Voyager, one of the crypto lending companies that went bankrupt after the Terra crash last year, can recommend 3 more coins in addition to the Ethereums (ETH) it sold to cover its debts.

Voyager chose to sell ETH first instead of SHIB

Bankrupt crypto lender Voyager continues to hold approximately $57.78 million worth of Shiba Inu. The company traded Ethereums in its reserve for stablecoins like USDC throughout the process. Voyager’s current portfolio consists of 5.17 trillion Shiba Inu (SHIB).

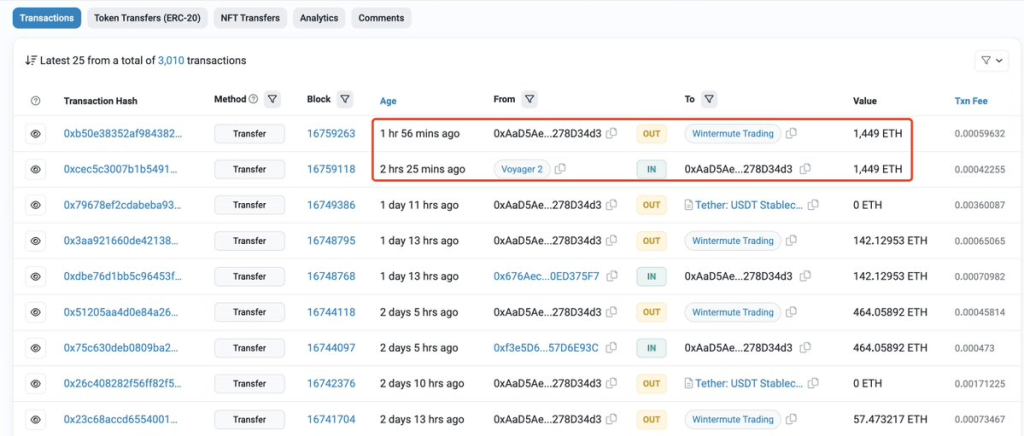

The bankrupt company sold most of its Ethereum in a recent transaction, swapping ETH for stablecoins like USDC. According to a recent update from on-chain researcher Lookonchain, the company has cashed out a total of 1,449 ETH through Wintermute. Ethereum sales were priced at an average of $1,553, and $2.25 million USDC was received in return.

Voyager continues to drain its crypto reserves, these 3 altcoins left

The bankrupt company currently owns 5.17 trillion Shiba Inu, along with Chainlink (LINK), Ethereum (ETH), and Avalanche (AVAX). Interestingly, he chose to sell his Ethereum reserve first, despite holding about $57.78 million worth of Shiba Inu. Voyager currently holds 148,774 Ethereum worth $233.5 million. It is not yet clear whether he will start selling the rest of his Ethereums or now SHIB. According to data shared by Lookonchain, Voyager has 4 more coins that it can sell outside of Ethereum:

- 148,774 ETH ($233.5 million)

- 5.17 trillion SHIB ($57.7 million)

- 1.44 million LINK ($10 million)

- 1.17 billion STMX ($7.3 million)

- 411,052 AVAX ($6.7 million)

Why is Voyager in trouble, can it pay off its debts with ETH sales?

At its peak, Voyager had 3.5 million users (roughly what Coinbase reached in 2015) and $5.9 billion in assets, comparable to a small regional bank or a reputable wealth management firm. The company, which went into bankruptcy in May 2022, says Terra was victimized only by unlucky partners, not by heavily investing in the likes of the UST stablecoin and LUNA token.

When the crypto winter began in early 2022, Voyager moved quickly to hedge its risk, in part by reducing loans and mitigating counterparty risk. The main trigger for Voyager’s collapse was the bankruptcy of Three Arrows Capital, a Singapore crypto hedge fund, to which Voyager lent more than $650 million in cryptocurrencies.

2/ Three Arrows Capital (3AC) is a crypto venture capital fund, lead by @zhusu and @KyleLDavies.

At their peak they were managing an estimated $18b in assets, ranking them in the top 3 VCs in the space.

Some of their most successful investments include: $AVAX, $NEAR and $ETH.

— Miles Deutscher (@milesdeutscher) June 17, 2022

Voyager said on July 6, 2022 that it had over $110 million in cash and cryptocurrencies to be used to support day-to-day operations during the bankruptcy process. The findings show that Voyager has a total debt of $1.12 billion. The company currently holds just $233.5 million worth of ETH. cryptocoin.com As we reported, Voyager’s Binance.US acquisition is on the agenda. Binance’s US arm agreed to buy Voyager’s assets for $1.02 billion in December 2022.