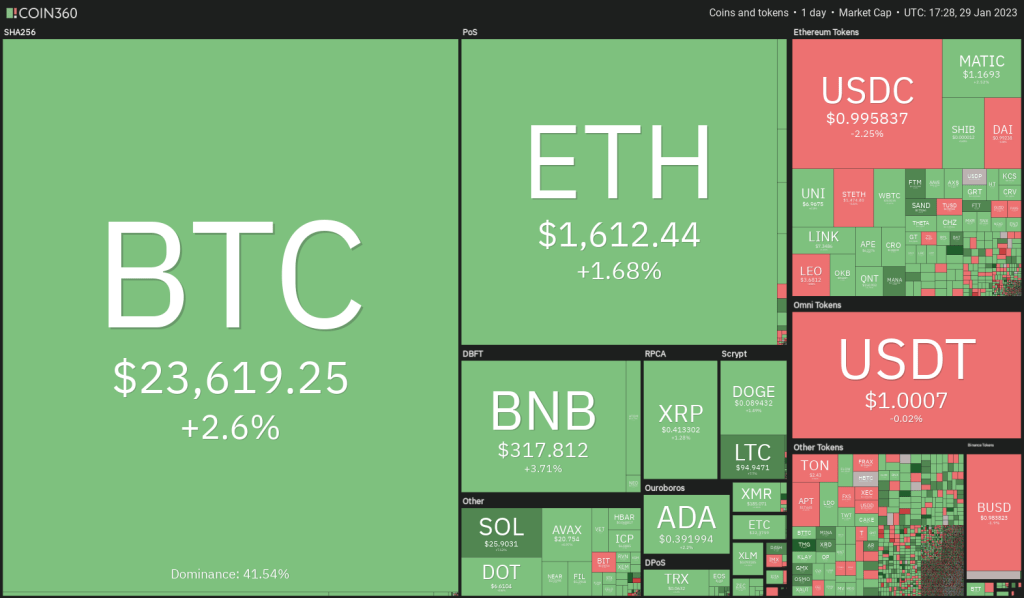

Bitcoin bulls want to push the BTC price to $24,000, and by doing so, these 4 cryptocurrencies can increase their monthly earnings.

Bitcoin continues to give bullish signals

Bitcoin is up nearly 40% so far in January, the best start of the year since 2013. The sharp up move turned several on-chain signals bullish, according to on-chain analyst Cole Garner.

Usually, a sharp rebound from market lows under the direction of the leader is a sign that strong hands may be buying aggressively. This may be because traders believe the sale may be overstated in the near term or they find the valuation attractive.

After the first run, a quick fix can be expected that will shake weak hands. The next drop will also confirm whether Bitcoin has formed a bottom. If the low is confirmed, a few cryptocurrencies could start to outperform Bitcoin in the near term.

5 cryptocurrencies that are on the radar of smart money

Bitcoin (BTC)

