2022 hasn’t been kind to stocks and crypto with its losses so far. Bitcoin (BTC) has lost around 37 percent of its value despite hitting an all-time high six months ago. Similarly, the S&P 500 has dropped nearly 17 percent since the start of the year. Gold prices are also trying to recover. We convey the views and developments of Kriptkoin.com analysts.

Some of the analysts are hopeful for the rest of 2022

Some analysts are hopeful for the rest of the year and stated that everything will not continue to decline. Mike McGlone, senior commodity strategist at Bloomberg Intelligence, shared his views on Twitter with the following words:

If stocks are falling, Bitcoin, gold and bonds could shake the market. Bitcoin has a tendency to outperform most risk assets and most commodities, especially if the Fed manages to keep its mouth shut.

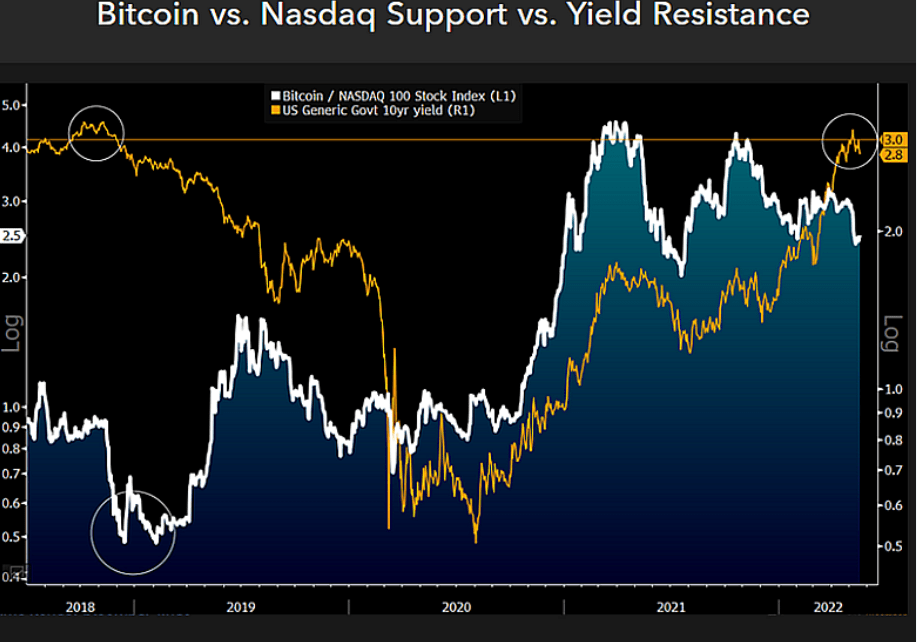

Overall, market watchers are skeptical of whether the Federal Reserve (Fed) is going to move too fast and has already priced in whatever stock price spikes could cause. divided on the issue. The Nasdaq index is down 28 percent so far as most tech stocks were negatively impacted by higher rates. Further rate hikes will likely be required for the Fed to rein in inflation, which, as McGlone points out, will mean more volatility for the stock market in the short term.

”When it rains gold fill the bucket, not the thimble”

The other two main classes have different reactions to increasing rates. Crypto has fallen this year despite being promoted as a cure-all to the market’s woes, such as rising interest rates, inflation, and a lack of purchasing power. Bitcoin’s decline began in November, when the Fed announced it would initially raise rates and market participants realized that liquidity could become an issue. However, analysts believe that investor adoption will lead crypto to end the year on a positive note. Commodities, on the other hand, had a solid year, with some reaching all-time highs, such as oil, wheat and nickel. Some of these increases can be attributed to fears of supply disruptions, the seizure of markets by Russian export bans, and the Russian invasion of Ukraine.

As geopolitical tensions persist, prices will remain high until the dispute is resolved and some normalcy is seen in European markets. The recent covid-related quarantines in China have brought supply chain stress, which has caused some price fluctuations. Overall, interest rates will likely continue to rise in 2022, but the question is, how high will they be? With solid earnings in the US and solid fundamentals for certain corporate companies, now might be a good time to buy some shares. On the other hand, if prices continue to drop, Warren Buffett’s quote may come in handy:

Opportunities rarely come. When it rains gold fill the bucket, not the thimble!