Bitcoin is on track to hit its sixth consecutive weekly loss, the longest streak to date. The realization of this pattern is thought to signal additional losses for the largest cryptocurrency in the world. So what exactly was behind the collapse in cryptos like Bitcoin, Dogecoin (DOGE), Ethereum (ETH), Shiba Inu (SHIB)? Crypto analytics platform Crypto Quant suggested one possible reason. Here are the details…

Markets dominate

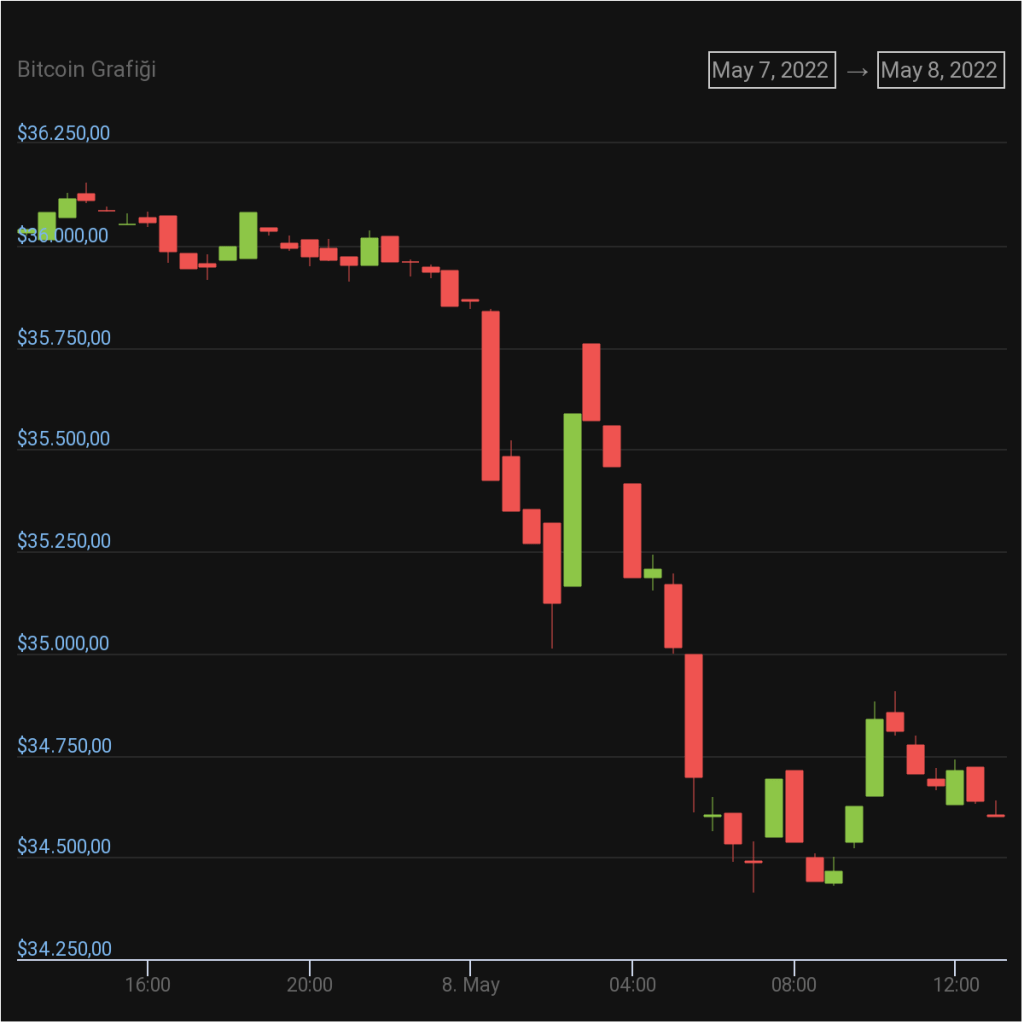

This week, Bitcoin experienced one of its fastest drops in 2022 as investors expect cash to dry up due to rising interest rates and sluggish economic development. The data shows that Bitcoin is down 7.5 percent from the previous week and is trading at $34,637, its lows for 2022.

Bitcoin Fear and Greed Index has once again reached the level of “extreme fear” as the price of cryptocurrencies continues to fall. The Fear and Greed Index is at its lowest level since the end of January, at 18 as of this writing, compared to 23 yesterday. In fact, the metric hasn’t dropped this much since the end of January when the Bitcoin price dropped to $33,000.

Why did Bitcoin, DOGE and SHIB crash? As we have reported as

Kriptokoin.com , the decline of Bitcoin affects other altcoins in a very negative way. In the last drop, besides BTC, many major altcoins lost value. It was noteworthy that there was no obvious reason behind this. Chinese crypto journalist Colin Wu shared data provided by South Korea-based on-chain data provider CryptoQuant that provides one of the explanations for the massive Bitcoin price drop that occurred earlier this week.

According to CryptoQuant data, the decline in the past two days may be dominated by short-term holders. On the 5th and 6th, a total of 11.76k "young" BTC held for less than 3 months flowed into the exchange. pic.twitter.com/aUCE9hiAtk

— Wu Blockchain (@WuBlockchain) May 7, 2022

CryptoQuant chart shared by Wu, short on May 5 and 6 It shows that futures crypto investors have moved 11,760 Bitcoins to multiple crypto exchanges. These BTCs had been held in the hands of investors for less than three months. In addition, another possible reason for the decrease in BTC is shown as the decision to increase the interest rate announced by the US Federal Reserve (FED) by half a point. The Fed recently announced the largest rate hike in more than two decades as it hardened its fight against rapidly rising prices.