Gold prices started the new week calmly, but managed to gain three straight days before losing traction on Thursday amid the move in US Treasury yields. However, gold closed the week almost unchanged around $1,860. According to market analyst Eren Şengezer, the highly anticipated inflation data from the US may affect the market pricing of the Federal Reserve’s interest rate outlook and provide a directional clue for gold next week.

Gold prices started the week calmly

In the absence of high-level macroeconomic data releases, gold fluctuated in a narrow range on Monday. However, after the sharp decline witnessed before the weekend, short closings allowed gold to technically correct. The hawkish Fed comments on Tuesday helped the greenback maintain its resilience against its rivals and capped gold’s rise. Minneapolis Fed President Neel Kashkari said that after the impressive January jobs report, the final interest rate forecast is still around 5.4%, saying that they have not yet made enough progress to declare victory in the battle against inflation.

“We probably need to raise rates more,” FOMC Chairman Jerome Powell said in an interview with The Economic Club of Washington, DC. The President also acknowledged that they expect 2023 to be the year of significant reductions in inflation. The probability of CME Group FedWatch Tool’s two more 25 basis points (bps) rate hikes in March and May was around 70%. This suggests that the comments did not affect the market pricing of the Fed interest rate outlook.

Gold comes under bearish pressure in the second half of the week

cryptocoin.com As you follow on Wednesday, gold came under bearish pressure late Thursday and wiped out all of its weekly gains after Wednesday’s indecisive action. As the US 10-year and US T-bond yield curve continued to invert, safe-haven flows dominated the markets and gold prices fell nearly 1% on the day to just below $1,860. Thus, it recorded the lowest daily close in a month.

Meanwhile, New York Fed President John Williams noted that the peak rate of 5%-5.25% is still a reasonable view. Also, Richmond Fed President Thomas Barkin said data continued to repel recession risks, allowing hawkish Fed forecasts to boost yields.

Finally, monthly data released by the University of Michigan on Friday revealed that the Consumer Confidence Index rose from 65 in January to a snapshot of 66.4 in February. In addition, the inflation expectations component next year rose to 4.2% from 3.9% in January. This helped the USD hold its ground ahead of the weekend.

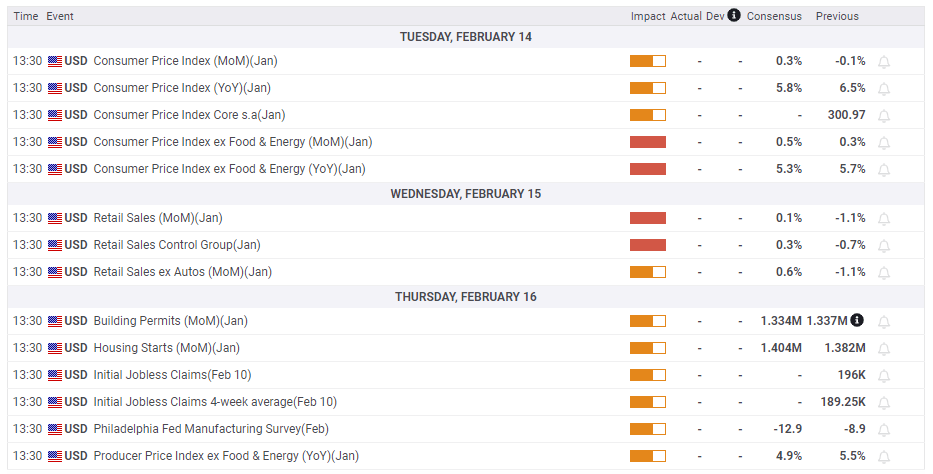

Event of the week: US inflation data

The US Bureau of Economic Analysis (BEA) will release its January inflation report on Tuesday. Market action is likely to remain under pressure ahead of this event, according to the analyst. The Consumer Price Index (CPI) is expected to decline to 5.8% year-on-year from 6.5% in December. Core CPI, which does not include variable food and energy prices, is expected to decline from 5.7% to 5.3%. As base effects are likely to distort the annual data, market participants are likely to react to the monthly Core CPI, which is expected to rise 0.5% after the 0.4% gain in December. The analyst makes the following assessment:

As mentioned above, the market position suggests more room for the US Dollar should the monthly Core CPI increase stronger than expected in January. On the other hand, data of 0.3% or less could revive the ‘Fed pivot’ narrative and add support to gold by weighing on US Dollar and US T-bond yields.

Statements from Fed officials will be followed.

It will appear on the January Retail Sales US economic list on Wednesday. However, this is unlikely to trigger a significant market reaction. On Thursday, January Housing Starts and Building Permits will be reviewed for new momentum. The real estate market is struggling with rising interest rates due to increased demand. Housing Starts are expected to bounce back 0.6% after contracting 1.4% in December. According to the analyst, a negative data could hurt the US Dollar. An unexpected increase can have the opposite effect. However, the market’s reaction to these data will likely be short-lived.

