In the week from September 2 to September 9, the highest-paid altcoin was Terra Classic (LUNC). The top five names of the green board are as follows:

- Terra Classic (LUNC): 127.97%

- Ravencoin (RVN): 54.49%

- Cosmos (ATOM): 23.92%

- Ethereum Classic (ETC): 18.26%

- Chainlink (LINK): 15.00%

Despite their performance exceeding 50 percent, will LUNC and RVN be able to keep up? To answer, let’s take a look at analyst Valdrin Tahiri’s technical analysis.

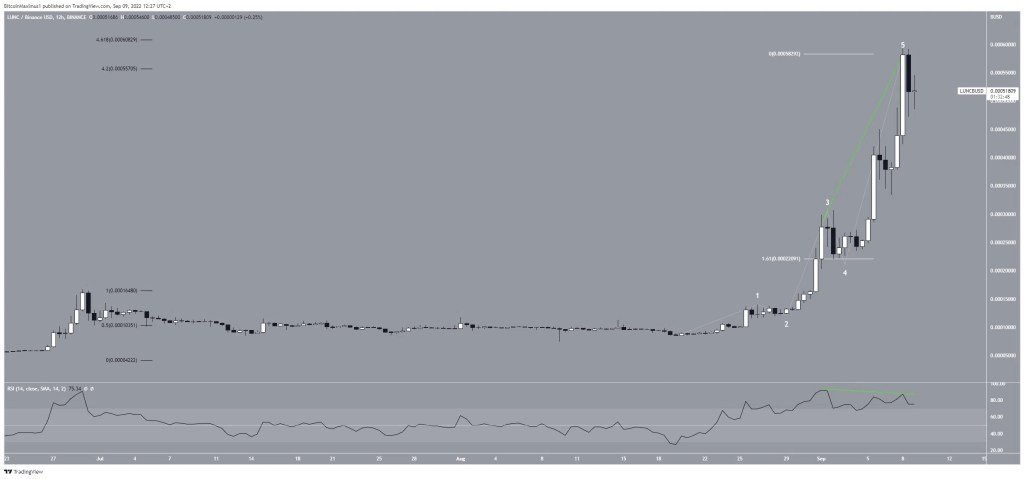

LUNC has reached a crucial Fib resistance level

LUNC has increased significantly since August 25. The upward move hit the highest level of $0.00059 on September 8 so far. The peak culminates in testing two key Fib resistance levels. 4.2-4.61 extensions of the first up move (black) and 1.61 long waves one and three (white). Therefore, LUNC reaching a peak soon is one of the possible scenarios, according to the analyst.

Also, the RSI has formed a bearish divergence (green line) indicating that a downside move could follow soon. In such a case, LUNC price could decline to the 0.5 Fib retracement level from the $0.0035 low.

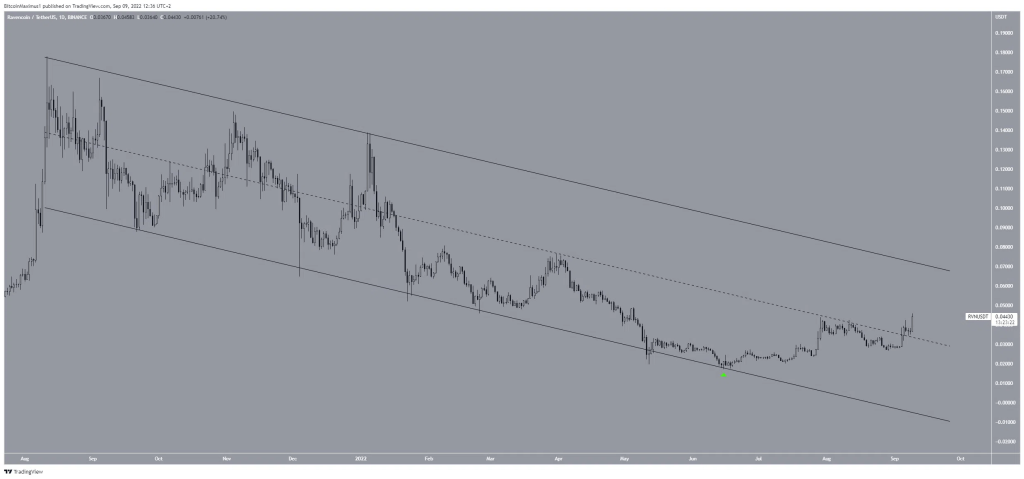

Ravencoin (RVN)

