After last week’s downside correction, gold prices started last week under bearish pressure. However, renewed US dollar weakness and lower US Treasury yields helped gold gain momentum midweek. Focus shifts to next week’s November employment report from the US. According to market analyst Eren Şengezer, the technical outlook for gold points to a slight uptrend in the short term.

Gold prices recovered after a bad start to the last week

China reported Covid deaths for the first time since May. Also, several districts in Beijing have closed schools due to the increasing number of cases. Additionally, Guangzhou has ordered a five-day lockdown in the Baiyun district. Concerns have risen again about China reinstating strict restrictions. The potential negative impact of the zero Covid policy on the demand outlook for the precious metal caused gold to decline earlier in the week.

Markets brushed aside China concerns on Tuesday. Thus, gold prices managed to recover as the improving market mood made it difficult for the US dollar to find demand. On Wednesday, gold rose sharply in the second half of the day and approached $1,760.

“Inflationary pressures will likely continue to cool”

The data released by S&P Global showed that the private sector business volume continued to contract by accelerating in November. It also revealed that the Composite PMI fell to 46.3 from 48.2 in October. This data missed the market expectation of 47.7 and triggered a US dollar sell-off. Commenting on the data, Chris Williamson, Chief Economist at S&P Global Market Intelligence, said that the rate of decline in production and demand is consistent with the economy contracting by 1% annually. In this context, Williamson made the following statement:

Inflationary pressures will likely continue to cool significantly, potentially in the months ahead. However, in the meantime, the economy continues to push into the depths of a possible recession.

Gold prices took strength from the dove FOMC, but…

cryptocoin.com As you followed on , the minutes of the Fed’s last policy meeting, later in the day, showed that most policy makers supported a slowdown in rate hikes. Additionally, he revealed that the Fed sees it is possible for the economy to enter a recession within the next year. By contrast, the benchmark 10-year US Treasury yield fell to 3.65%, its lowest level since early October. This helped gold continue to rise late on Wednesday.

In the second half of the week, trading volumes weakened due to the Thanksgiving holiday in the US. Therefore, financial markets remained relatively calm. However, China reported a record one-day high with 32,695 coronavirus cases. Due to this, gold prices could not carry their upward momentum to the end of the week. Accordingly, it closed the week almost unchanged near $1,750.

“Gold prices may rise with the first reaction to this data”

There will be no high-impact data on Monday. That’s why investors will look to coronavirus headlines from China. According to the analyst, if China continues to tighten restrictions over the weekend, it is possible for gold to take a step back.