Meanwhile, statements from Fed officials following the inflation data will be closely watched by market participants. The bond market reaction could provide a directional clue for gold as gold is inversely correlated with yields, particularly the 10-year reference.

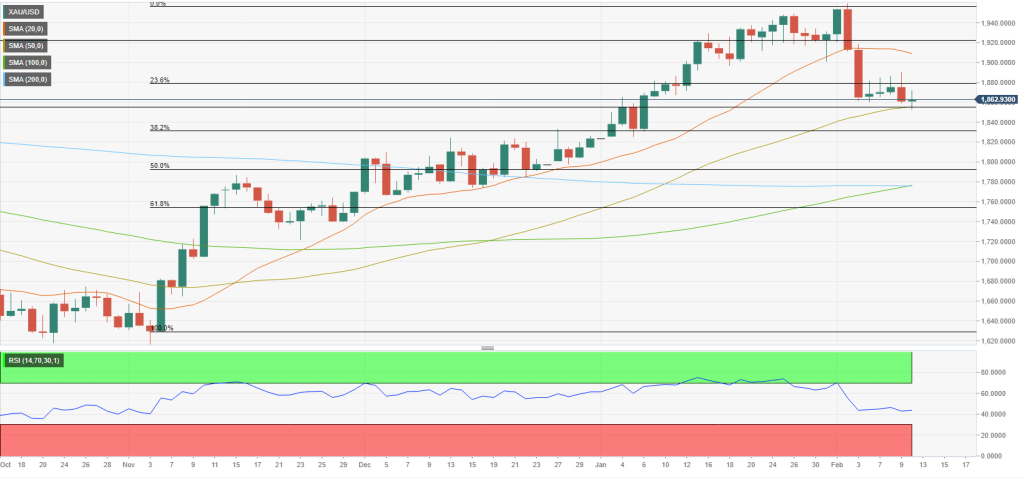

Gold prices technical analysis and gold forecast survey

Eren Şengezer draws attention to the following levels regarding the technical outlook of gold. The gold short-term technical picture points to a neutral/bearish trend. The Relative Strength Index (RSI) indicator on the daily chart is moving sideways slightly below 50, but the 50-day Simple Moving Average (SMA) remains intact around $1,855. A daily close below $1,855 could bring additional sellers and open the door for a long decline towards $1,830. Should the second support fail and start acting as resistance, gold price could decline towards $1,800.

On the upside, $1,880 (Fibonacci 23.6% retracement) is aligned as key support ahead of $1,900/1,905 (psychological level, 20-day SMA). Once gold breaks the second hurdle, it could target $1,920 (static level, previous support).

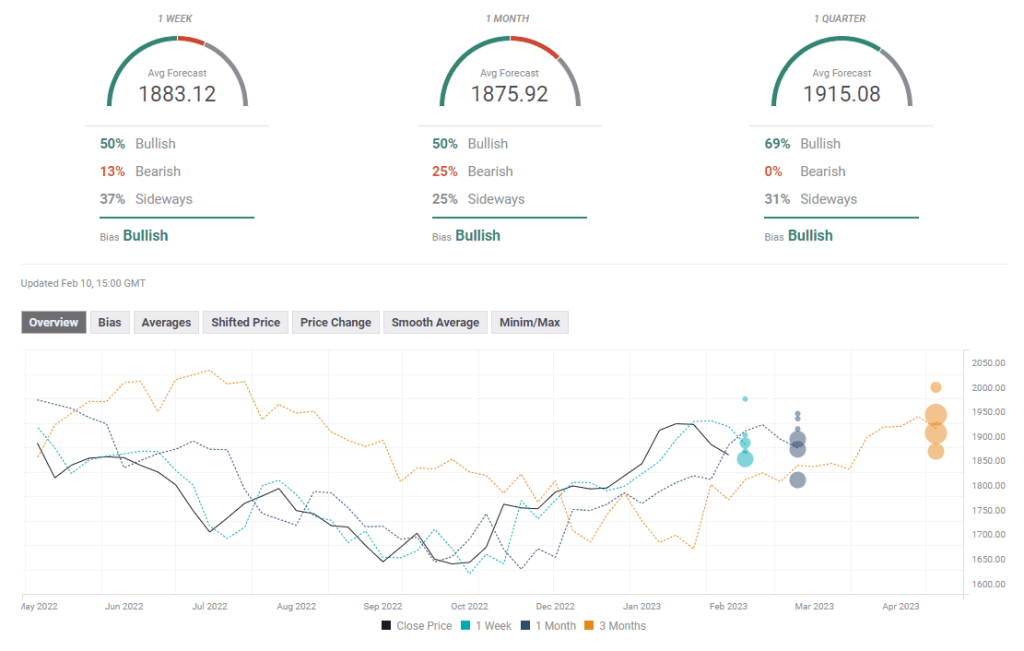

The FXStreet Forecast survey points to a slight bullish trend in the one-week outlook with the average target of $1,883. Half of the experts surveyed expect gold to continue to rise in the next four weeks and four months.