Bitcoin price skyrocketed to $26,400 in the minutes following the US inflation data for February, which was announced recently.

February US inflation data announced: Bitcoin exceeds $26,000

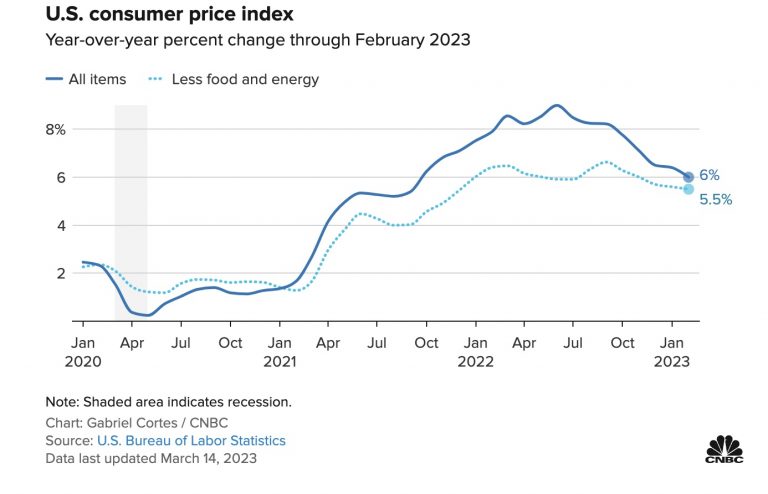

Inflation in the US rose in February, but the increase was in line with expectations. According to a report by the US Department of Labor, the consumer price index (CPI) rose 0.4% in February, bringing the annual inflation rate to 6%. Core CPI excluding food and energy rose 0.5% in February and 5.5% in the last 12 months.

US inflation data was well received in the crypto market, with the largest cryptocurrencies gaining over 10%. Bitcoin price rose 18% to reach 26,400, while Ethereum was up 10% to surpass $1,700. Other cryptocurrencies including OKB, LTC, SOL, DOT and BNB also experienced gains ranging from 5% to 25%.

BTC price peaked

Bitcoin price (BTC) rose to a nine-month high of $26,422.21 in the minutes following the inflation data. The largest cryptocurrency started the weekend of March 10 at just under $20,000. It has gained more than 30% in value in the last 4 days.

“BTC will continue to rise”

Wall Street giants are confident the Fed will cut back on its aggressive rate-raising policy amid the banking crisis in the US. The latest non-farm employment and unemployment data also support a rate hike of 0 or 25 basis points in March. Goldman Sachs, for example, no longer sees any reason to raise interest rates at next week’s meeting, citing “recent stress” in the financial sector. The firm had previously expected the Fed to raise interest rates by 25 basis points.

Analysts believe that the Fed will print money again after the CPI and that Bitcoin will rise parabolic. Others suggest that quantitative easing (QE) is likely to inject liquidity amid the banking crisis in the US following Monday’s closed-door meeting. Fed Chairman Jerome Powell is likely to abandon his rate hike plan this month, creating a positive mood among investors.

Less than a week ago, traders had bet that the Fed would raise the benchmark fed funds rate by 50 basis points at its March meeting. After Silicon Valley Bank went bankrupt on Friday and Signature Bank closed for the weekend, traders quickly rebounded and are now pricing in the lowest odds of any March rate hike and mid-summer rate cut. cryptocoin.comIn this article, we have included the expectations from the FOMC meeting to be held on March 22.