In the Bitcoin and altcoin world, institutional investors continue to exit digital asset products. On the other hand, there is also a difference in sensitivity on a regional basis. Let’s take a look at the Coinshares report on what institutional investors did this week.

Outflows continue in Bitcoin and altcoin investment products

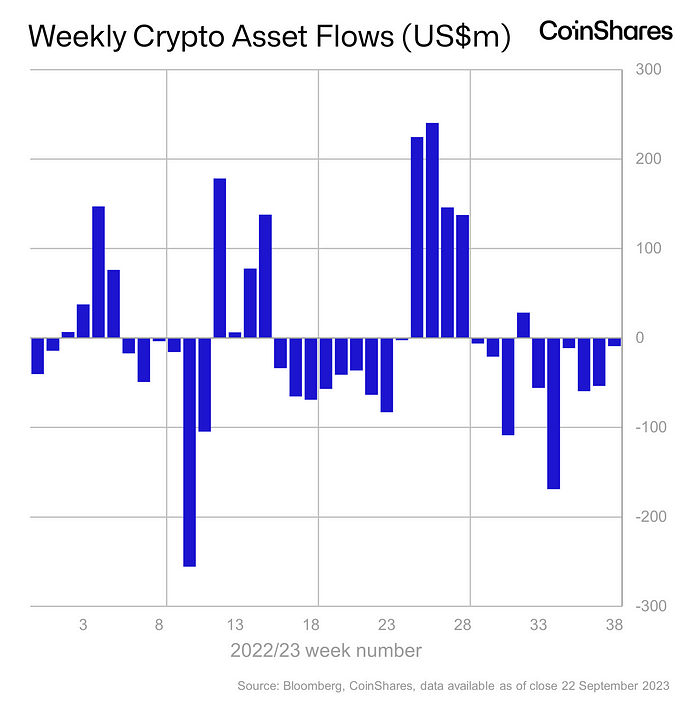

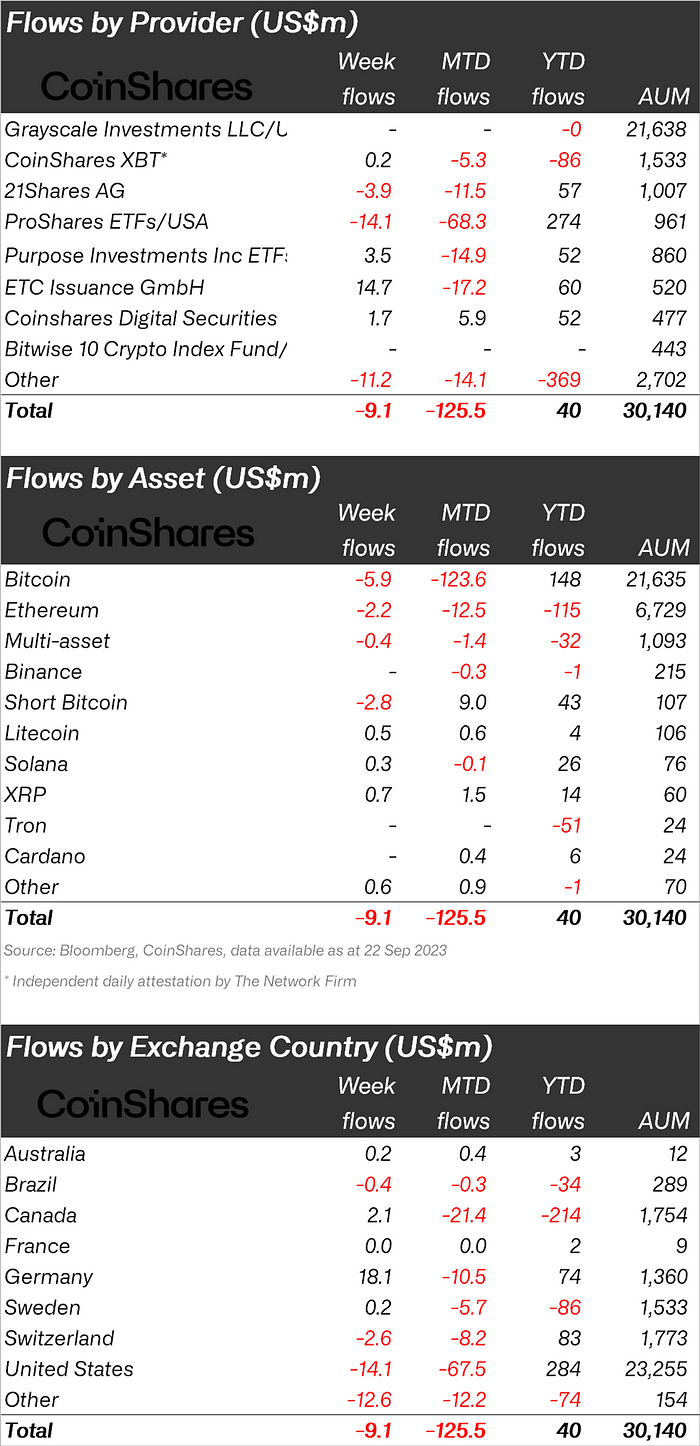

There were outflows from digital asset investment products for the sixth consecutive week. Accordingly, a total of 9 million US dollars left the market. Last week’s trading volumes remained low at US$820 million. It was also well below the yearly average of US$1.3 billion. This trend reflects the sluggish trading activity of the broader Bitcoin and altcoin market.

On the other hand, sensitivity on a regional basis is also increasingly different. Accordingly, a significant difference in sentiment has emerged between regions over the past week. European investors showed optimism. Thus, it generated an inflow of $16 million. Investors perceived the recent legal challenges as an opportunity. In contrast, US investors withdrew $14 million, likely reflecting ongoing concerns about recent events in the market.

Bitcoin and short focused Bitcoin flows

Excluding altcoin projects, Bitcoin witnessed small outflows totaling $6 million for the third consecutive week. At the same time, there was an outflow of $2.8 million in short-focused bitcoin products. The US$15 million inflow into short-focused Bitcoin over the course of a week earlier this month appears to be an isolated incident. Over the last 22 weeks, there have been outflows accounting for 78% of assets under management (AuM). This also shows that investors tend to abandon their short positions.

It was a tough week for altcoin Ethereum. Ethereum continued to face difficulties, with outflows of $2.2 million continuing for the sixth consecutive week. Multi-asset investment products have also faced difficulties this year. Accordingly, there has been a total outflow of 32 million US dollars to date. In the altcoin space, investors are becoming more selective, as evidenced by ongoing inflows into XRP and Solana at $0.66 million and $0.31 million respectively. On the other hand, the 500 thousand dollar entry into Litecoin draws attention.

Dynamic environment continues

Despite ongoing outflows and low trading volumes, the digital asset market remains dynamic. On the other hand, when we look at it as cryptokoin.com, it is affected by regional sensitivities and specific asset performance. Investors are carefully navigating this evolving landscape, weighing the opportunities and challenges in the cryptocurrency space.