Bitcoin is moving back and forth between the $22,500-$23,500 line. Additionally, the bears are increasing their efforts to lower the price in today’s trading session. The cryptocurrency has seen an increase in selling pressure from BTC whales. However, US indicators continue to affect the market. As Solana struggles, Ethereum (ETH) is back at $1,700. The crypto market has seen mixed results throughout the week.

Price levels for BTC, ADA, SOL, ETH and DOT

We are now very close to closing the week. However, analysts expect a decline in some cryptocurrencies and a rise in others. So what are the price levels to follow for BTC, ADA, SOL, ETH and DOT? What prices are analysts betting? cryptocoin.comWe have compiled the answers to these questions for you.

Bitcoin (BTC)

At the time of writing, Bitcoin (BTC) is trading at $22,900, with 2% profit in the last 24 hours and 4% loss last week. BTC lags behind among the top 10 cryptocurrencies by market value. This is because altcoins such as ETH, BNB, ADA and DOT make profits during these periods. However, data from Material Indicators pointed to a shift in market dynamics for lower timeframes. Accordingly, Bitcoin investors with around $100,000 to $1 million in sell orders started dumping their assets into the market. As a result, BTC price is losing momentum. If investors continue to apply pressure in the coming days, further losses in price are possible. An analyst at Material Indicators noted that investors with these orders have “the most impact on the price of Bitcoin.”

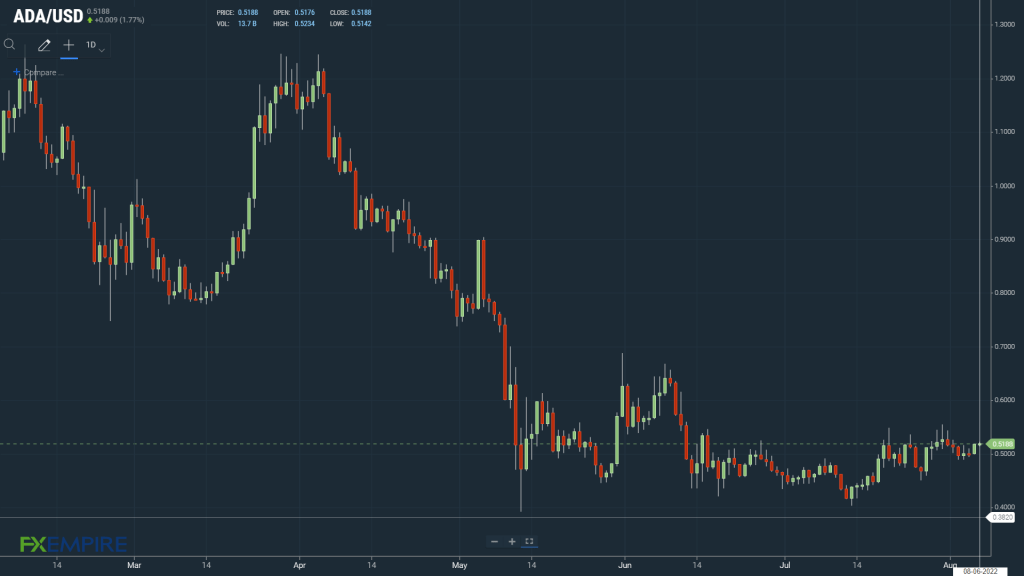

Cardano (ADA)

For the current week, the ADA price is up 0.43% to $0.5188. Traders saw ADA hit Monday’s high of $0.5266, after a mixed start. However, ADA has since dropped to $0.4890, which is Tuesday’s low. The altcoin recovered from the previous week’s low of $0.4509 and the May 12th’s current-year low of $0.3919. Thus, it found support to revisit the $0.52 levels before easing. The delay announcement of Cardano’s Vasil hard fork upgrade limited the going to Saturday. Based on the trend analysis, ADA will need to break through the July high of $0.5556 to target the June high of $0.6688. A drop from last week’s low to $0.4509 would place the year-low at $0.3919 into probabilities.

