Axie Infinity price is currently down 97% from the $166 peak reached during the 2021 Metaverse rally. Crypto expert Ibrahim Ajibade examines the recovery possibility of the popular metaverse altcoin project through on-chain data.

Axie Infinity strives to save the community

Popular metaverse altcoin project Axie Infinity (AXS) has fallen out of the top 50 cryptocurrency rankings. At the peak of the Metaverse rally in 2021, Axie Infinity’s market cap reached $9.6 billion. However, in the current situation, its value has decreased by more than 93% to $630 million. AXS price hit a low of $4.95 around August 20.

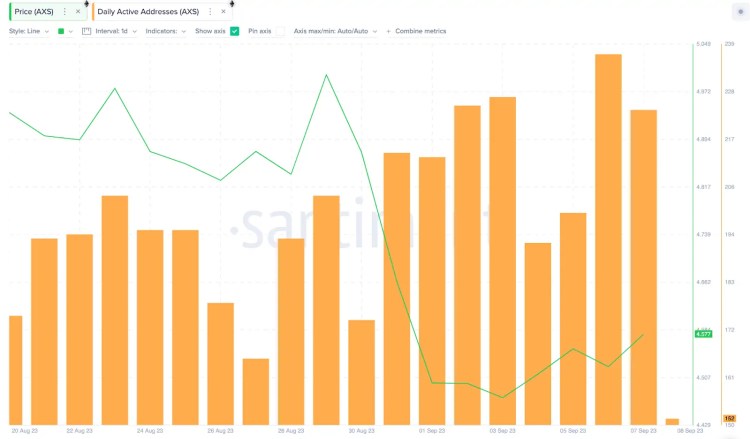

However, on-chain data shows that instead of panic, the Axie Infinity network is witnessing an optimistic response. According to Santiment data, AXS Daily Active Addresses have been showing a steady increase since August 21. As of August 20, only 176 wallet addresses had interacted on the AXS network. However, since then, AXS network activity has gradually increased. Thus, it has exceeded 200 addresses on all but one trading day since August 31.

Axie Infinity Daily Active Addresses. Source: Santiment

Axie Infinity Daily Active Addresses. Source: SantimentAs you can see above, there has been a steady increase in altcoin Active Addresses over the last three weeks. This shows that individual investors are taking action to avoid terminal losses. Increased network activity typically means increased network demand for the underlying asset. Unsurprisingly, the increase in active network addresses helped AXS maintain the $4.50 support level. Thus, it stopped the panic selling in late August.

Bullish traders did not give up their recovery hopes!

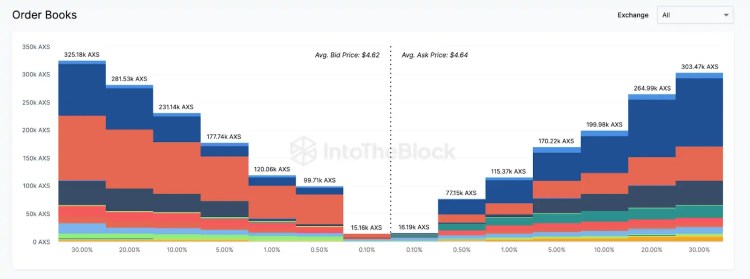

According to exchange order books, many strategic traders have set up a very high sell wall to reduce the danger of the altcoin price falling to zero. As you can see below, crypto traders have placed active orders to buy 1.25 million AXS tokens around current prices. Meanwhile, bearish traders shorted only 1.14 million AXS.

Axie Infinity Exchange Order Books. September 2023. Source: IntoTheBlock

Axie Infinity Exchange Order Books. September 2023. Source: IntoTheBlockThe Exchange On-Chain Market Depth chart shows the volume of active orders placed by AXS traders on well-known crypto exchanges. The chart above reveals that despite the prevailing bearish sentiment, current market demand for AXS still exceeds supply by 110.00 tokens. This is a vital sign that the AXS token still has enough demand to absorb the upcoming selling pressure and prevent the price of Axie Infinity from falling to zero.

Altcoin price prediction: Consolidation in the $5 range

Bulls continue their last-ditch recovery efforts. However, AXS will face serious difficulties in reclaiming the $5 zone. This is clearly demonstrated by the In/Out Around Price data, which summarizes the purchase price distribution of existing AXS holders. The data highlights that 279 investors purchased 1.05 million AXS tokens at a maximum price of $4.70. Unless there is a significant change in market sentiment, it is possible that they will sell early. This is likely to trigger another decline.

However, if the bulls break through this resistance zone, it is possible for them to save the altcoin price from approaching zero. In this case, there is a possibility that they will consolidate around $5 instead.

Axie Infinity IOMAP data. August 2023 | Source: IntoTheBlock

Axie Infinity IOMAP data. August 2023 | Source: IntoTheBlockStill, if the troubling emotions surrounding the metaverse intensify, the bears could potentially trigger a massive decline towards zero. However, 283 addresses have purchased 343,580 AXS at a minimum price of $4.37. And if they choose to HODL, the altcoin price is likely to rebound. However, if this support level gives way, AXS price may start to approach zero.