February 2025 was closed with damage to the Altcoin market due to political tensions such as US-Mexican voltage. Last week, with increasing volatility, global crypto market capitalization fell to the lowest level of the year. While investors prepare for what will happen in March, some Altcoin projects attract attention with high earnings in this tense environment.

The trend on the last day of February 2025, 3 Altcoin

Sui (water)

Layer-1 (L1) Coin is one of the most sought-after beings today. The value of the water, which is affected by the decrease of the wider market, decreased by 10 %in the last 24 hours and is currently traded for $ 2.63. This is close to the low levels in November 2024.

The decline in the transaction volume of SUI confirms high sales pressure in the spot markets. The transaction volume, which reached $ 1.12 billion in the last 24 hours, has decreased by 15 %.

If the price and transaction volume of an asset decreases at the same time, the market interest is weakened and the procurement pressure is reduced. This shows that the demand for SUI has decreased and the liquidity has a risk of decreasing as it narrows.

If the price decrease continues, the water may decrease to $ 2,10. If this level does not hold, the price of Coin may decrease below $ 2 and drop to $ 1.57. On the other hand, if the purchase activity starts again, the value of the water may rise above $ 3.

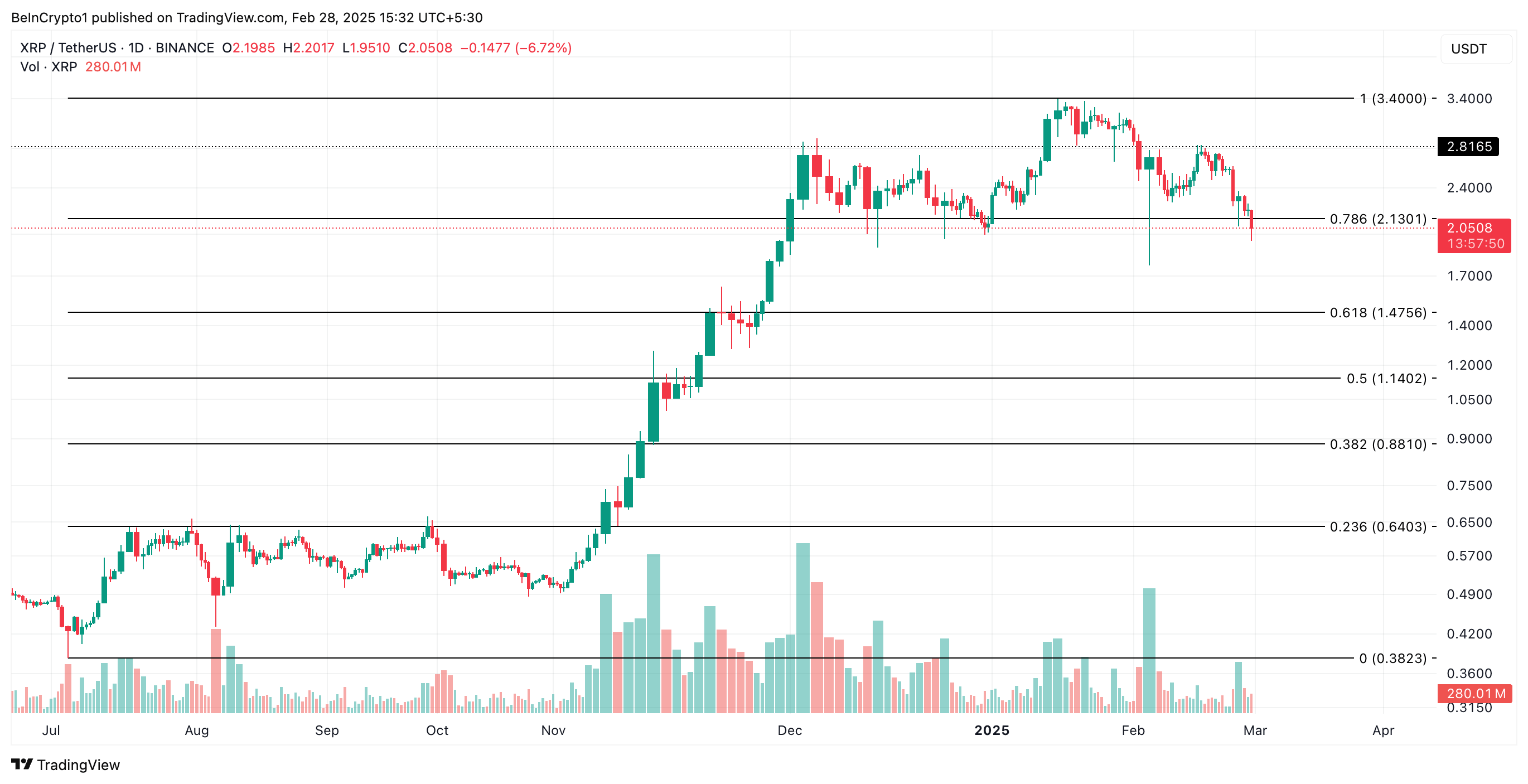

XRP (XRP)

Another trend today is another Altcoin XRP. Investors discussed the future of the Ripple case after a closed meeting with the United States Securities and Stock Exchange Commission on 27 February.

While the regulatory institution has rejected the cases against large crypto companies such as Coinbase, Uniswap and Robinhood, the expectations of whether Ripple will receive regulatory help has increased.

