Bitwise Investments Chief Investment Officer Matt Hougan evaluated the current state of the cryptocurrency market. He also shared his views on cryptocurrencies that investors should consider.

These cryptocurrencies are a favorite of institutional investors

Bitwise Investments’ Chief Investment Officer Matt Hougan was a guest on the ‘Making Money with Matt McCall’ podcast recently. Hougan discussed the current state of the cryptocurrency market and the types of assets investors should consider. Hougan emphasized how important it is to have both Bitcoin (BTC) and Ethereum (ETH) in a portfolio. He also stated that Bitcoin is ‘still a very important crypto asset’ and that institutions feel most comfortable owning. Ethereum is the second most popular cryptocurrency.

Matt Hougan noted that there is a huge market for Bitcoin driven by institutions accepting the cryptocurrency and decreasing volatility of the asset. Hougan highlighted the important technological advances the ecosystem has undergone when it comes to Ethereum. cryptocoin.com As you follow, Ethereum has switched from PoW to PoS with Merge. Hougan cited a large number of programmers and constantly falling transaction costs as an example. In that context, “I’m excited about what’s happening in Ethereum,” he said.

Hougan suggested considering Cosmos’ native cryptocurrency (ATOM). He also described it as ‘an interesting altcoin if you want to go beyond the big two’. Bitcoin and Ethereum are the ‘two major’ cryptocurrencies currently in circulation. He highlighted the enthusiasm and activity associated with the asset, noting that it could propel the Bitcoin market forward at some point in the future.

What do institutional investors think?

In a recent survey, CoinShares, which proclaimed itself as ‘Europe’s largest digital asset investment and trading group’, wanted to learn about the views and behavior of investment managers in the cryptocurrency space. The survey was conducted to learn more about the digital asset space.

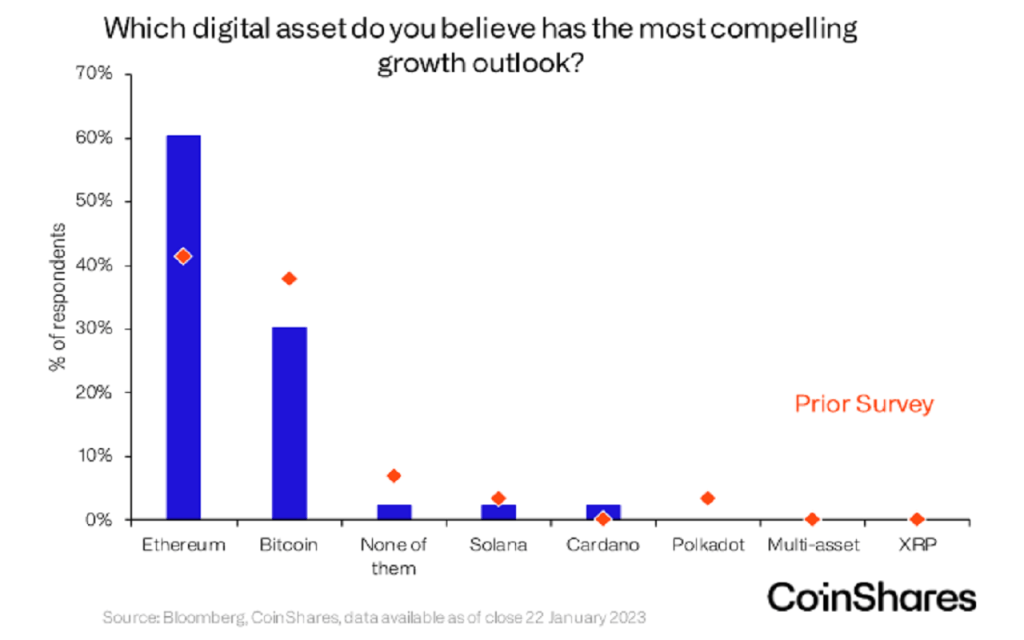

According to the findings of the most recent edition of CoinShares’ Digital Asset Quarterly Fund Managers Survey, 60% of the forty-three fund managers surveyed who have a total of three hundred and ninety billion dollars worth of assets under management truly believe that Ethereum is the most important in 2023. thinks it has positive economic prospects.

