately 14 to 15 days. The market immediately responded to this news and ONG witnessed a notable rise. As of November 27, the coin has risen above $0.45 and is currently trading at $0.4512, marking a significant increase of more than 25 percent in the last hour. This increase highlighted the anticipation and positive sentiment towards the launch of Binance Futures’ new perpetual contract, further solidifying the exchange’s position as a key player in the cryptocurrency derivatives market.