Capitulation is the process of selling at a loss where any hope or belief that prices will rise is lost. According to Glassnode data, a significant portion of investors who do this are those who bought at the 2021-2022 market peak. Also, Bitcoin miners are fast approaching capitulation…

Long-term Bitcoin investors are selling at a loss, according to Glassnode data

According to on-chain data provider Glassnode, most of the Bitcoin selling pressure comes from long-term investors in particular. A significant portion of these investors are those who bought near the market peak in 2021-2022.

Our new #MarketPulse piece is fresh out of the oven;

"The recent rally has given allowed Long-Term Holders an opportunity to exit a fraction of their holdings at their cost basis, at prices which essentially <get their money back>."@glassnode https://t.co/OlQ9JnQ3tJ

— CryptoVizArt.₿ 📈 | ZiCast 🎙 (@CryptoVizArt) August 5, 2022

Glassnode tracks long-term investors who control approximately 13,337 million BTC, or 79.85% of the current supply. According to the firm, long-term investors have sold approximately 222,000 BTC net since the beginning of May. From mid-July, they preferred to sell at a loss as the market recovered slightly. According to Glassnode, this data confirms that long-term investors are selling at a loss in the current market.

On the other hand, investors who bought in the 2017-2021 period remained inactive. According to Glassnode, those who bought Bitcoin in the 2017-2021 period (or before) mostly protect their wallets, as opposed to those who bought it during the 2021-2022 market peaks. According to the report, the collective behavior of long-term investors in the 2021-2022 group has changed from 79,000 BTC/month accumulation to 47,000 BTC/month distributions over the past three weeks. The recent market recovery has also given investors a chance to exit some liquidity.

What are miners doing in this environment?

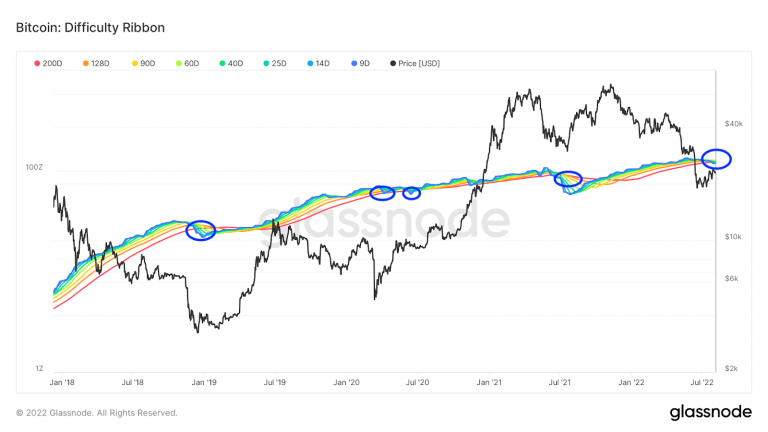

Glassnode also points to miner capitulation that could force the BTC price to bottom again. The colored strip below consists of short and long simple moving averages that compress the miner’s activity. This happens when miners close operations that cause hash rate drop and mining difficulty.

The compression now indicates that mining the block, including verifying transactions, will be more difficult. However, the mining difficulty is adjusted every two weeks. However, it is adjusted depending on the number of participants in the mining network and the total mining power.

On the other hand, as the Ethereum merge is fast approaching, there is a possibility that ETH miners will switch to Bitcoin alongside EthereumClassic. Therefore, if the price withstands the bearish pressure next weekend, it will have the opportunity to rally for the rest of next month. Otherwise, experts expect a sharp drop in BTC price. Thus, the bulls will have the opportunity to push the price back to $20,000 or below. cryptocoin.comWe have compiled the current technical analysis in this article.