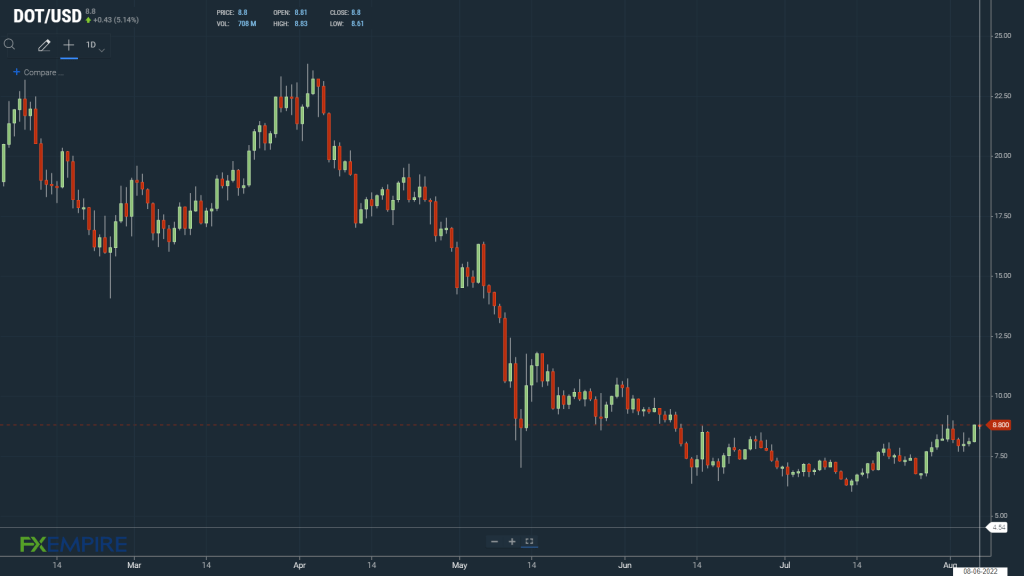

Polkadot (DOT)

The DOT was up 1.97% over the week at $8.80. Following the broader market, Polkadot rose to $8.99 on Monday before falling to $7.68 on Tuesday. After the price fell, it found support from the broad market and returned to $8.88. Alchemy news spread across the Polkadot ecosystem through the Primer partnership provided support. Significantly, DOT broke into the crypto top ten, replacing Dogecoin. Looking at the trends, a DOT move to the July high at $9.20 would support a run to $10.00 and $10.73. The DOT has the potential to make a net rally from the $10.73 low to the May high of $16.44. On the downside, staying away from the year-low $5.99 remains key.