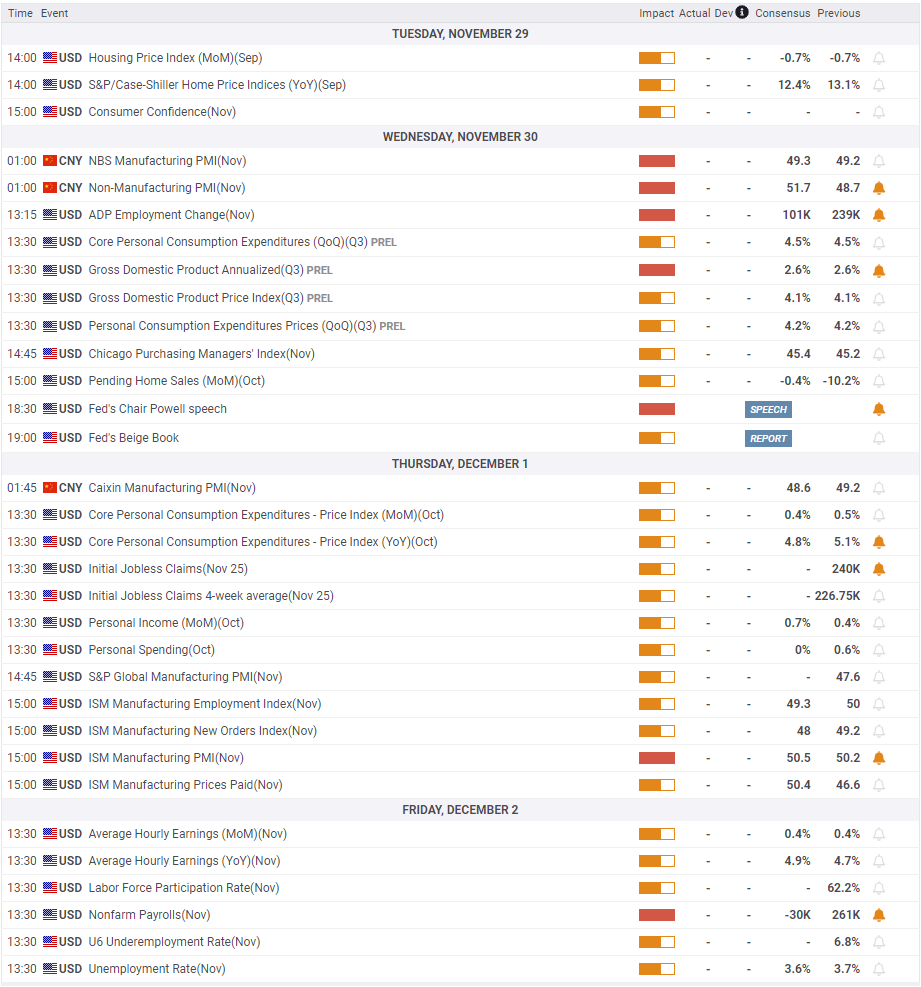

The Conference Board’s Consumer Confidence Index will appear on the US economic list on Tuesday. However, the analyst says that market participants will likely refrain from basing their trading positions on this data before the key data will be released this week. On Thursday, ISM will release November Manufacturing PMI data. Markets expect the headline PMI to drop to 49.3 from 50 in October. Moreover, there is an expectation that the Price Paid Index component will increase from 46.6 to 50.4. The analyst makes the following assessment:

The market reaction to S&P Global’s PMI surveys suggests that the US dollar will likely come under selling pressure if ISM’s PMI report shows that price pressures continue to ease as activity shrinks in November. In this scenario, it is possible for the gold price to rise with the initial reaction.

Data of the week will be US NFP

The U.S. Bureau of Labor Statistics will release labor market data for November on Friday. Expectations are for Non-Farm Payrolls (NFP) to fall by 30,000, after increasing 261,000 in October. According to the analyst, a negative data is likely to put heavy pressure on the US Dollar. Also, it is likely to open the door for bullish action ahead of the weekend.

CME Group’s FedWatch Tool shows that markets are currently pricing in a 71% probability of a 50bps Fed rate hike in December. The analyst notes that a disappointing employment report could confirm a smaller rate hike. It’s even possible to revive expectations for a center next year. Based on this, the analyst makes the following comment:

Such a market assessment is likely to cause US T-bond yields to drop sharply. This is likely to help gold maintain its bullish momentum. On the other hand, a positive NFP surprise has the opposite effect on financial markets. Thus, it is possible that it will force the gold price to decline.

Gold prices technical view

Market analyst Eren Şengezer draws the technical picture of gold as follows. Gold prices lost their bullish momentum after this week’s move as the Relative Strength Index (RSI) indicator on the daily chart dipped just below 60. However, gold is comfortably holding above the 20-period Simple Moving Average (SMA). This suggests that sellers are staying on the sidelines for now.

Ahead of gold, $1,780 stands as initial resistance. With a daily close above this level, a test of $1,800 is possible if it manages to break this resistance. Later, it is likely to target $1,830. On the downside, $1,720 is forming a strong support ahead of $1,700.

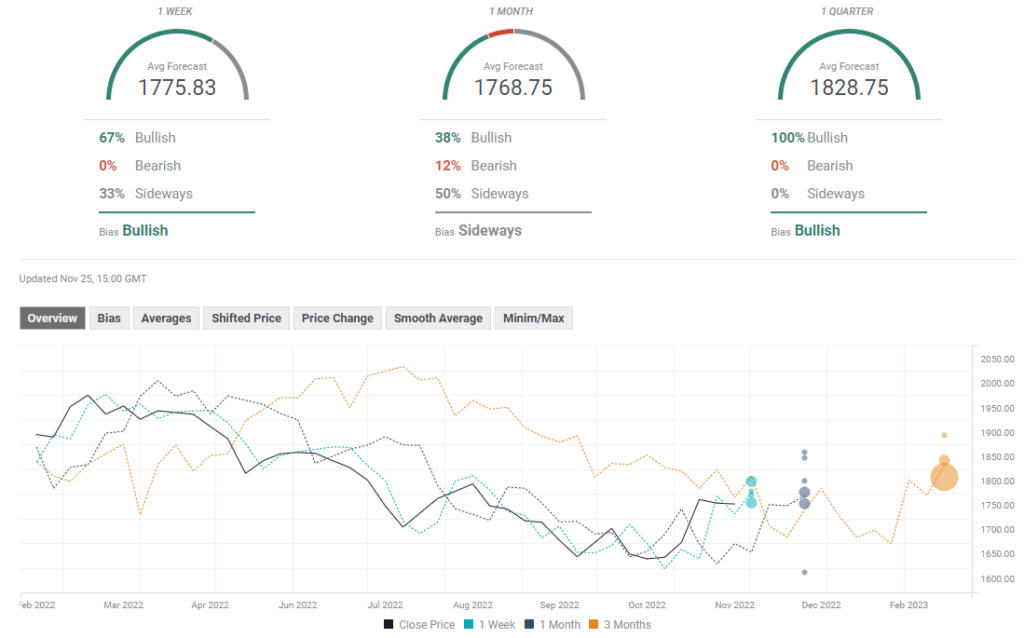

Gold price prediction survey

The FXStreet Forecast Survey shows the one-week target at $1,775 in the near-term view of gold. Thus, the survey indicates that respondents are overwhelmingly bullish. Meanwhile, the one-month outlook remains mixed. However, most experts surveyed predict that gold will rise above $1,800 in the one-quarter outlook.