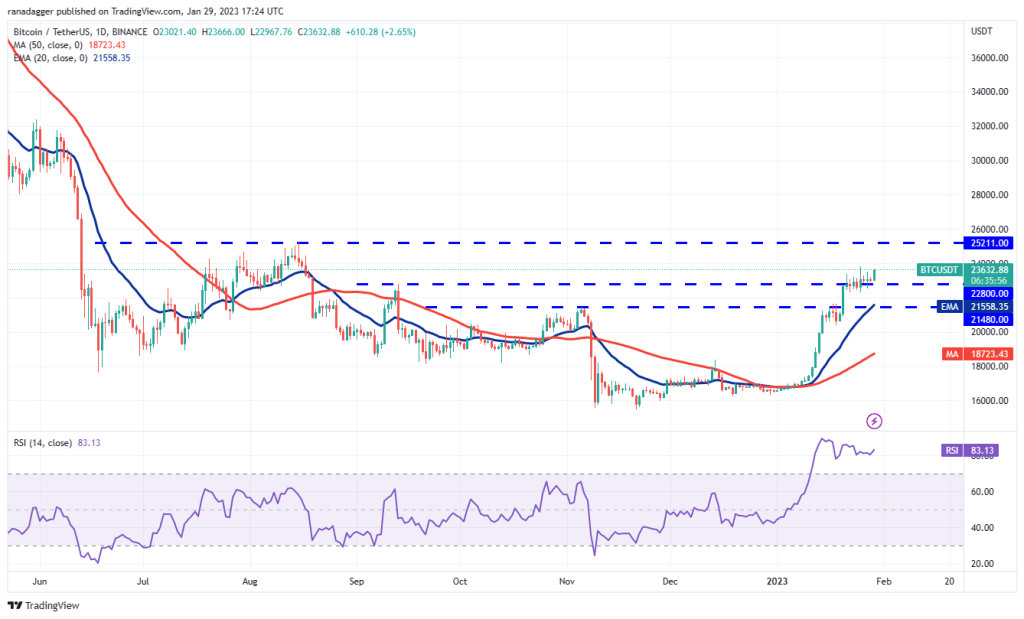

cryptocoin.com As we mentioned, Bitcoin has been trading above $ 22,800 since January 25, which indicates that the bulls are trying to turn the level to support. The upward sloping 20-day exponential moving average ($21,558) shows that the bulls are in the dominance, but the relative strength index (RSI) in the overbought zone indicates that the rally may be overbroad in the near term.

If buyers push the price above $23,816, the BTC/USDT pair could start a northward walk towards $25,211. This level can act as a tough resistance. On the downside, the 20-day EMA is an important level for the bulls to defend because if it breaks, the pair could drop to the $20,000 psychological support.

The RSI on the four-hour chart is forming a negative divergence and suggests that buyers may be losing control. If the bulls want to maintain their dominance for this coin, they will have to push the price above the $23,816 resistance. This could initiate the next leg of the upward movement.

Conversely, if the price breaks through the overhead resistance, the bears will try to push the pair below the moving averages. There is a minor support at $22,715 but if this level falls, the pair could retest $21,480.

Litecoin (LTC)

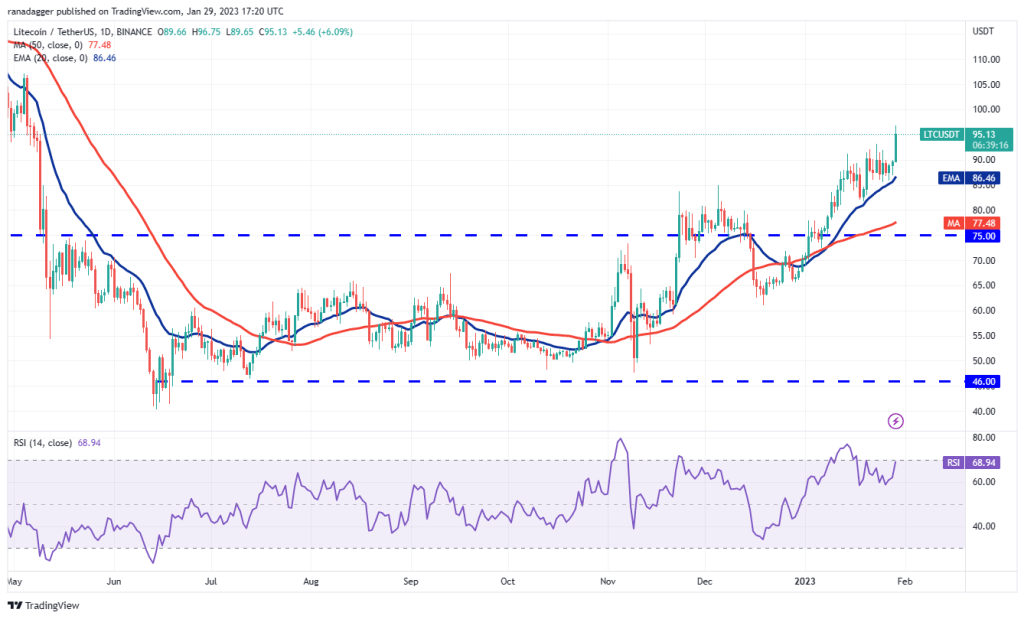

Litecoin has been in a strong uptrend for the past few days. After a brief consolidation, buyers pushed the price above the overhead resistance of $92, indicating that the upside move is intact.

The LTC/USDT pair could rally to $100, the psychological level at which the bears might try to build a roadblock again. If the bulls do not give up much from this level, the pair may extend its journey to $107. The rising 20-day EMA ($86) and the RSI near the overbought zone are taking advantage for buyers.

This positive view may be invalidated if the price drops and dips below the 20-day EMA. The pair could then drop to $81 and then to $75. A break and close above the $92 level indicates that the consolidation is in favor of the buyers. If the bulls hold the price above $92, the pair could rally towards the $98 pattern target.

The bears may have other plans. They will try to push the price below the $92 breakout level and trap the aggressive bulls. If they manage to do so, the pair could drop to $86. This is an important level for the bulls to defend, as a break below this could shift the advantage in favor of the bears.

