This week may be more important than some crypto investors think, as global financial markets prepare for the release of June CPI data. Another unexpectedly high inflation data will likely negatively impact Bitcoin (BTC) and major L1 blockchains, as we have seen earlier.

CPI impact on leading cryptocurrency Bitcoin

As we reported on cryptokoin.com, unexpectedly high inflation data forced the Fed to accelerate inflation control moves and raise the key rate to 0.75 percent. The determined 0.75 percent rate immediately caused a 10 percent drop in BTC price after the 23 percent reversal caused by the CPI data mentioned above. If the inflation data is higher than expected this week, we are likely to see a similar effect in the cryptocurrency market. Given the lingering pressure of the US dollar, which continues to rebound against other foreign currencies, Bitcoin is unlikely to show any positive moves in the market unless it sees an unexpectedly positive CPI release.

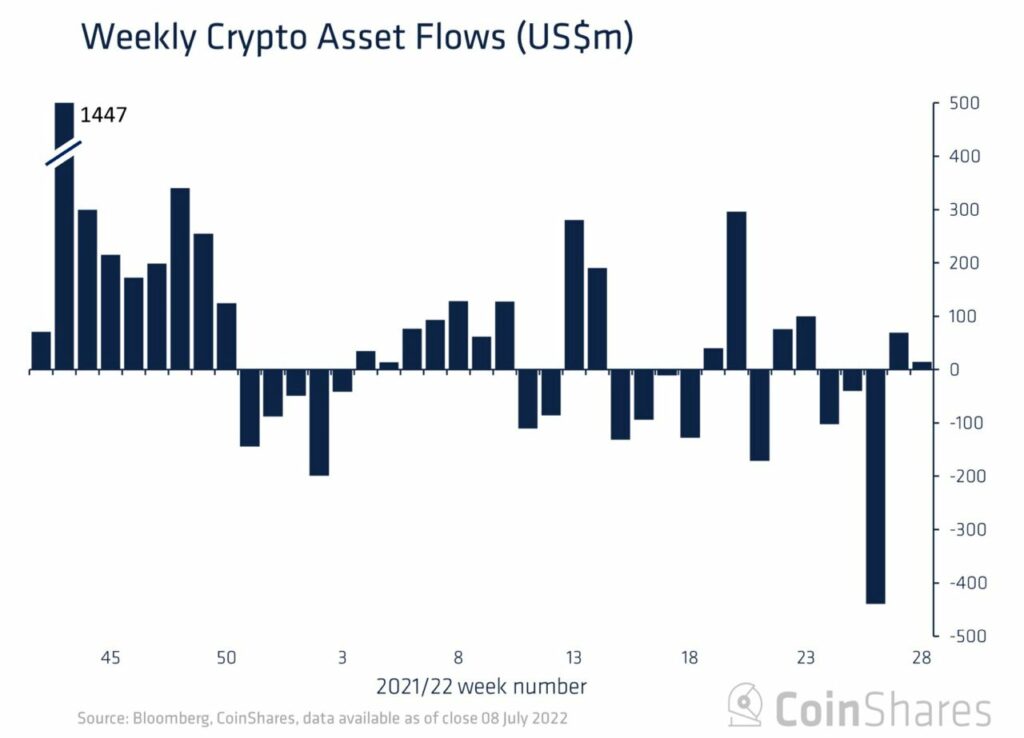

According to the daily chart of BTC, we can clearly see that the top cryptocurrency BTC’s reversal attempt last week failed as it bounced back below the $21,000 price range and is currently struggling around $20,500. The main reason for the failed attempt to reverse the momentum is the lack of market entry and trading volume. Institutional entry data shows that funds and companies are in no rush to buy more Bitcoin as the macro environment in the crypto-asset market continues to suffer after falling 75 percent. Compared to last week, when institutional investors seized nearly $65M worth of cryptocurrencies, this week’s data shows that only $15M in crypto was purchased by investors.

Ethereum, Cardano and other altcoins also hit

The aforementioned inflation data and the US dollar rally are key factors driving institutions away from buying more cryptocurrencies and fueling a potential recovery rally. The lack of access to Bitcoin also affects alternative cryptocurrencies such as Ethereum (ETH) and Cardano (ADA), which have lost around 10 percent of their value in the last two days. If we give an example of Ethereum; We still see tremendous selling pressure in the market as exchanges like FTX offer extremely high interest rates for anyone willing to lend their ETH to fund short positions.

Additionally, Celsius sent around $50 million worth of cryptocurrencies to different exchanges to cover some of its loans. After the massive liquidation volume from Three Arrows Capital and other institutional investors, Ethereum suffered a massive 45 percent loss. The crypto industry today remains heavily dependent on inflation expectations, rate increases, and other factors that were previously in no way connected to the cryptocurrency market. The institutional adoption we saw in 2021 has tied the industry to traditional financial markets that still show no signs of recovery to date.