According to crypto analyst Filip L, Cronos is on a frightening trajectory that means 15% loss. Also, the analyst says it’s time for UNI to say goodbye to the $5 handle. The analyst says that the price of an altcoin is at a 15% risk of falling. Finally, analyst Ekta Mourya explains what’s next for PEPE.

This altcoin could wipe out all 2023 gains

The Cronos price adjusts itself so that all gains for 2023 are completely wiped out. Along the way there were several signs warning the bulls of what was to come. The false break of the red descending trendline followed by rejection of the upper against the 55-day Simple Moving Average on Monday was the moment when the sell was triggered.

CRO has suffered a 12% loss so far for weekly performance. It is now preparing to at least double that amount. The bears are moving away from this red descending trendline. It is also preparing to make one final drastic move that could see an additional 15% loss in just one trading session. Expect altcoin price to stop near $0.054 and bears toss a coin to see if 2023 lows can be broken before the weekend.

CRO 4-hour chart

CRO 4-hour chartInvestors will have noticed that the tank with the sales force is empty and needs to be refueled. This is one way of looking at the Relative Strength Index that extends into the oversold territory. The bears will begin to ease the selling pressure. This will give some room for the CRO to bounce back to $0.065 with a chance to climb above the red descending trendline again.

It’s possible for UNI to say goodbye to $5!

Uniswap price was well on its way to break above $5.20 during the ASIA PAC trading session. However, the recovery was short lived. The bears came back hard and squandered the bulls’ opportunity to retrace some losses. Doom and gloom comes from Bitcoin slumping towards two-month lows.

UNI investors can isolate themselves from Bitcoin’s performance. Unfortunately, as a standalone altcoin, Uniswap faces another challenge. This is the strong dollar. Dollar Index rose above 102. Also, the US dollar is gaining strength as it advances against several major G7 currencies. This causes UNI to fail to punch against these extremely strong fall elements. This market is valuing at $4.60, which is 10% lower this Friday.

UNI 4-hour chart

UNI 4-hour chartIt is possible that a very small element here can still save the situation. However, this is a purely technical issue. The last three dips higher each time could indicate large buys from investors that saved it from a crash. Wait for it to break $5.20 as confirmation. From there, the UNI will likely rise quickly towards $5.67.

These altcoin bulls have lost control

Litecoin price sees the bulls create a bullish breakout, resulting in an upside ‘squeeze’ against the 200-day SMA. During the week, the bulls tried to undo this. However, it failed every time. Meanwhile, a minor ascending trendline is forming with higher lows that are largely exposing the bulls.

LTC could see the bears come in for the kill, triggering all the stops of the bulls placed just below this ascending trendline. This will trigger a wave of sell orders, which will see LTC rise rapidly towards $73.50. Another drop towards $65, a new low for 2023, is possible once the monthly S2 breaks the support level.

LTC 4-hour chart

LTC 4-hour chartStill, it’s possible that ‘squeeze’ might work. This, too, is likely to push LTC above the 200-day SMA near $82. Once that happens, a range trade is the next setup that looks very attractive with the 55-day SMA at $90. Wait for definitive confirmation before getting involved with a clear break above. Also, test for support at the 200-day SMA before enjoying a 10% rally.

PEPE struggles with heavy selling pressure

Popular meme coin PEPE is facing increasing selling pressure. Experts at Scope Protocol monitored on-chain activities. As a result, he said, 33 trillion PEPE tokens worth $46.37 million have been deposited by 1,176 addresses.

In the past 24 hours, a large amount of $PEPE has been deposited into exchanges:

33T $PEPE worth $46.37M, with a net deposit of $22.94M from 1,176 addresses.

Beware of MEME coin drop risks pic.twitter.com/443wqMCTTJ

— 0xScope (🪬 . 🪬) (@ScopeProtocol) May 12, 2023

Scope Protocol analysts have warned the crypto community of the risks associated with massive fluctuations in meme-coins like PEPE. Typically, a large increase in the token’s investment on exchanges is considered a decline for the asset. According to data from CoinGecko, the price of PEPE has fallen sharply by 21% in the past 24 hours. With the increasing exchange wallet balances of PEPE tokens, the meme coin’s price is likely to experience further corrections.

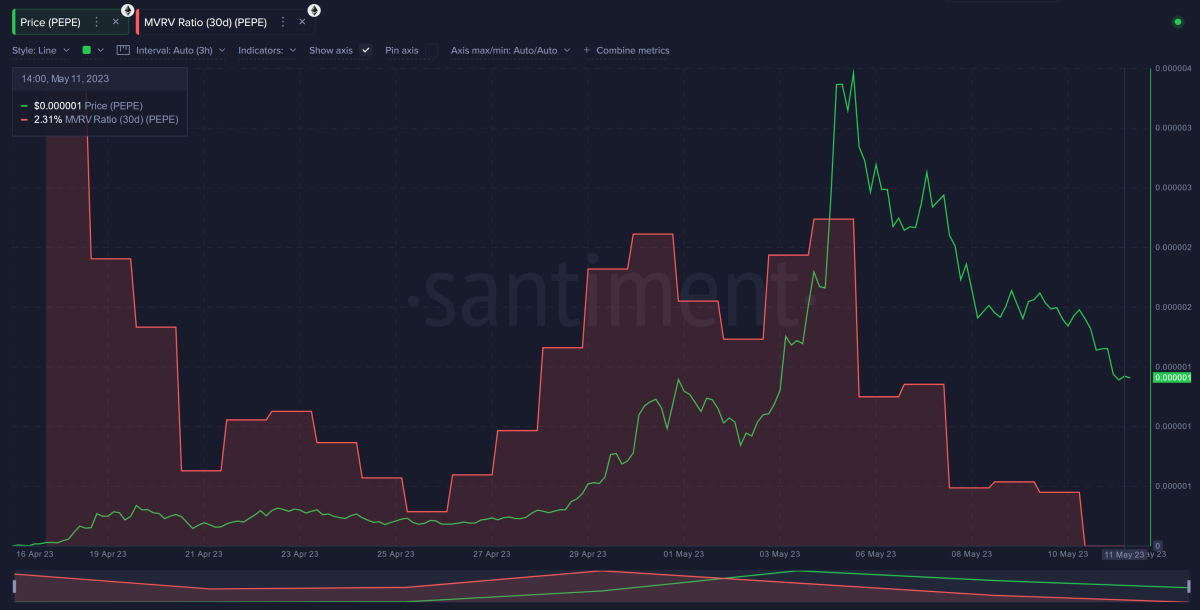

PEPE holders break even, what’s next for meme coin?

On-chain analysts at Santiment published a report on PEPE. In this context, he examined on-chain metrics to find out where the meme-coin is going. In the last 24 hours, the 30-day market value to realized value MVRV (the ratio of an asset’s market value to its realized value) shows that holders are currently at a par.

PEPE MVRV graph

PEPE MVRV graphHowever, a drop in PEPE price below $0.00000126 could push it into negative territory. This makes it an “opportunity zone” for whales and traders to buy at a relatively low price. It should be noted that altcoin price, similar to other meme-coins, is heavily influenced by speculation and expectations. Therefore, PEPE holders are likely to witness a correction in the short term.