Currently, XRP is trading for $ 2.05. Parallel to the overall decrease of the market, the XRP price fell by 9 %in the last 24 hours. In the daily graph, the price is traded below the resistance level of $ 2.13.

If the speculation of the possibility of reducing the case against Ripple against Ripple increases the demand for the XRP, the price may rise to $ 2.81. However, if the decline continues, the price of XRP may decrease to $ 1.47.

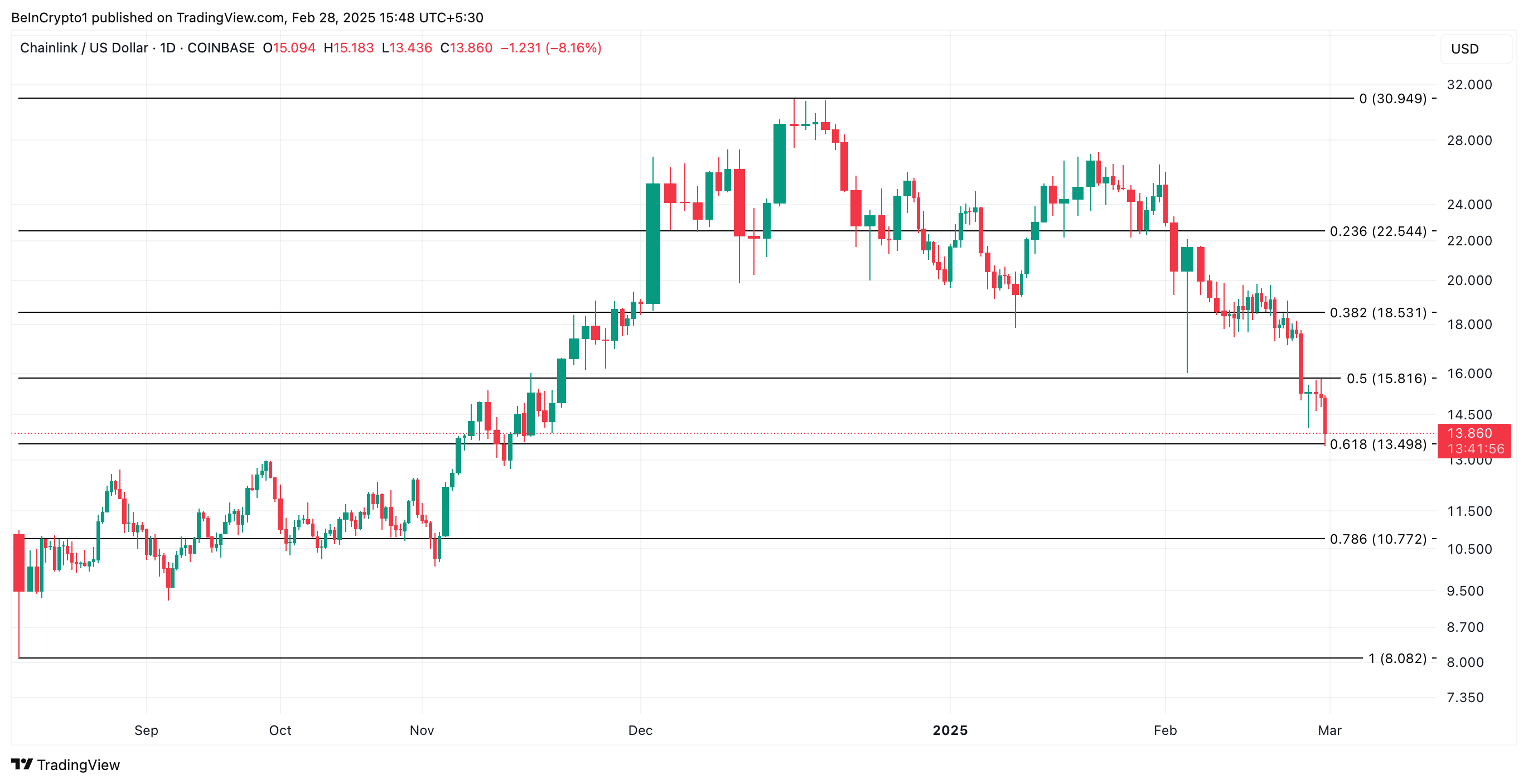

Chainlink (LINK)

Chainlink’s Link is one of the trends today. LINK, which decreased by 11 %in the last 24 hours, is traded for $ 13.89 at the time of writing. In the daily graph, Aroon Down Line confirms the power of LINK’s price drop. Currently this value is 100 %.

The Aroon indicator measures the power and direction of a trend, follows how much time has passed over the last highest peak or lowest bottom level. When the aroon down line is 100 %, it indicates that this being has decreased to a new bottom level and a strong decline trend has begun, which indicates the ongoing decline momentum.

This is the case for LINK; Reaching a four -month bottom level, LINK is at risk of experiencing a further decline with the worsening of the procurement pressure. If the price decrease continues, the LINK may decline to $ 10.

However, if the demand for LINK increases, this may invalidate the expectation of decline. In such a case, token’s price may rise up to $ 15.81.

To be aware of last -minute developments Twitter ‘ in, Facebookin And Instagram follow and follow Telegram And Youtube Join our channel!