Notable developments continue to occur in the world of Bitcoin and altcoins. The latest developments came from the Chicago Mercantile Exchange (CME). The recent increase in the trading volume of CME’s Bitcoin futures, surpassing Bybit, draws attention. Accordingly, it raises intriguing questions about the potential impact of these transactions on the Bitcoin price. CME is playing an increasingly prominent role in the cryptocurrency world. Its increased influence may therefore have implications for the wider market.

Historical importance of CME for Bitcoin

The debut of CME’s Bitcoin futures contract in 2017 has some significance. It coincided with the period when Bitcoin skyrocketed to its all-time high of $19,800. However, the subsequent market decline highlights the binary nature of CME’s derivative contracts. It also allows both bullish bets through leverage and bearish strategies through short selling.

On the other hand, the Securities and Exchange Commission’s skepticism towards Bitcoin exchange-traded fund (ETF) proposals due to manipulation concerns on unregulated exchanges has led to the growing importance of the CME’s Bitcoin futures market. This importance has encouraged startups like Hashdex to propose a Bitcoin ETF based on transactions on the CME’s regulated market.

Use of Bitcoin derivatives

Professional traders use BTC derivatives to manage risk effectively. Strategies include selling futures contracts while simultaneously buying Bitcoin with stablecoins borrowed on margin. Also, trading longer-term BTC futures while buying perpetual contracts can take advantage of price discrepancies over time.

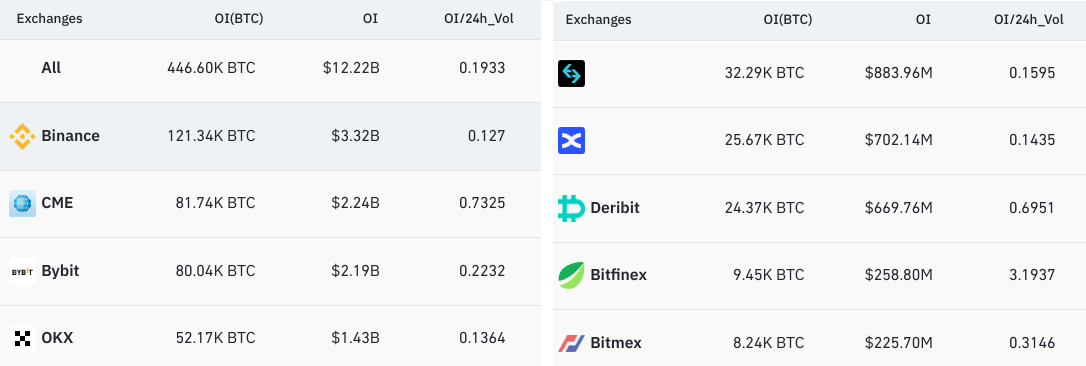

CME’s role in the Bitcoin futures market has evolved significantly. On the other hand, it collected a significant amount of open positions. In recent years, it has been following exchanges such as Binance, OKX, Bybit and Bitget. But CME’s resilience during market turmoil sets it apart. Notably, during the recent Bitcoin price drop, CME was unaffected in terms of open interest. This also elevated it to the second largest trading platform.

Differences and inconsistencies

CME’s custom monthly contracts and cash settlement mechanism contrast with the perpetual swap contracts offered by crypto exchanges. This inequality contributes to the difference in open interest as well as trading dynamics. The daily volume of the CME lags behind the open position. Accordingly, crypto exchanges are witnessing higher trading volumes compared to open interest due to factors such as margin requirements and trading hours.

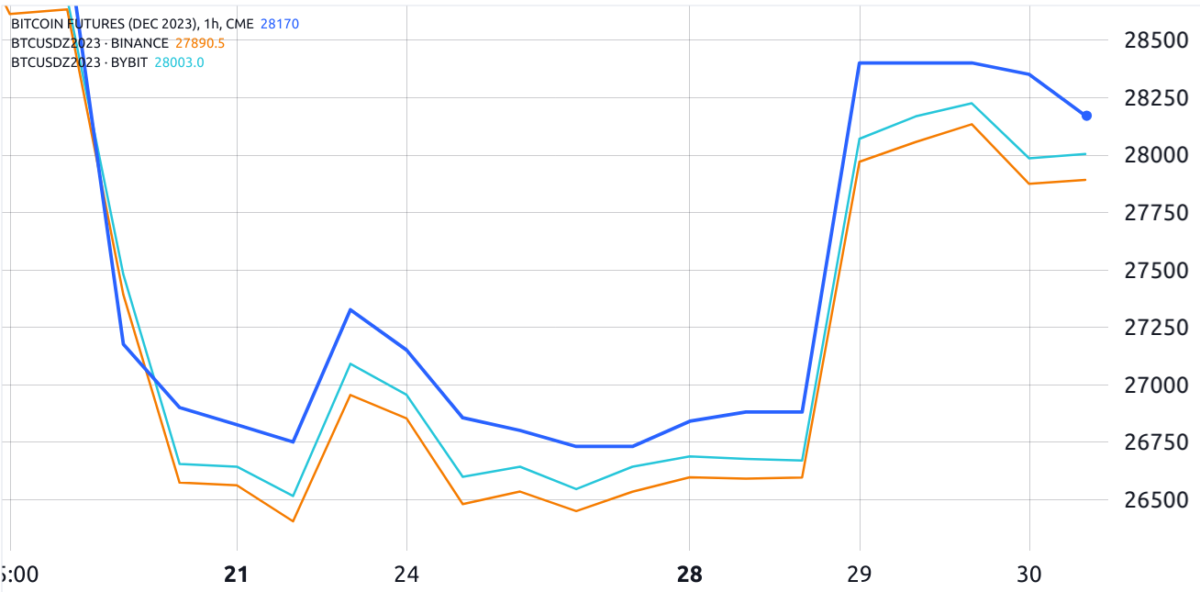

The divergence in trading volumes and pricing between CME and crypto exchanges is evident. Binance and OKX are posting higher daily trading volumes compared to their open positions, driven by various factors. Price differences between exchanges are affected by the demand for leverage. In addition, the Bitcoin index can be affected by price calculation variability. Finally, there is the impact of solvency risks related to margin deposits.

Indicates an important situation

CME’s rising trading volumes point to its growing importance. On the other hand, when we look at cryptokoin.com, the pricing mechanism draws attention. However, this may not fully reflect the price movements of Bitcoin BTC on crypto exchanges.

There is a complex interplay of variables that affect pricing and trading dynamics. Given this interaction, investors should be wary of the CME’s role. On the other hand, they should provide nuanced information about Bitcoin BTC’s price dynamics rather than precise price guidance.