Avalanche (AVAX)

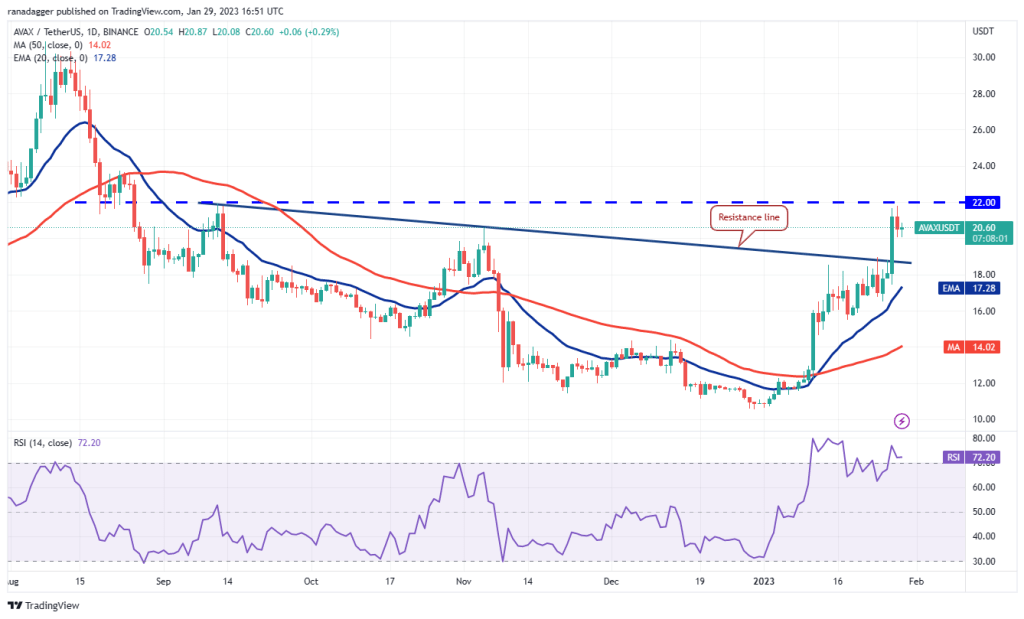

Avalanche broke above the resistance line on January 27 and reached the general barrier at $22 on January 28. The bears are trying to delay the recovery at $22, but the bulls seem in no rush to take profits. This increases the likelihood of a break above the upper barrier. If this happens, the AVAX/USDT pair could accelerate towards $30. There is a minor resistance at $24, but it will likely scale.

Another possibility is for the price to go down and retest the resistance line. If the price bounces back from this level, it will show that the bulls have turned it into support. This could increase the likelihood of a break above $22. The bears could gain the upper hand if the price breaks below the 20-day EMA ($17).

The four-hour chart shows the pair retreating near the 20-day EMA. If the price bounces off the current level, the bulls will attempt to push the pair back above the $22 hurdle. If this level scales, the pair could rally to $24.

The first sign of weakness would be a break and close below the 20-EMA. This could present an opportunity for the bears to make a comeback. Sellers can gain an advantage if they pull the pair below the resistance line and sustain it.

aptos (APT)

