A New York court placed an NBA-branded NFT project in security status. The decision led to a double-digit drop in related altcoin projects.

US judge ruled that this altcoin project is a security

New York Southern District District Judge Victor Marrero ruled in a class action lawsuit that Dapper Labs’ NBA-branded NFT tokens, named “Top Shot”, are securities. Top Shot NFTs were put in a class action lawsuit in 2021 for Dapper Labs selling NBA games without regulation. The company at one point used its control over the collections to prevent investors from withdrawing their funds.

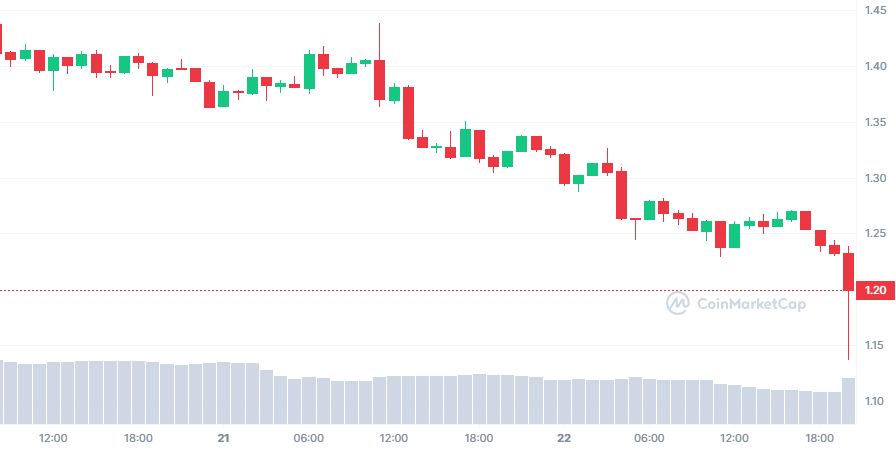

Dapper Labs petitioned to dismiss the lawsuit last September, arguing that the NFT collections are not securities. However, Judge Marrero disagreed with Dapper Labs’ request to dismiss the lawsuit, stating that the tokens are securities. The decision on Top Shot NFTs based on Flow (FLOW) led to a sharp drop in the price of FLOW.

Flow (FLOW) price drops by double digits

Ranked among the top 50 by market value, it gained 10% in value after its latest developments. The altcoin price slumped from the daily high of $1.34 to $1.14. Flow; It is a specialized Blockchain for next generation games, applications and especially NFTs.

Flow-based Top Shot NFTs had over 1 million registered users as of September 2021. The platform briefly reached over $1 billion in volume in NFT sales.

Why is altcoin considered a security?

According to the ruling, Dapper Labs’ FLOW tokens – although not necessarily securities themselves – are “necessary for the integrity of the scheme in question.” According to the judge’s decision:

Plaintiffs claimed that without FLOW tokens, no transactions on the Flow Blockchain could be verified. In fact, the “Proof-of-Stake” mechanism used by Flow Blockchain needs FLOW to power it and incentivize miners to verify transactions. In this context, FLOW’s utility creates value for NFTs through the network’s consensus on ownership and the price of each transaction.

The judge also cited plaintiffs’ allegations that Dapper Labs held funds from the sale of Moments to protect the value of FLOW tokens and raise funds. That said, he supports the conclusion that there could be a secondary market controlled by Dapper Labs.

Dapper Labs says the case isn’t over yet

Dapper spokeswoman Stephanie Martin said in a statement that the judge “did not conclude that the plaintiffs were right, and it is not a final decision on the merits of the case. Courts have repeatedly found that consumer goods, including art and collectibles such as basketball cards, are not securities under federal law. “We are confident the same applies to Top Shot NFTs and other collectibles, digital or otherwise, and we look forward to vigorously defending our position in court as the case continues.” cryptocoin.comMeanwhile, Binance is under the spotlight in the US, as you follow.