On-chain researcher Lookchain reports that an altcoin whale that has been dormant for over five years is back in action today. The whale, which mined in 2017, has about $16 million worth of crypto wallets.

Altcoin whale, which has been inactive for 5 years, completes its first transfer

According to data provided by Lookchain, the whale, which accumulated 10,266 ETH through mining in 2017, has today moved its entire wallet worth $16 million. 1,322 ETH worth $2 million has been transferred to the central cryptocurrency exchange Poloniex. This indicates that the whale probably wants to cash out 1,322 ETH.

An address that has been dormant for more than 5 years transferred 10,266 $ETH ($16M) out.

The 10,266 $ETH was obtained through mining in 2017.

Among them, 1,322 $ETH ($2M) was transferred to #Poloniex.https://t.co/hsXiBh5iS2 pic.twitter.com/7L1nkx6Fe6

— Lookonchain (@lookonchain) March 6, 2023

The timing of the transfer comes at a time when Ethereum is on the decline, approaching a critical support level. With 10,266 ETH that has been dormant for over 5 years, the whale will likely want to profit at an ideal price level. Current technical analysis suggests that it might make sense for the big investor to wait a little longer.

“If Bitcoin breaks this level, Ethereum (ETH) may be in another rally”

In the hours of the Ethereum whale awakening, Chris Burniske, founder of venture firm Placeholder, detailed a scenario in which ETH could explode. The crypto analyst predicts that if the dollar and interest rates fall, Bitcoin could surpass $25,000, and if Ethereum does the same, it could lead to another bull market.

Bitcoin has been experiencing some volatility over the past few days. Another technical analyst, Jake Wujastyk, believes that Bitcoin price is trying to catch a bid after establishing a fixed volume-weighted average price (VWAP) on the daily chart.

#Bitcoin $BTCUSD An @alphatrends anchored VWAP pinch forming on the daily chart.

Price attempting to catch a bid here. pic.twitter.com/1b0DWaYHSv

— Jake Wujastyk (@Jake__Wujastyk) March 6, 2023

The price of Bitcoin has fluctuated sharply since last week, from $23,880 on March 1 to $22,198.98 on March 4. cryptocoin.com As we reported, Bitcoin price dropped roughly 6% on March 3, reaching its intraday low of $22,000. This drop was linked to the collapse of Silvergate, a cryptocurrency-friendly bank.

Silvergate’s shares took a big hit and hit an all-time low after the bank delayed its annual report. Major cryptocurrency clients, including Coinbase, Bitstamp, Circle, and Paxos, have severed ties with the bank.

Altcoin investors adopt high leverage on Ethereum

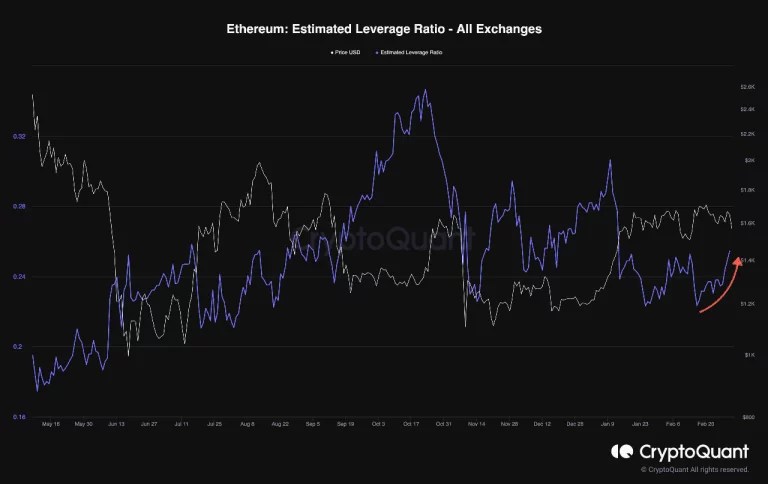

According to current on-chain data, ETH has been experiencing a surge in leverage since early February following volatility and slowing demand. Contrary to its performance in January, however, recent observations point to an increased risk of liquidation, which could lead to an increase in volatility.

A recent CryptoQuant analysis addressed the potential for the Ethereum futures market to overheat. The analysis was based on the observed increase in leverage demand among futures market participants. The increase in leveraged trades reflects the low demand in the market and thus the low enthusiasm in the price action.

Ethereum (ETH) is trading above the $1,500 zone at the time of writing. It has decreased by around 5% compared to the last 24 hours.