Surprisingly, Bitcoin’s trading volume has dropped to levels not seen in nearly five years, raising questions about the fundamental dynamics of the cryptocurrency market. Meanwhile, Bitcoin miners are grappling with increasing difficulties due to the stagnant price and increased competition. Here are the details…

Bitcoin price in distress

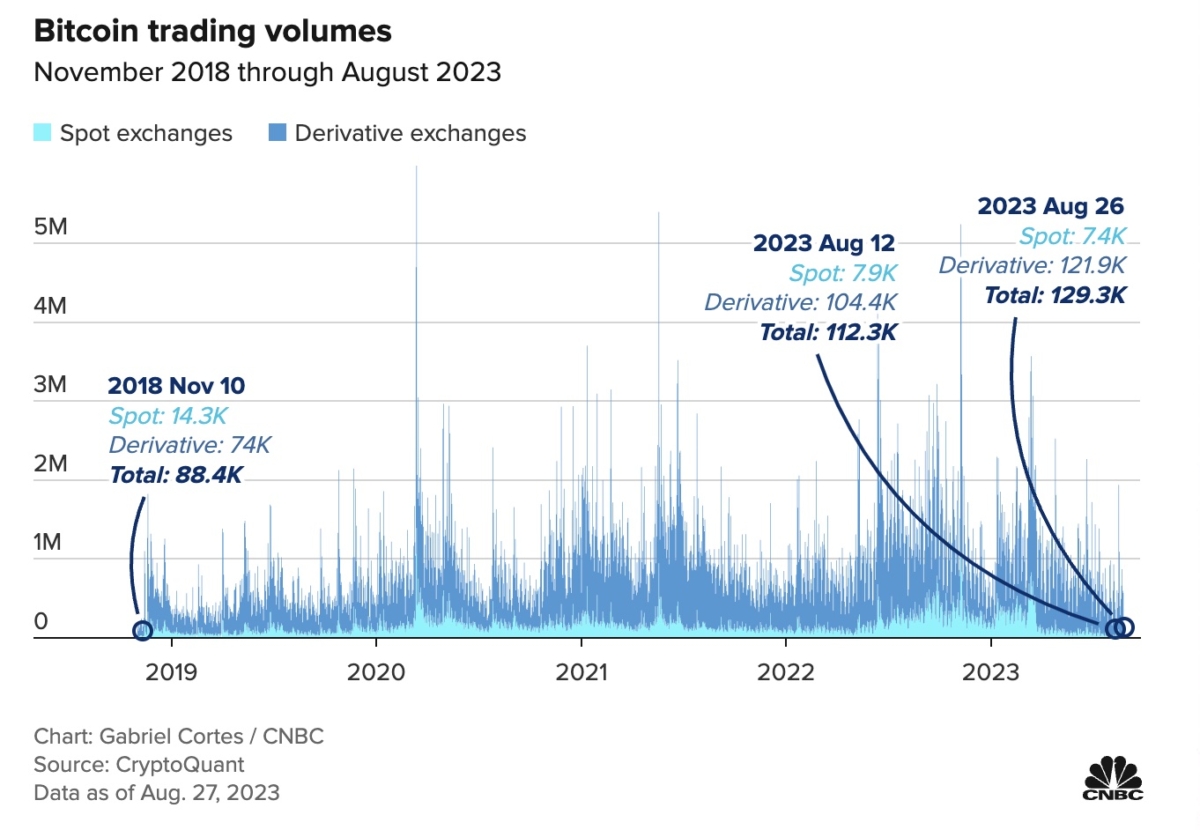

According to a recent report by CNBC, the world’s leading cryptocurrency Bitcoin has struggled to regain its trading momentum, causing traders and analysts to speculate about potential catalysts to rekindle market interest. Data analysis from CryptoQuant, a cryptocurrency analysis firm, has revealed an alarming drop in Bitcoin’s trading volume on both spot and derivatives exchanges. Volume reached an unprecedented low since 2018, raising concerns among investors and market participants.

Julio Moreno, Head of Research at CryptoQuant, attributed the decline to the departure of retail investors during bear markets. Moreno drew parallels with a similar trend observed in 2022 and expressed his cautious optimism that trading volume could recover as the market moves into a bullish phase. Interestingly, despite the drop in trading volume, Bitcoin’s price has not followed suit. The cryptocurrency is currently hovering around $26,100, marking a 57% price increase for the year. This disparity between trading volume and price performance has raised questions about the forces driving the behavior of the cryptocurrency market.

What is behind this silence?

Analysts and experts point to a combination of factors contributing to the sluggish trading activity. Regulatory pressures in the US and the resolution of the banking crisis in May triggered the migration of market makers, resulting in reduced market activity. Even a significant wave of selling failed to trigger a sustained backlash in the market. But long-term investors don’t seem bothered by these developments, pointing to resilience among those committed to the cryptocurrency. Gautam Chhugani, an analyst at Bernstein, stated that he expects a new catalyst rather than a downtrend by the nature of the market. This sentiment revolves around pending decisions from the Securities and Exchange Commission regarding various spot Bitcoin ETF applications.

While the market awaits potential catalysts, industry experts advocate patience and a long-term view. While Gautam Chhugani emphasized that the Bitcoin halving in the spring of 2024 is a potential turning point, Cantor Fitzgerald underlined Bitcoin’s enduring role as an alternative asset and store of value.

BTC miners are also in trouble

Bitcoin mining as a parallel development also faces its own challenges. Hashrate Index reported that hashprice, a measure of mining revenue, hit an all-time low of $0.06. This drop in revenue is a result of stagnant Bitcoin prices and increased competition among miners. The expectation that the next Bitcoin halving will occur in 2024 has prompted miners to expand their operations to secure rewards before the halving reduces rewards. However, this increase in mining activity has led to record high mining difficulty levels, making it more difficult to earn rewards.

Some miners managed the low hash price by raising capital earlier in the year. However, if the Bitcoin price continues to stagnate or fall and competition among miners intensifies, liquidity issues may force some miners to exit the market. As a result, the decline in Bitcoin’s trading volume and the difficulties faced by miners underline the dynamic nature of the cryptocurrency world. While the market awaits new catalysts and the upcoming halving, resilience and a long-term outlook remain key attributes for both investors and miners.