The crypto market is in recession mode. An explosive move is likely to clear the blockage. However, it may take days to appear. That’s why making an early entry is a purely speculative gamble at the moment, according to crypto analyst Tony M. We have prepared Tony M’s analysis of Bitcoin, Ripple and Ethereum for our readers.

“Bitcoin price remains unstable”

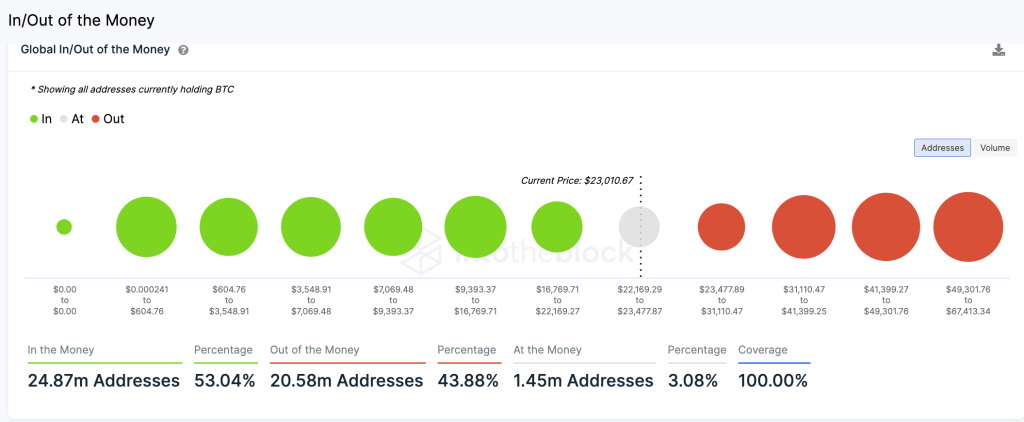

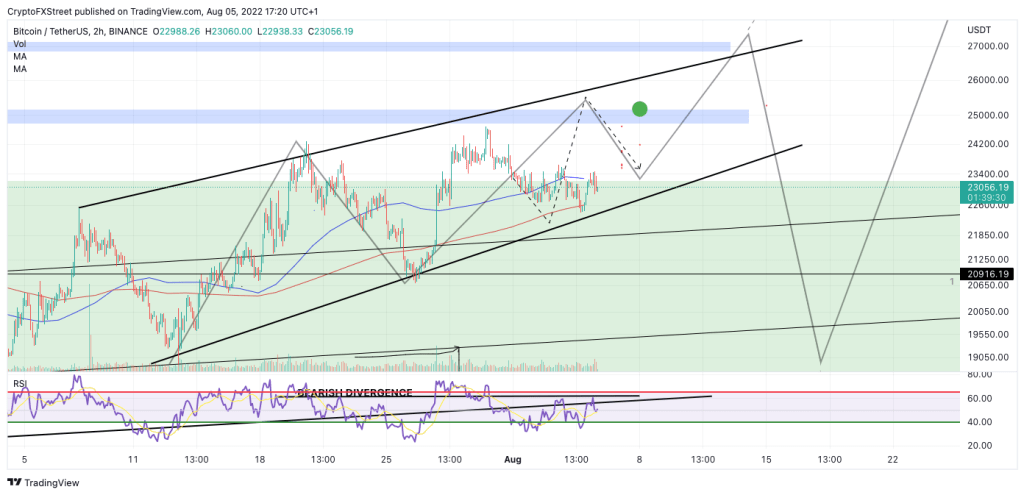

Bitcoin price continues to wrap inside a wedge-like leading diagonal. According to the block entry/exit money indicator, 54% of traders who open positions are currently in profit. Therefore, casual price action is likely to continue until the smart coin has enough liquidity to wreak havoc on one side of the boat.

Intotheblock: Money In/Out Indicator

Intotheblock: Money In/Out IndicatorAt the moment, it is unclear in which direction the BTC price will go. Previous forecasts are targeting higher liquidity levels at $24,600 and $25,200, which have yet to be labeled.

“Ethereum will outperform”