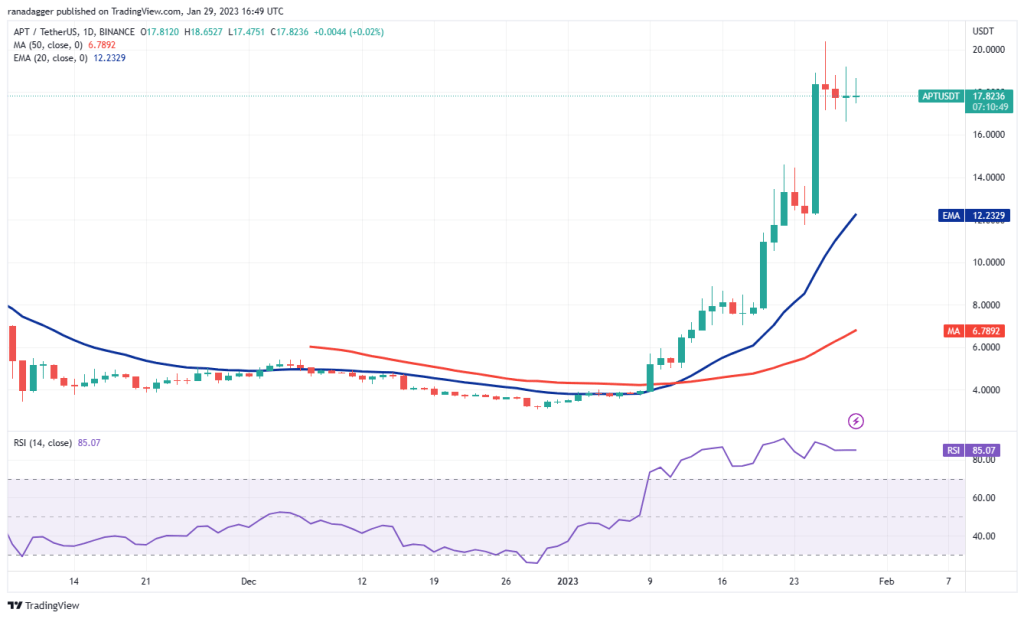

Aptos has been having a dream run for the past few days. Usually, when an asset gains momentum, it continues to move in the same direction for a while. The APT/USDT pair dropped from $20.40 on January 26, but the bulls are trying to stop the pullback from $16.62. The shallow correction shows that every small decline is bought by the bulls.

Buyers will try to push the price above $20.40 and start the next leg of the uptrend. The pair could rally to $24 later. The risk with this assumption is that the RSI has been in the overbought territory for the past few days. This increases the risk of a short-term correction. If the price drops and breaks below $16.60, the pair could drop to $14.57 and then to the 20-day EMA ($12.23).

The four-hour chart shows the negative divergence formed in the RSI. If the price breaks below the 20-EMA, the pair could test the 50-SMA. This is an important support to watch because if it breaks, the pair could drop to $12. On the contrary, if the price rises and rises above $20.40, it will show that the bulls are re-arguing their superiority. This could invalidate the negative divergence that developed in the RSI and resume the uptrend.

Phantom (FTM)

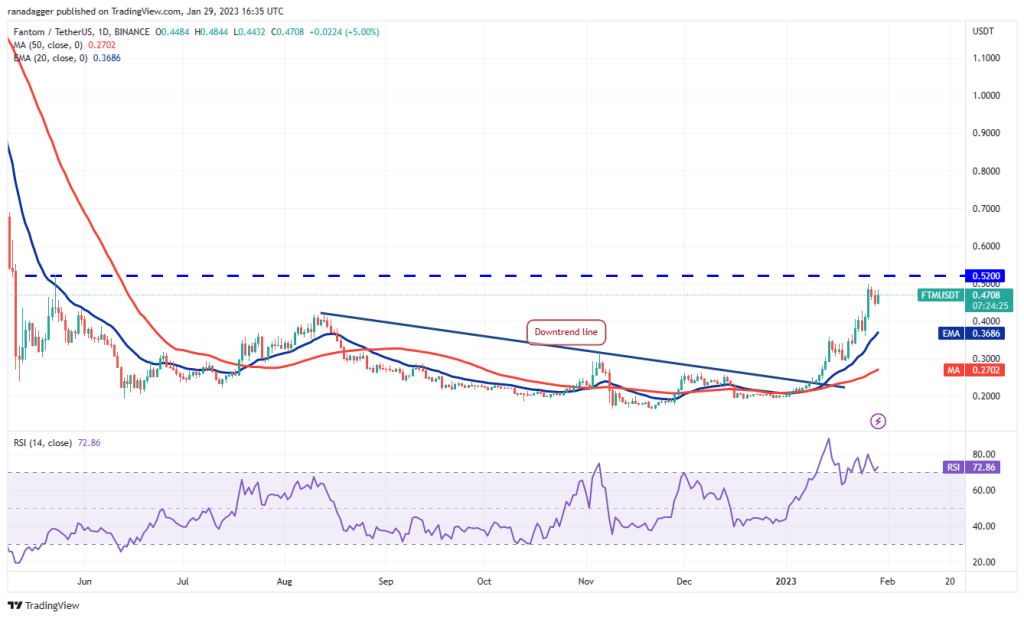

Phantom has been in a tremendous run since breaking above the downtrend line. The sharp rally in the last few days shows that the bulls are buying aggressively. Indicators show that the bulls are in tight control. During strong upward moves, corrections are short-lived as the bulls buy on every small dip. The bears are attempting to stop the upside near the psychological resistance at $0.50, but if the bulls pierce this level, the FTM/USDT pair could rally to $0.56 and then $0.63.

Sometimes vertical rallies are followed by sharp declines. Therefore, traders should be cautious, as a break and close below $0.43 could push the pair down to the 20-day EMA ($0.37). This is the key level to watch out for on the downside as a break below it could signal that the uptrend may have ended in the near term.

The pair bounced back from overhead resistance at $0.50 but found support at the 20-EMA. This shows that sentiment remains positive and traders are buying the dips. The bulls will again try to break through the general barrier at $0.50 and continue the upward move.

The bears may have other plans as they will try to push the price below the 20-EMA. This is an important level to watch in the short term, as a break below it could open the door to a possible drop to the 50-day simple moving average. If this level is also broken, the next stop could be $0.36.