Shares of cryptocurrency exchange Coinbase (COIN) have surprisingly experienced a significant rise, reaching an 18-month high. This comes on the heels of rival exchange Binance and its former CEO Changpeng “CZ” Zhao being found guilty of money laundering and sanctions violations in the United States. While Coinbase’s shares closed at $119.77 on November 27, reaching their highest point since May 5, 2022, investors are closely following the aftermath of these legal developments.

Binance exchange’s legal problems benefited Coinbase

Coinbase’s share price has risen approximately 256.5% year to date, reflecting the market’s positive reaction to the issues facing Binance. Despite this impressive rise, Coinbase is down 65% from its all-time high of approximately $343 on November 12, 2021. The recent rally positions Coinbase as a notable player in the wake of regulatory challenges faced by its rival.

cryptokoin.com As we reported, Binance and CZ struck a staggering $4.3 billion deal with US authorities, resulting in CZ stepping down as CEO and Binance agreeing to compliance monitors from the US Department of Justice and Treasury Department for up to five years. This regulatory development created a significant market shift that contributed to Coinbase’s newfound momentum.

Coinbase got lucky

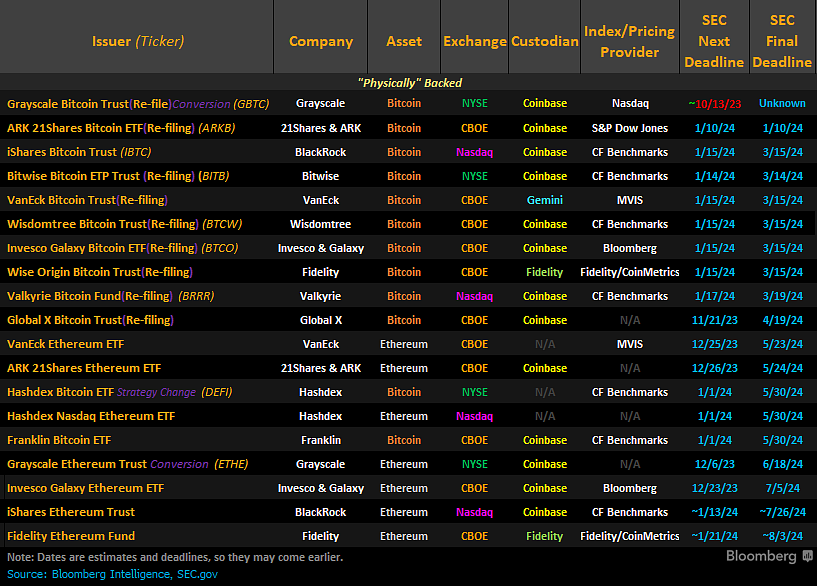

In addition to the share increase, Coinbase has also gained significant fortune through pending US spot Bitcoin and Ether exchange-traded funds (ETFs). Analysis by Bloomberg ETF analyst James Seyffart reveals that Coinbase is currently responsible for 13 of the 19 spot crypto ETFs awaiting approval from the U.S. Securities and Exchange Commission (SEC). This positions Coinbase as a key player in the evolving landscape of cryptocurrency investments.

The strategic move into the ETF market has not only diversified Coinbase’s revenue streams, but has also contributed to the recent rise in its share prices. As regulatory developments continue to shape the cryptocurrency industry, Coinbase’s role as a custodian for crypto ETFs adds a layer of stability to its market position.

Sale came from the famous whale

In particular, ARK Invest, a leading player in the cryptocurrency investment space, is actively benefiting from the rise in Coinbase’s shares. The investment firm sold 43,956 shares of Coinbase from its ARK Fintech Innovation ETF, valued at a total of $5.3 million at the time of the sale on November 27. This move is part of a trend as ARK has been selling Coinbase shares continuously throughout 2023. Despite the stock hitting an 18-month high, ARK’s divestiture strategy points to a calculated approach to managing its portfolio in the ever-evolving cryptocurrency market.