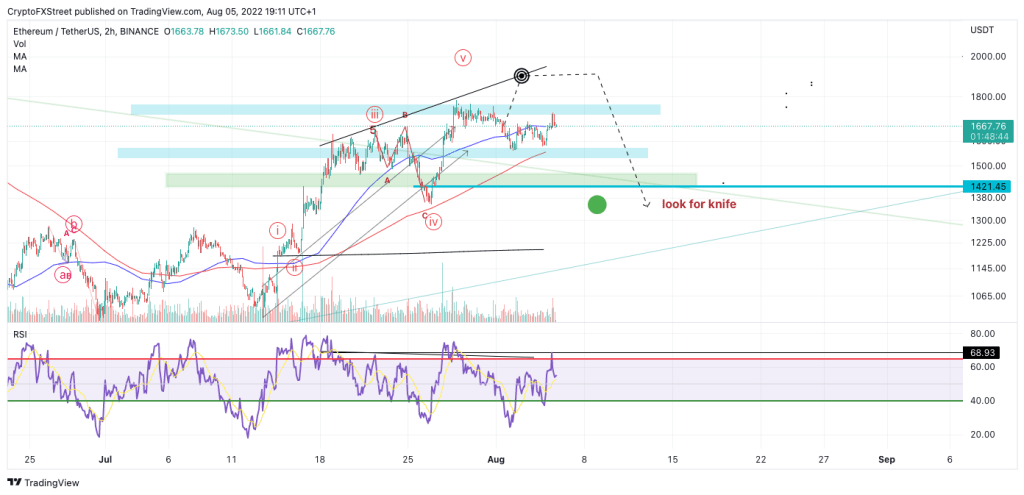

Ethereum price remains in a negative mood due to the community dispute over the upcoming Merge. In the first trading week of August, Ethereum is hovering near new monthly highs at $1,676. It is also possible to evaluate it independently of what the community thinks. In this regard, based on techniques and on-chain analysis, Ethereum price is poised to rise.

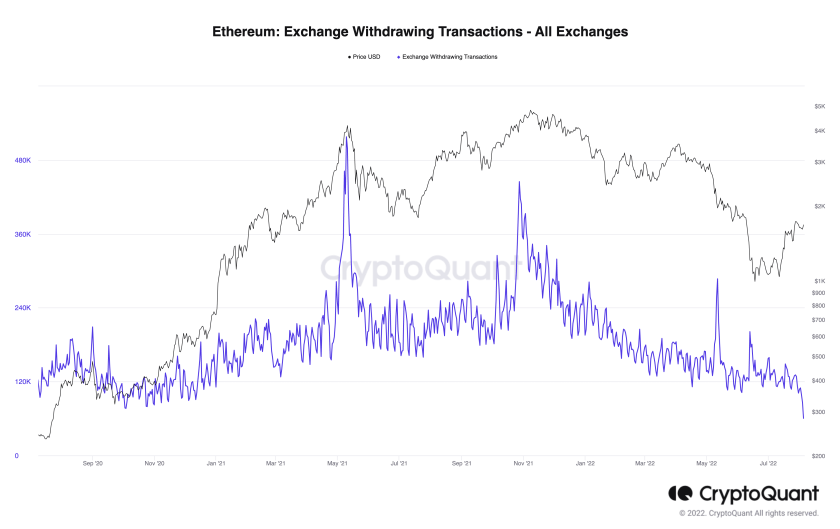

Crypto Quants- Ethereum: Exchange Withdrawals – All Exchanges

Crypto Quants- Ethereum: Exchange Withdrawals – All ExchangesAdditionally, Ethereum price is showing new annual lows in Crypto Quants’ ‘Ethereum: Exchange Pulls’ indicator. According to Crypto Quant “Total number of withdrawals from all exchanges”, in theory, more withdrawals from exchanges means, conversely, that fewer participants are actively trading digital tokens. Also, a less liquid digital asset is easier to be influenced by price.

“XRP price continues to show optimism”

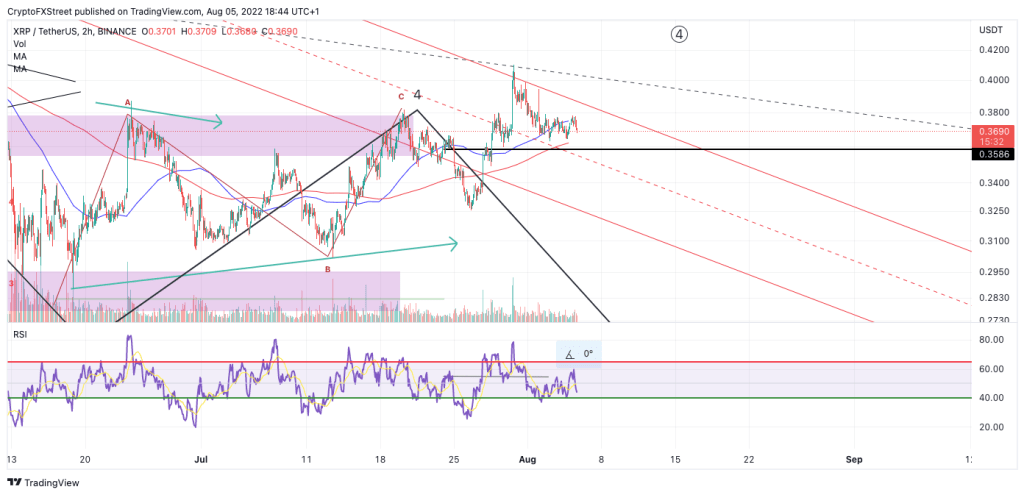

XRP price is hovering above an important trend channel: the middle line. The bearish pressure comes under a significantly lower volume compared to the bullish impulse that provided the 25% rally towards the end of July. If market conditions are indeed bullish, it is possible that a surge above $0.38 is the catalyst that triggered an additional 25% rally targeting $0.47 in the short term.

cryptocoin.com The XRP price has also witnessed an uptick in the rumors surrounding their collaboration with the World Economic Forum. Market sentiment is likely to continue to build positive momentum. In this case, it’s possible that hype and FOMO will become a new factor for XRP. While traders take a break from their screens, it’s possible that smart money is trying to pull off a rally. Therefore, it should stay on trader watch lists over the weekend. Invalid uptrend still remains at $0.3250 until further notice.