Cryptocurrency whales first attacked the popular meme coin Shiba Inu (SHIB) and the recently popular altcoin Polygon (MATIC), making a hefty $881 million. Whales are now chasing two Ethereum-based altcoins.

The whales have had their fill of SHIB and MATIC!

cryptocoin.com As you follow, the crypto market is starting to heat up. In the heat of crypto waters, whales appeared and began to swallow the tokens they had caught sight of. Of these, Shiba Inu (SHIB) and Polygon (MATIC) were among the whales’ favorite tokens. Accordingly, the whales devoured SHIB and MATIC2 worth approximately $900 million. Crypto whales’ eyes are now focused on two other altcoin projects running on the Ethereum (ETH) Blockchain.

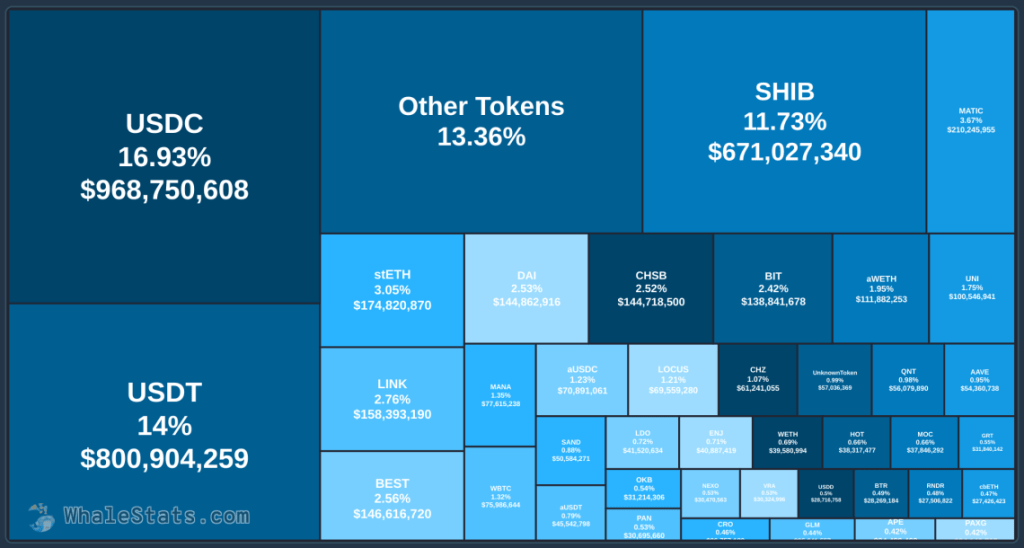

Whale-tracking platform WhaleStats reveals that the top 1,000 Ethereum whales have amassed $671 million worth of SHIB and $210 million worth of MATIC.

Source: WhaleStats

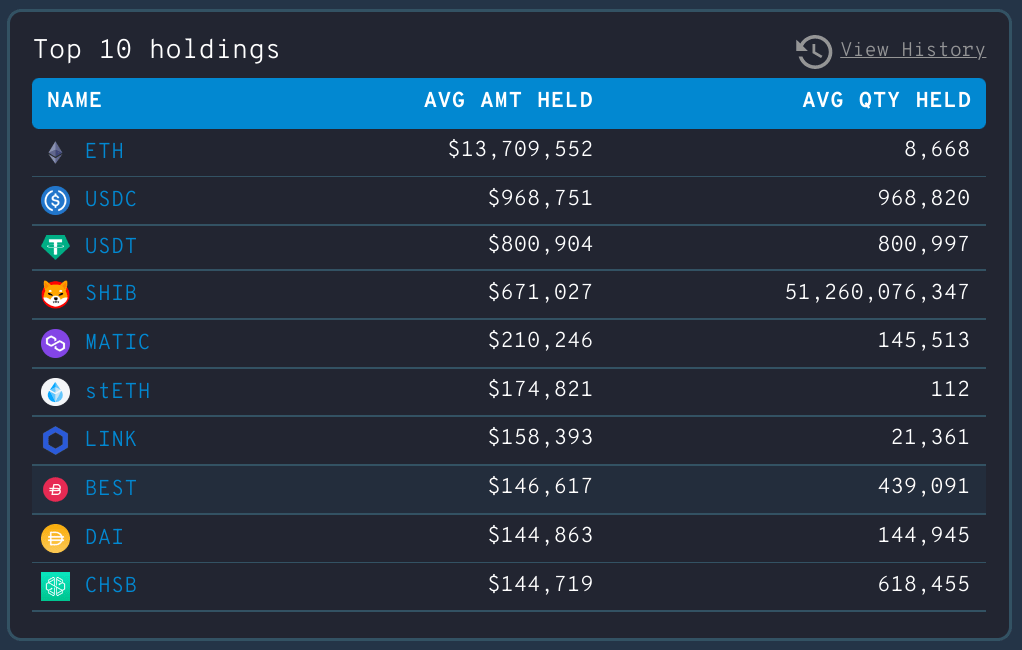

Source: WhaleStatsAccording to the whale watcher, SHIB remains the most-held altcoin among the investor group, excluding ETH itself and stablecoins Tether (USDT) and USD Coin (USDC). Also, MATIC comes right behind the popular meme coin Shiba Inu.

Whales have turned their eyes to these two altcoins

After MATIC, the 1,000 largest Ethereum whales are feasting on Lido Staked ETH (stETH), a liquid staking derivatives token that can be exchanged 1:1 for Ethereum on Lido Finance. WhaleStats shows that Ethereum whales have an average of $174,821 worth of stETH. The decentralized oracle network Chainlink (LINK) follows stETH with the 1,000 largest ETH whales owning an average of $158,393 worth of LINK.

Source: WhaleStats

Source: WhaleStatsWhaleStats also reported an increase in LINK whale accumulation over a one-day period. In this regard, “LINK is currently among the top 10 tokens purchased among the top 1,000 ETH whales in the last 24 hours,” he explained. At press time, LINK was trading at $7.93, up 13.9% on a weekly basis. However, the altcoin has seen some pullback on a daily basis.

Data from WhaleStats also reveals that Ethereum whales currently hold more than $1.76 billion worth of USDT and USDC stablecoins, taking up more than 30% of their crypto portfolios. According to experts, the massive allocation to stablecoins shows that Ethereum whales are cautious after market-wide rallies this year. Because stablecoins are indexed to the dollar, they are not affected by market volatility on a large scale like other cryptocurrencies.