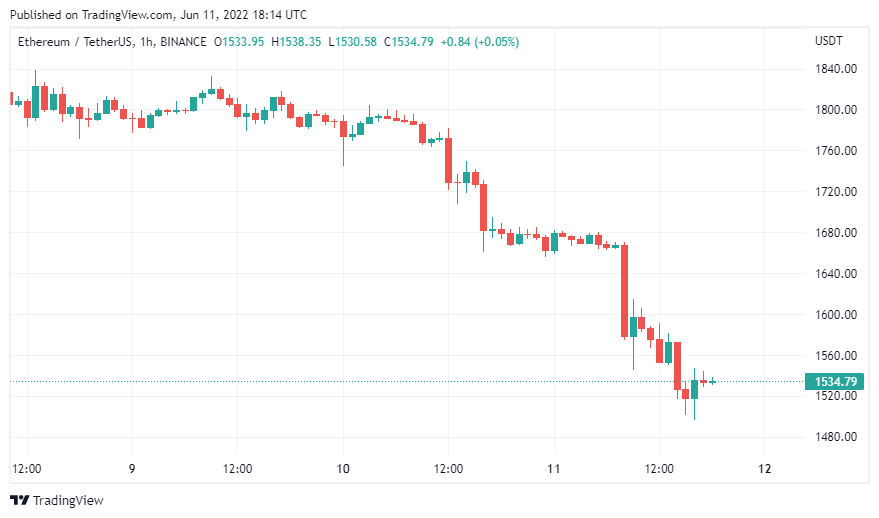

Ethereum (ETH) has lost more than 10% today. Meanwhile, the staked Lido (stETH) price for ETH has similarly dropped. Due to a new offering, altcoin whales are now flocking to stETH.

Leading altcoin 10% meltdown, causing panic selling

Lido found a proposal to change the governance mechanism outlining LDO + stETH. The plan aims to minimize governance in the protocol. It focuses on the associated risks that can be met by aligning incentives between the DAO and shareholders.

stETH is a derivative token backed by Ethereum’s 1:1 value. However, Ethereum registered a price gap. The leading altcoin is currently trading at an average of $ 1533. Staked Ethereum (sETH) is trading at $1468. According to the report, Lido’s token fell for the second time in the month. This collapse increased the risk of staking the liquidity of derivatives.

Lido’s stETH leads to whale buying

Lido’s proposal risks a worst-case scenario, a takeover that could trigger stakeholders. This decision will also affect the ETH network. The plan also highlights that the DAO and the team do not have direct control over the validators.

The protocol added that they have control over the stETH upgrade, Lido can upgrade its derivatives contract. It will allow staked Ethereum to be burned and minted at any arbitrary address. It means that the DAO has no authority over producing Ethereum. There is also the risk that users’ funds will work.

However, the collapse of stETH could also be triggered by its sale on the secondary market. On the other hand, Ethereum whales benefited from this sale. According to Whalestate, the largest ETH wallets have purchased more than $28 million in stacked Ethereum in the last 24 hours. As a result, the whales added more than 18.8k sETH to their wallets. Meanwhile, the largest recorded transaction was approximately $7.9 million. Meanwhile, a whale also bought over $1.1 million in strapped ETH. Kriptokoin.com We have got the details covered in this article.

How does Ethereum staking work?

PoS powered Blockchain, unlike PoW, aggregates 32 transaction blocks, lasting an average of 6.4 minutes during each verification round. In a nutshell, Beacon Chain divides the stakers into 128 ‘committees’ and randomly assigns them to a specific shard block. Each committee is assigned a “slot” and has a specific time to propose a new block and validate internal transactions.

ETH 2.0 uses annual interest rates and the inverse square root function to calculate rewards. Additionally, in layman terms, this means that the lower the total amount of ETH staked, the lower the incentives will be for each validator.