As Art Basel begins, the busiest week of the year is about to begin for Miami. Former FTX CEO Sam Bankman-Fried will appear at the NYT’s DealBook summit this week. However, it is expected to search virtually. The Grayscale Bitcoin Trust (GBTC) NAV discount hit an all-time low last week. So this will be something to watch as Genesis grapples with liquidity issues.

Art starts in Basel Miami

Miami’s busiest week of the year begins. Of course, Art Basel is not just about real art. The week will breathe the air of tech and Web3 every few years. Whether you want to collect personalized NFTs, test a decentralized ridesharing application, or build a good old-fashioned network, it’s possible here. Meanwhile, the MiamiWeb3 summit kicks off the meetings on Monday.

Big day for Sam, ex-CEO of collapsed FTX

Janet Yellen, Mark Zuckerberg and Larry Fink will be speaking at the New York Times’ DealBook summit on November 30. Interestingly, however, there is another notable among these important names. Despite the bankruptcy and subsequent filing of FTX and its related companies, Sam Bankman-Fried is on the speaker list alongside movie stars and national leaders. Despite everything that happened!

Meanwhile, Sam Bankman-Fried took a break from last week’s cryptic tweeting thing. However, anything Bankman-Fried has to say will certainly appeal to thousands of customers and investors seeking answers.

How much is the Grayscale Bitcoin Trust (GBTC) discount?

cryptocoin.com After the collapse of FTX, fallout swept the crypto markets. The so-called Sam coins felt the heat as the stock market sank. However, now one of the most popular financial products in the crypto market is under pressure.

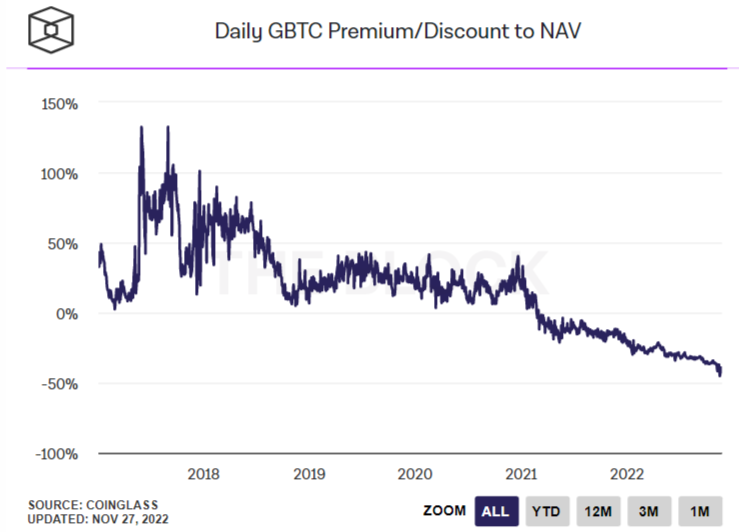

Grayscale Bitcoin Trust’s (GBTC) NAV discount hit an all-time low of 45.2% last week. GBTC allows investors to invest in Bitcoin through a fund structure. The fund’s reduction later showed signs of recovery. Thus, it rose from its lows throughout the week. However, it closed the week at a discount of over 40% again.

Uncertainty over Grayscale’s parent company Digital Currency Group, which also owns troubled crypto lending firm Genesis Capital, is having a negative impact on GBTC. In other GBTC-related news, the fund’s issuer, Grayscale, claimed that the SEC was hurting investors by rejecting its application to convert the fund into a spot Bitcoin ETF. The SEC has until December 9 to respond to the firm’s petition.