A huge altcoin whale protecting its purchases nearly two years ago is piling millions of tokens on centralized exchanges like Binance. Prices are down 15% as the whale becomes active again on March 10.

The whale that has been sleeping for two years has stacked it on Binance from this altcoin

An address that bought 16.04 million RNDRs two years ago sent nearly $1 million worth of RNDR to Binance, according to tracking data from Chinese on-chain analyst Bit Ember on March 10. Active in mid-2022 and mid-2022, this wallet transferred a total of 11.02 million RNDR to centralized exchanges such as Binance, and the average selling price of RNDR was $1.13 at the time of transfer.

The whale, which has become active again as of today, has put additional pressure on the price drop of RNDR. It comes amid influential news like the likely whale sale, the Biden budget, and the bankruptcy of Silvergate…

2 小时前,一个在两年前(21/3/15)获得 1604 万 RNDR 初始分配的地址,将 100 万 $RNDR ($1M)转进了币安。

该地址在 21/3/15-22/5/31 期间一共向 Binance 等交易所转入了 1102 万 RNDR,按转入交易所时价格计算他的 RNDR 平均出售价格为 $1.13。

本条推文由 @LionDEX_CN 赞助 pic.twitter.com/Qh6nKjbqHG

— 余烬 (@BitcoinEmber) March 10, 2023

Render (RNDR) price drops by double digits

RNDR, which is ranked 96th by market capitalization, lost more than 15% in the midst of sales that also affected Bitcoin and Ethereum. The price is struggling to hold above $0.97 after hitting $1.17 during the day.

Silvergate is officially bankrupt: Altcoin market is falling

Silvergate, one of the most important banks serving crypto companies in the USA, announced that its activities will be stopped. Senior bank crypto exchanges, miners, stablecoin issuers, etc. It operated as a gateway for over 1,000 institutional crypto market participants.

According to Bloomberg’s report, Silvergate plans to shut down all operations after market sell-offs fueled by FTX have exhausted its financial strength. The bankruptcy, which surfaced on March 8, triggers double-digit sales on the market. According to CoinMarketCap data, the total value of the crypto market has dropped 6.50% in the last 24 hours. cryptocoin.comIn this article, we have included the developments that led to the decline of cryptocurrencies today.

Bitcoin dropped to $20,000, how is the altcoin market?

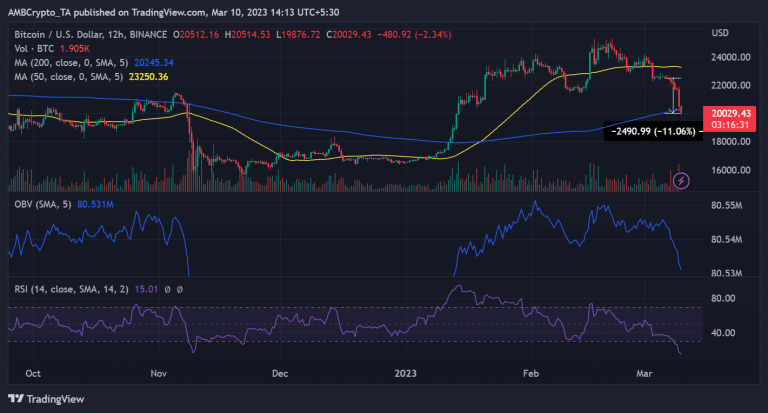

The 12-hour price range tool shows that Bitcoin (BTC) has lost more than 11% of its value since March 6, when the decline began. At the time of writing, BTC price was trading below $20,000. Since it started its rise in January, the current price range is at its lowest ever.

The total value of the market is also melting due to the falling BTC and altcoin prices. According to data from CoinMarketCap, TOTAL fell from the $1 trillion level. According to CoinMarketCap, Ethereum has lost about 8% of its value in the last 24 hours. More than 10% of its value was deleted last week. Also, Solana (SOL) has dropped over 8% in the last 24 hours and over 19% in the last seven days. A look at the altcoins on CoinMarketCap showed that it had lost to BTC in the last 24 hours.