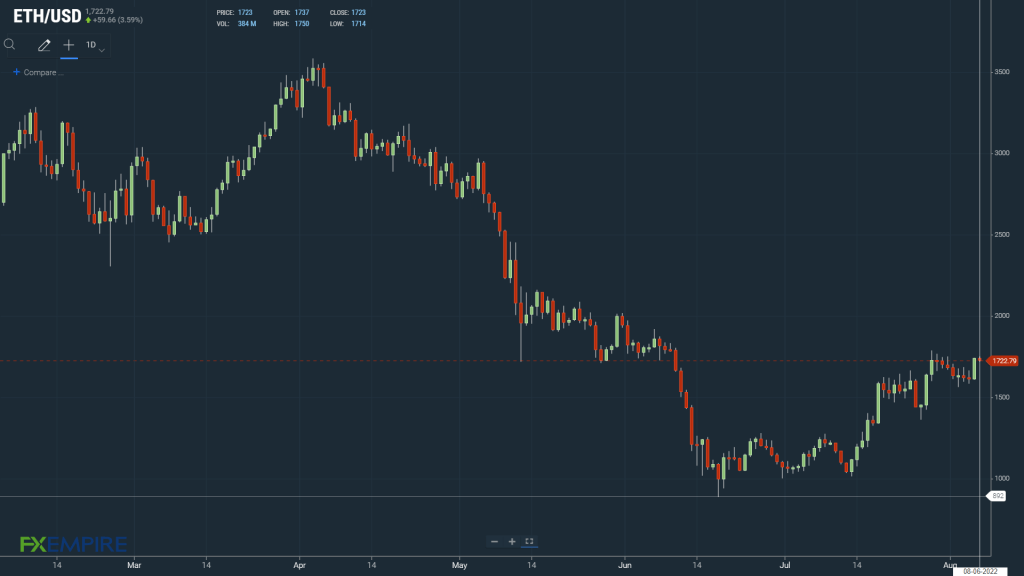

Ethereum (ETH)

From Monday to Saturday, ETH was up 2.56% to $1,723. Sensitivity to the Merge upgrade has been in the background this week. Concern ahead of key US economic indicators plunged ETH as low as $1,562 on Tuesday. However, the altcoin found support until Friday. Thus, it reached the high of $1,750 on Saturday before consolidation. For ETH, price volatility appears to be on the rise before US economic indicators. However, news about Merge will continue to be the main driver. Looking at the trends, a break from the July high of $1,788 is needed. Thus, it would be possible for the altcoin to target the June high of $1,972 and $2,000. However, any news of a delay for Merge in September will pave the way for the price to drop. In this scenario, a drop below $1,500 would bring the July low of $1,010 to the table.

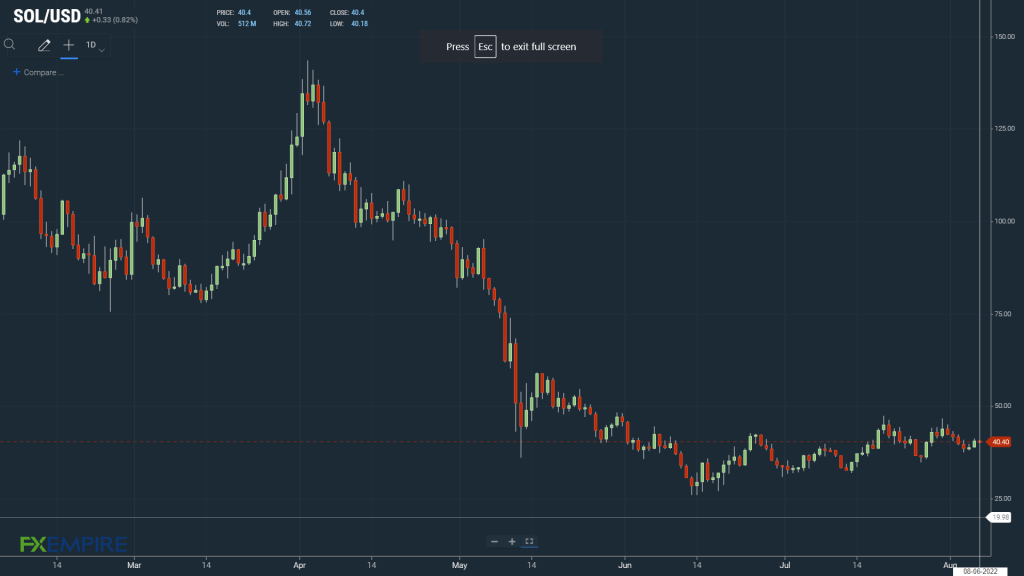

Left (LEFT)

During the week, SOL fell 4.65% to $40.40. Solana showed a bearish trend in the first half of the week. Thus, it fell from Monday’s high of $43.26 to Wednesday’s high of $37.48. In fact, the altcoin was not following the broader market trend. The SOL price crash was caused by the hack attack on Solana wallets. However, finding support from the crypto market, SOL managed to return to the $40 levels to limit the damage. Looking at the trends, a move towards the July high of $47.45 is possible. If that happens, the price has the potential to run to $50. It is also possible to target May’s high of $95.17 after that. If the price drops, it will return below $30. In this scenario, avoiding June and this year low of $24.84 is key.