RVN, the second highest-earning altcoin project of the week, has been falling within a long-term descending parallel channel since August 2021. The downside move reached $0.017 in June 2022. The price has been rising since then and managed to retake the middle of the channel on August 5.

The descending parallel channel is considered a bullish pattern. That often leads to breakage. Combined with the recovery of the middle of the channel, this indicates that a move towards the $0.06 resistance line of the channel and a possible breakout are likely.

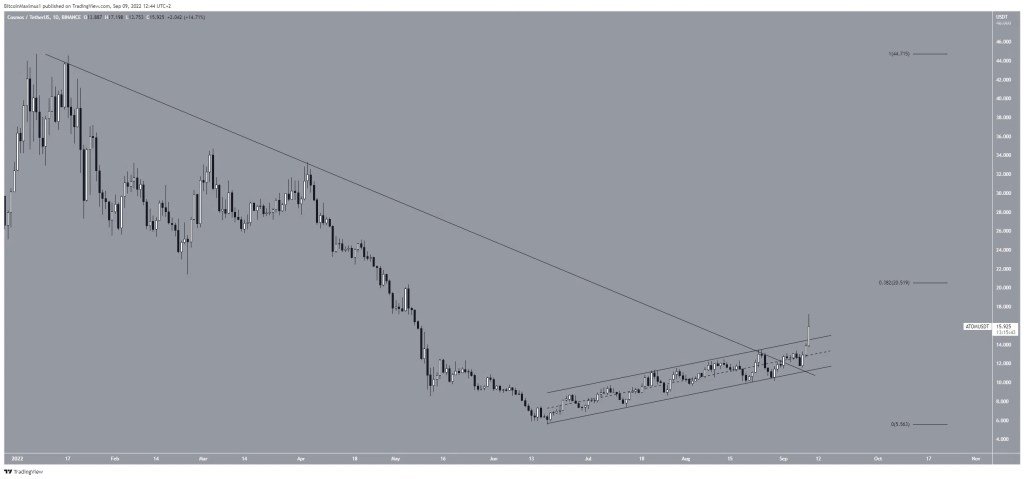

ATOM breaks out of long-term descending resistance line accompanied by altcoin market

ATOM has been rising within an ascending parallel channel since June 18. While these channels often contain corrective moves, ATOM managed to get out of it on September 9. More importantly, this also resulted in a break from a long-term descending resistance line that has been present since the all-time high in January.

If the upward move continues, the next closest resistance area will be at $20.50, especially created by the 0.382 Fib retracement level of the entire downward move since the ATH level.

Ethereum Classic (ETC)

ETC has been moving upwards since hitting its lowest level on June 18. The move hit $45.36 on July 29. The price has since been falling within an ABC corrective structure.

It is possible that the previous increase was a five-wave upward move. If so, ETC is expected to increase towards new highs. A break above $45.36 (green line) confirms this possibility, while a drop below $30.34 (red line) will invalidate it.

LINK trades between $6.20 and $9.30

cryptocoin.com As we reported, LINK price has been trading close to the $6.20 horizontal support area since May 9. It deviated below this area (red circle) before retaking the area on 13 June. This is a bullish development that often leads to significant price increases. LINK bounced off the horizontal support area of $6.20 on August 25 and has been rising ever since. A move above the $9.30 resistance area will likely accelerate the uptrend.