The TrueUSD (TUSD) stablecoin had a small amount of funds at a US custodian that was ordered to stop withdrawals, according to the token’s reserve report. This situation worried the market. Subsequently, TrueUSD left its $1 stable (de-peg) on the Binance.US exchange. The altcoin fell to approximately $ 0.80. Here are the details…

Altcoin project drops on Binance

A June 23 review by verification provider The Network Firm revealed that $26,434 worth of TUSD backing assets are “held at a US custodian, which has informed customers that the agency has been instructed by state regulators to cease deposits and withdrawals for fiat and crypto-asset accounts.” . The firm added that $26,269 of the funds were “related to customer withdrawals for redeemed tokens.” The Network Firm did not specify the US institutions where the funds are held.

However, the TUSD issuer has previously said that the stablecoin is “not exposed” to the booming crypto custodian Prime Trust, which acts as its banking partner in the US. The issuer tweeted on June 10 that it had stopped issuing tokens through Prime Trust, adding that “minting and redemption services were not affected” through other banking rails. The token issuer did not respond to multiple requests for comment. Prime Trust has halted withdrawals and was ordered by Nevada state regulators to cease operations Thursday due to a “lack of client funds.” The regulator later said on Tuesday that it had filed to take over the custodian and freeze all its business.

FTX.US team reviewed evidence of reserve

Validation of the Proof of Reserve of the embattled stablecoin TrueUSD was handled by the same team that once worked with Sam Bankman-Fried for FTX.US. The Network Firm was born from the crypto-asset app of accounting firm Armanino. Armanino stopped crypto audits last year, underscoring that it is becoming increasingly difficult for crypto firms to secure audit and reserve attestation from leading accounting firms, and Mazars has also halted proof-of-reserve work for crypto clients.

FTX has been criticized for a lack of internal control, with its new CEO, John Ray III, appointed for the bankruptcy proceedings, saying it “doesn’t keep proper books and records or security controls.” “In my career, I have never seen corporate controls fail so badly and reliable financial information so lacking as here,” Ray said in his filing with the court in November. Armanino’s 2021 audit did not provide an opinion on FTX.US or FTX Trading’s internal controls over accounting and financial reporting.

Earlier in 2019, the Public Company Accounting Oversight Board highlighted shortcomings in Armanino’s quality control processes and that the firm later faced controversy due to an audit of Lottery.com, which overstated its cash balance by $30 million and improperly recognized revenue, and A class action lawsuit against Lottery.com’s executives was reportedly prompted by Armanino’s resignation in September.

TUSD loses stable on Binance.US

Finally, TrueUSD (TUSD) is traded at a discount compared to Tether (USDT) on Binance’s US subsidiary, Binance.US. At press time, the TUSD/USDT pair was trading at 89 cents on Binance.US and fell as low as 80 cents on Wednesday, according to data from charting platform TradingView. On Binance, the pair traded at around $0.9980. The volatility of stablecoins, which have evolved as funding currencies over the past three years, often feeds the broader market. So far, TUSD’s volatility has not affected the broader market, with Bitcoin (BTC) continuing to trade in familiar ranges above $30,000.

What exchange is this on? Binance spot has $0.9984 pic.twitter.com/XMdXFlt55t

— Alexander The Hodlr 🗡 (@xbt_ag) June 28, 2023

With a market cap of $3 billion, TUSD poses less systemic risk to the broader market compared to Tether with a market cap of $83 billion. According to so-called market watchdog Parrot Capital, TUSD is taking a hit amid low volumes. TUSD’s bearish surge on Binance.US comes hours after the token’s reserve report showed that the project has $26,000 in assets backing the stablecoin at a US custodian that has been ordered to halt withdrawals.

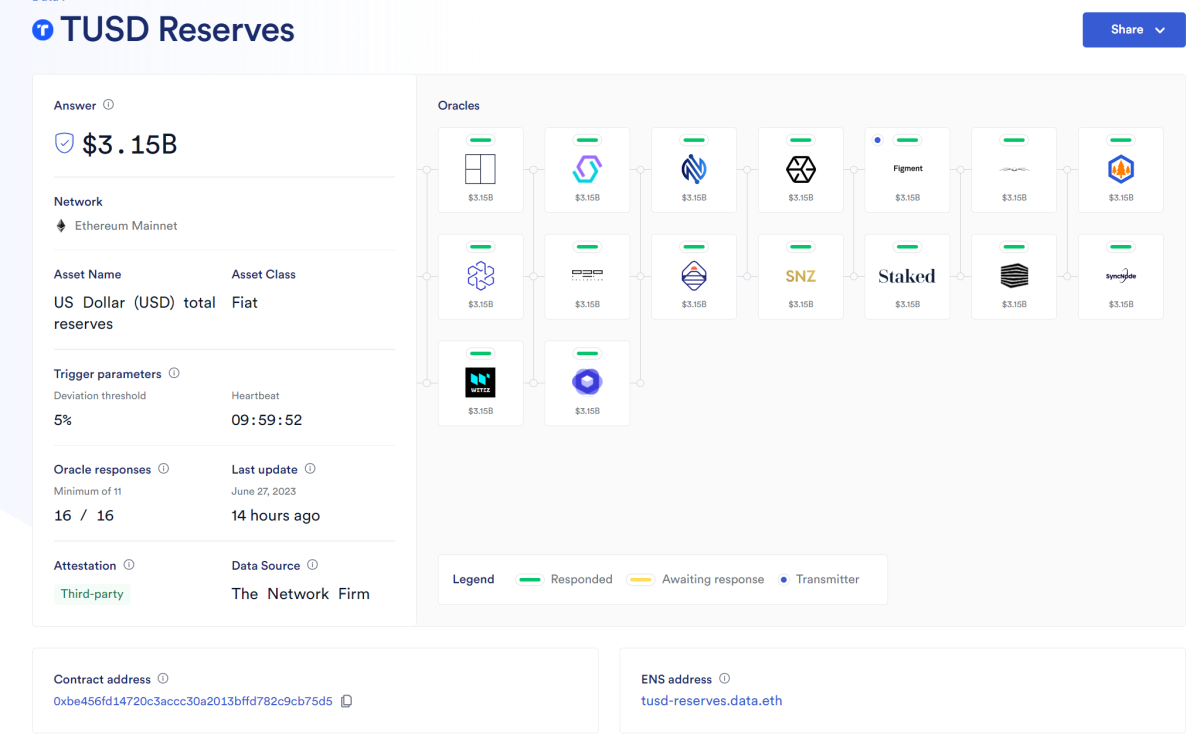

According to Cochran, TrueUSD’s Chainlink price oracle consists of 17 different notes, but they all get the data from the same source, The Network Firm. Traders took bearish bets on TUSD earlier this month amid rumors that the stablecoin project is using embattled crypto service provider Prime Trust to mint and use the tokens. Later, TrueUSD announced that it has no Prime Trust exposure.