Risked by the SEC lawsuit, Binance’s cryptocurrency BNB will trigger a massive liquidation in the DeFi altcoin market if it drops another 30%.

Falling BNB plunges altcoin market into massive liquidation

According to DeFiLlama data, Binance’s BNB ecosystem will face a $200 million liquidation if its price drops below $220. The BNB price tumbled significantly after the week’s SEC lawsuit. On June 5, the SEC sued the stock market and its managers for violating federal securities laws. BNB has lost more than 15% since that date.

Danger of $200 million liquidation

If the BNB price continues to decline, $204.2 million will be liquidated on the DeFi protocol Venus. DeFi researcher Ignas describes the current situation as “the largest unsettled potential liquidation in all DeFi.” According to their analysis, the massive liquidation will occur when the BNB price drops 20% to $220.

1/3 BNB is in trouble if the price drops by 29% to $220 USD

There's a potential $200M liquidation on Venus if #BNB price reaches this level.

It's the single largest potential liquidation in all #DeFi that cannot be closed.

The price will never drop that much, right? 😅 pic.twitter.com/5xBxcbl1EO

— Ignas | DeFi Research (@DefiIgnas) February 23, 2023

Ignas also stated that the purge was due to a vulnerability in October 2022 when the BNB cross-chain was hacked. On that date, attackers exploited a message validation vulnerability in the BSC bridge to transfer 2 million BNB (approximately $590 million) to the Venus protocol.

As a result, they seized 900,000 BNB. They then deposited it on Venus as collateral used to borrow other assets from the protocol. They laundered a significant part of the stolen funds in mixers.

Binance regulation issues

On June 6, the SEC took action to freeze the assets of its US subsidiary, Binance US. In addition, Binance.US announced yesterday its plans to become a purely crypto-focused exchange after its banking partners decided to shut down US dollar payment channels. cryptocoin.comAs we have reported, Binance bases this decision on the “unfair” and “baseless” practices of the SEC.

The SEC has taken to using extremely aggressive and intimidating tactics in its pursuit of an ideological campaign against the American digital asset industry. https://t.co/AZwoBOgsqS and our business partners have not been spared in the use of these tactics, which has created… pic.twitter.com/rlIe6swIoY

— Binance.US 🇺🇸 (@BinanceUS) June 9, 2023

Will altcoin bulls be able to defend $220 in BNB price?

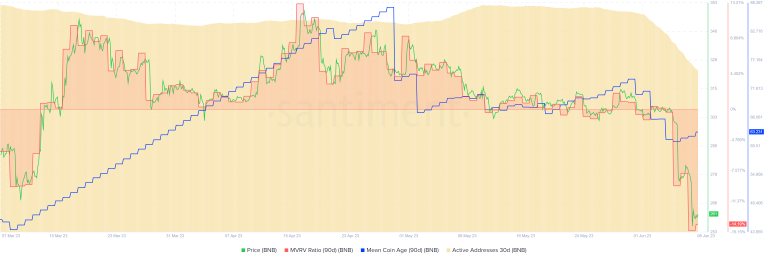

BNB price is currently trading at the $260 level, where it has declined slightly on the day. On-chain metrics show investors are nervous, while technical findings highlight the bearish trend in the market.

Technically speaking, BNB rallied from $220 to $338 from December to February. Then, in late April, the 90-day average age of crypto started to decline sharply. In May, Binance Coin moved in the tight zone between $301 and $315. During this time, the average crypto age has seen a small increase. However, he did not see a sustained uptrend like he saw in March.

In summary, the coin age metric shows that there is no accumulation trend for BNB. The recent drop triggered by the SEC lawsuit also resulted in a decline in the MVRV rate. Overall, vendor dominance was evident. This is likely to continue in the coming days. BNB price needs to rise above $317 to push the daily structure to the upside.