Which cryptocurrency has the best looks? Source: CoinShare

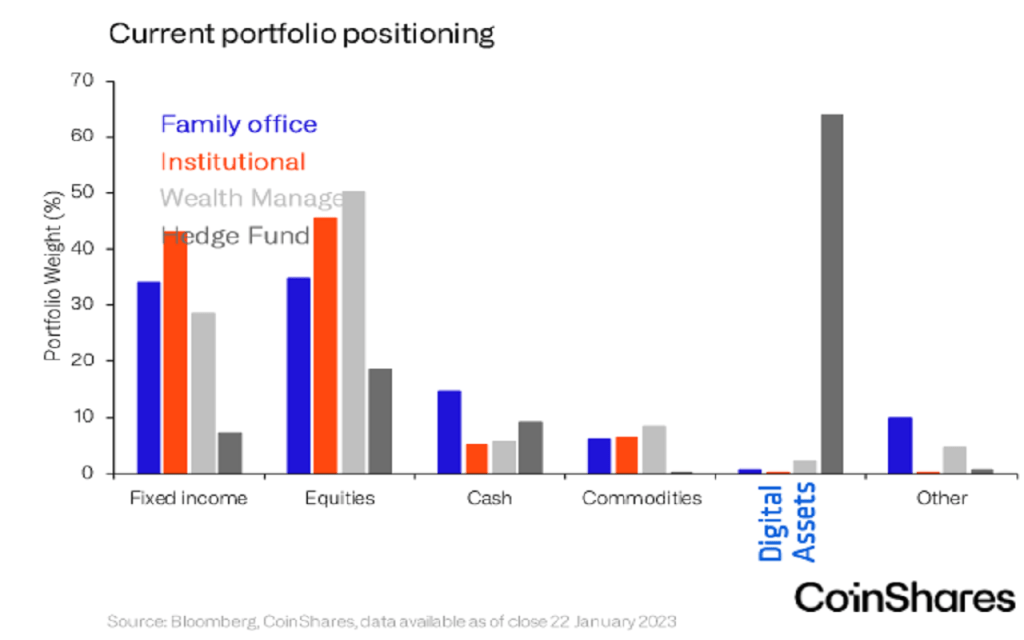

Which cryptocurrency has the best looks? Source: CoinShareThe survey also showed that Bitcoin and Ethereum investments were consolidated and digital currencies were rapidly being incorporated into hedge fund portfolios, increasing from 0.7% to 1.1% of total assets under management.

Cryptocurrencies are an important part of portfolios / Source: CoinShare

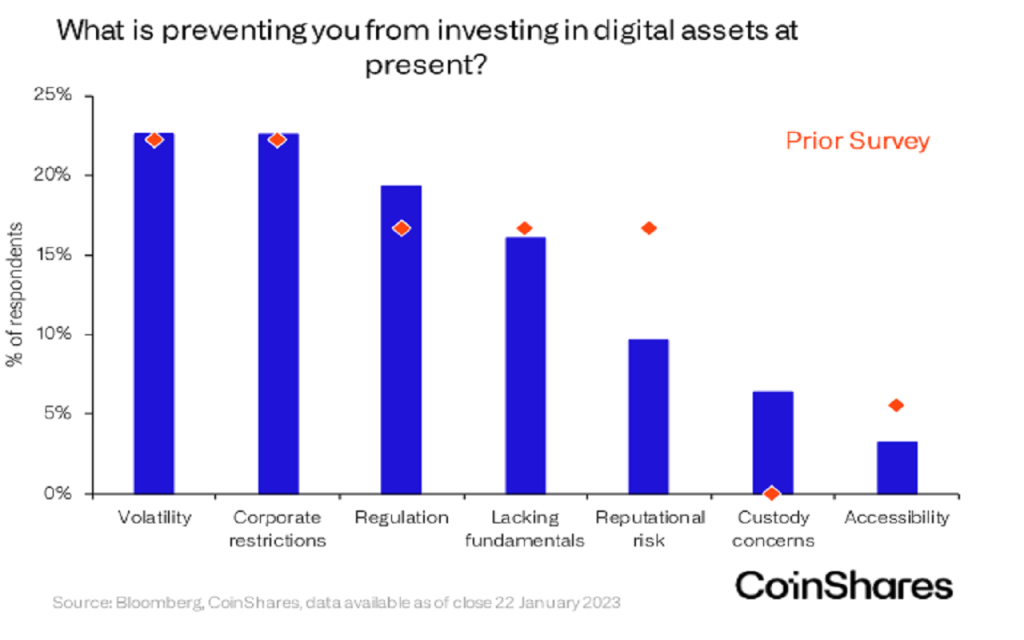

Cryptocurrencies are an important part of portfolios / Source: CoinShareCustomer demand and market speculation have been the main forces behind the increasing trend towards incorporating digital assets into investment portfolios. It is interesting to note that some investors see possibilities in the current market. When respondents were asked what factors led them to avoid participating in digital assets, the survey showed that the perceived danger of reputational damage had decreased, but regulations remained a cause for concern.

Current concerns about cryptocurrencies / Source: CoinShare

Current concerns about cryptocurrencies / Source: CoinShare