Attackers hacked the Curve omni-pool platform Conic Finance. In this event, hackers managed to steal $ 3.2 million worth of ETH. According to initial analysis by Peckshield, the main reason Conic Finance was hacked was the new CurveLPOracleV2 contract. After the news of the hack, the altcoin price saw a vertical decline.

DeFi altcoin hacked, price crashed!

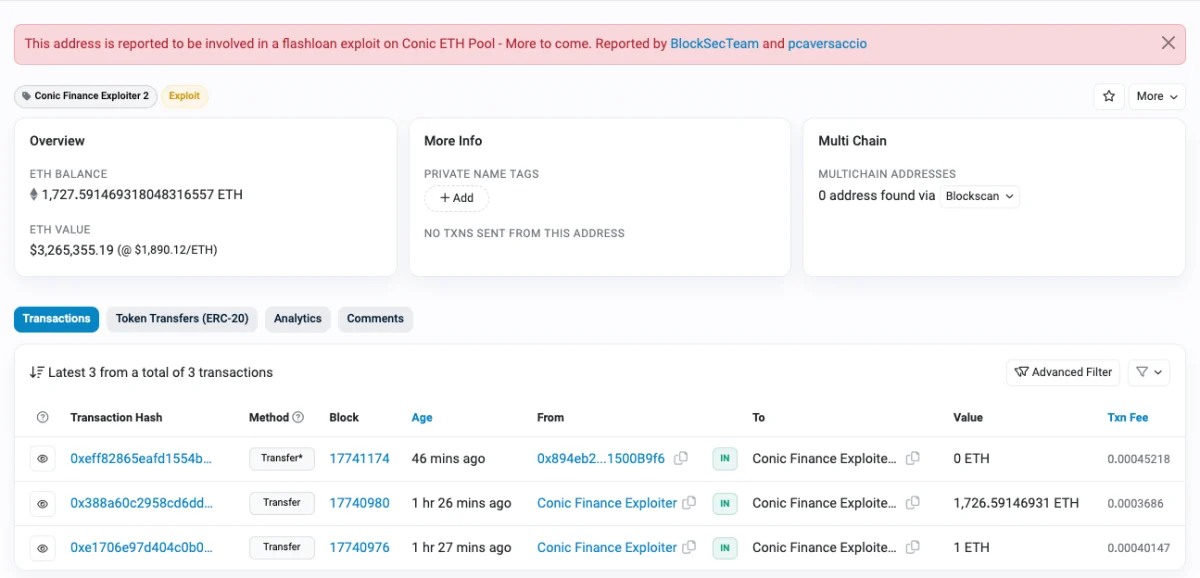

Conic Finance, a liquidity pool balancing platform for decentralized finance (DeFi) protocol Curve, has suffered an exploit on the Ethereum omnipool. Conic Finance has been hacked, Web3 risk alert resource Beosin Alert reported on July 21. Hackers managed to steal $3.26 million worth of Ethereum (ETH). According to data provided by Beosin, almost the entire amount of stolen cryptocurrency was sent to a new Ethereum address in a single transaction.

Transactions on the address containing a flash-loan exploit in the Coin ETH Pool. Source Etherscan

Transactions on the address containing a flash-loan exploit in the Coin ETH Pool. Source EtherscanConic Finance was quick to confirm the news on Twitter. He stated that the platform is currently investigating the exploit and will share updates as soon as they become available.

We are currently investigating an exploit involving the ETH Omnipool and will share updates as soon as they are available.

— Conic Finance (@ConicFinance) July 21, 2023

The altcoin price was hit hard by the news. On the initial reaction, Conic Finance (CNC) price is down more than 35%. Although the altcoin managed to recover a bit later, at press time, it was trading at $4.34, down 22% on a daily basis.

CNC daily price chart / Source: CoinMarketCap

CNC daily price chart / Source: CoinMarketCapPeckshield made a statement about the hack

According to the initial analysis provided by blockchain security firm Peckshield, the root cause stems from the new CurveLPOracleV2 contract. Peckshield shared the following on his Twitter account:

Our audit detected a similar read-only issue. However, the same issue arose with the new CurveLPOracleV2 contract, which was not part of the audit scope.

About an hour after the initial report of the attack, Conic Finance also reported that the platform has disabled ETH Omnipool deposits on the Conic frontend. Curve Finance later said, “We are collaborating with Conic on this issue. We identified the problem. Only the ETH omni-pool is affected here,” he wrote.

cryptocoin.com As you follow, DeFi hacks are nothing new to the industry. DeFi hacks and scams caused hackers to steal more than $204 million in the second quarter of 2023 alone, according to a report by Web3 portfolio app De.Fi. Losses from DeFi hacks and scams were actually less in Q2 than Q1. Meanwhile, CertiK reported over $320 million in losses from January to March.