According to crypto analyst Yashu Gola, Binance Coin (BNB) has entered the breakout phase of the dominant ascending triangle pattern alongside some negative fundamentals that could push the price down further. The analyst says that the altcoin project is under threat of going through a significant price correction in the coming weeks.

BNB triangle collapse pattern continues

From a technical perspective, the altcoin has entered the breakout phase of the multi-month ascending triangle pattern, which is a trend continuation indicator. It is possible for this to continue until the price is of equal length to the maximum height of the triangle. In other words, BNB’s ascending triangle collapse target is near $170. This means a decrease of about 30% from current price levels as shown below. BNB/USD is likely to drop to this level by January 2023.

BNB ascending triangle collapse pattern / Source: TradingView

BNB ascending triangle collapse pattern / Source: TradingViewFor now, BNB’s bearish action seems to hold near $222, which has acted as a strong support level in the recent history, including the dips witnessed following the collapse of Terra (LUNA) in May 2022. It is possible for BNB to retest $222 as support based on the technical setup of the ascending wedge forming on the four-hour chart.

BNB 4-hour price chart includes rising wedge collapse setup / Source: TradingView

BNB 4-hour price chart includes rising wedge collapse setup / Source: TradingViewShorts gain momentum for altcoin

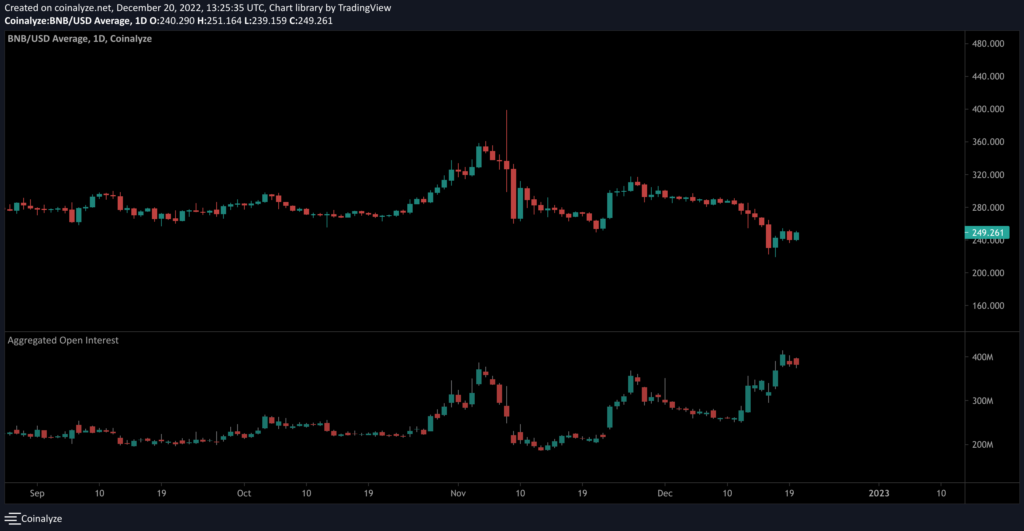

The downside technical setup for BNB is getting more cues from the increasing number of shorts. Notably, the price drop that BNB has witnessed in recent days coincided with the surge in shorts (OI) that exceeded $415 million on December 18, the highest level since November 2021. Traders are opening new short positions in the BNB market.

BNB daily price chart against total short position / Source: TradingView

BNB daily price chart against total short position / Source: TradingViewWick, an options trader and analyst, conducts a situation assessment. The analyst says BNB will be in ‘big trouble’ if Bitcoin drops further. The daily correlation coefficient between BNB and BTC has been mostly positive throughout their history. “Initial target is $197,” the analyst tweeted.

Binance bankruptcy fears increase withdrawals from the exchange

From a fundamental point of view, the altcoin has been further weakened by the growing legal issues of its parent platform, Binance. cryptocoin.com As you follow, Binance is facing various problems. These include potential criminal charges related to money laundering and sanctions violations. Also, the FTX debacle has created skepticism towards Binance among investors. Many people think that Binance, like FTX, may have used BNB as collateral for loans. Binance has denied such rumors. However, their statement did not help BNB much to break the downtrend.

BNB daily price chart / Source: TradingView

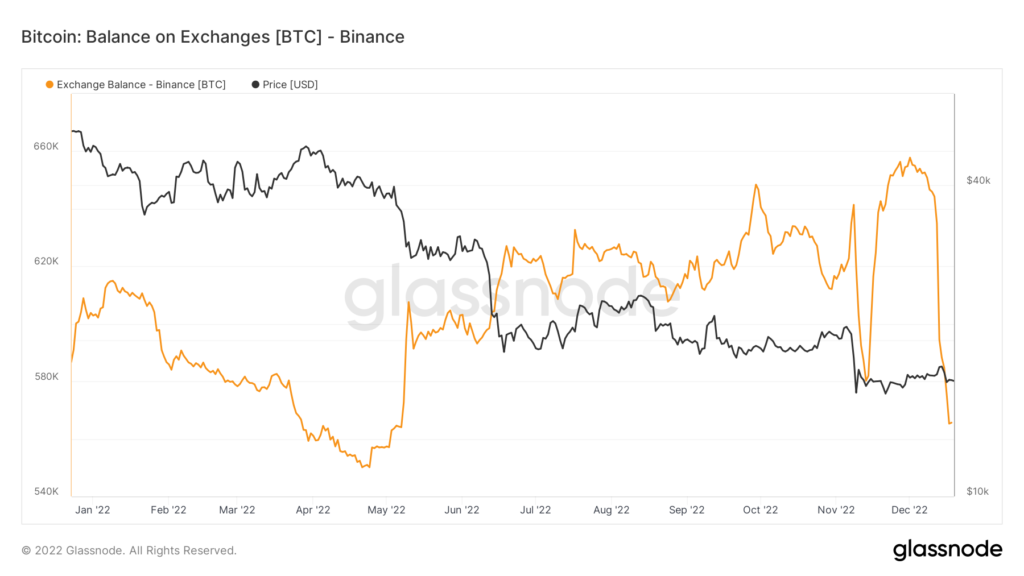

BNB daily price chart / Source: TradingViewAlso, according to Nansen’s December 13 data, increased uncertainty caused customers to withdraw $3.6 billion worth of cryptocurrencies within a week. Later, the exchange stopped the withdrawal of USD Coin (USDC), which is backed by rivals Circle and Coinbase. This intensified rumors that he was going bankrupt.

Bitcoin balance on Binance / Source: Glassnode

Bitcoin balance on Binance / Source: GlassnodeOn December 14, Binance CEO Changpeng Zhao downplayed bankruptcy risks, noting that the exchange experienced larger withdrawals during the Terra and FTX crashes. He also said that their ability to meet withdrawal requests points to healthy ‘stress tests’. Afterwards, Zhao said, “Now the deposits are coming back.”