Bitcoin ETF and halving rumors have increased BTC’s demand relative to Ethereum in recent weeks. Meanwhile, the price of Ethereum’s native token Ether fell to a 15-month low against Bitcoin. It is also trading at its lowest level since Ethereum switched to proof-of-stake (PoS). Will it continue to weaken for the rest of 2023? Crypto expert Yashu Gola evaluates ETH’s potential to turn its course upward.

Ethereum price breaks below critical support against Bitcoin

ETH/BTC parity dropped to 0.056 BTC earlier this week. In doing so, the pair broke below its 200-week exponential moving average (200-week EMA; blue wave) near 0.058 BTC, further increasing downside risks heading into 2023. The 200-week EMA has historically served as a reliable support level for ETH/BTC bulls. For example, the Ethereum/Bitcoin pair recovered 75% three months after testing wave support in July 2022. Conversely, it fell over 25% after losing the same support in October 2020.

ETH/BTC weekly price chart. Source: TradingView

ETH/BTC weekly price chart. Source: TradingViewETH/BTC is looking at similar sell risks in 2023 after losing its 200-week EMA as support. In this case, the next downside target lies around the 0.5 Fib line near 0.051 BTC in 2023, a decline of approximately 9.5% from current price levels. Conversely, if ETH price reclaims the 200-week EMA as support, it could rally towards its 50-week EMA (red wave) near 0.065 Bitcoin.

BTC bull case overshadows Ethereum

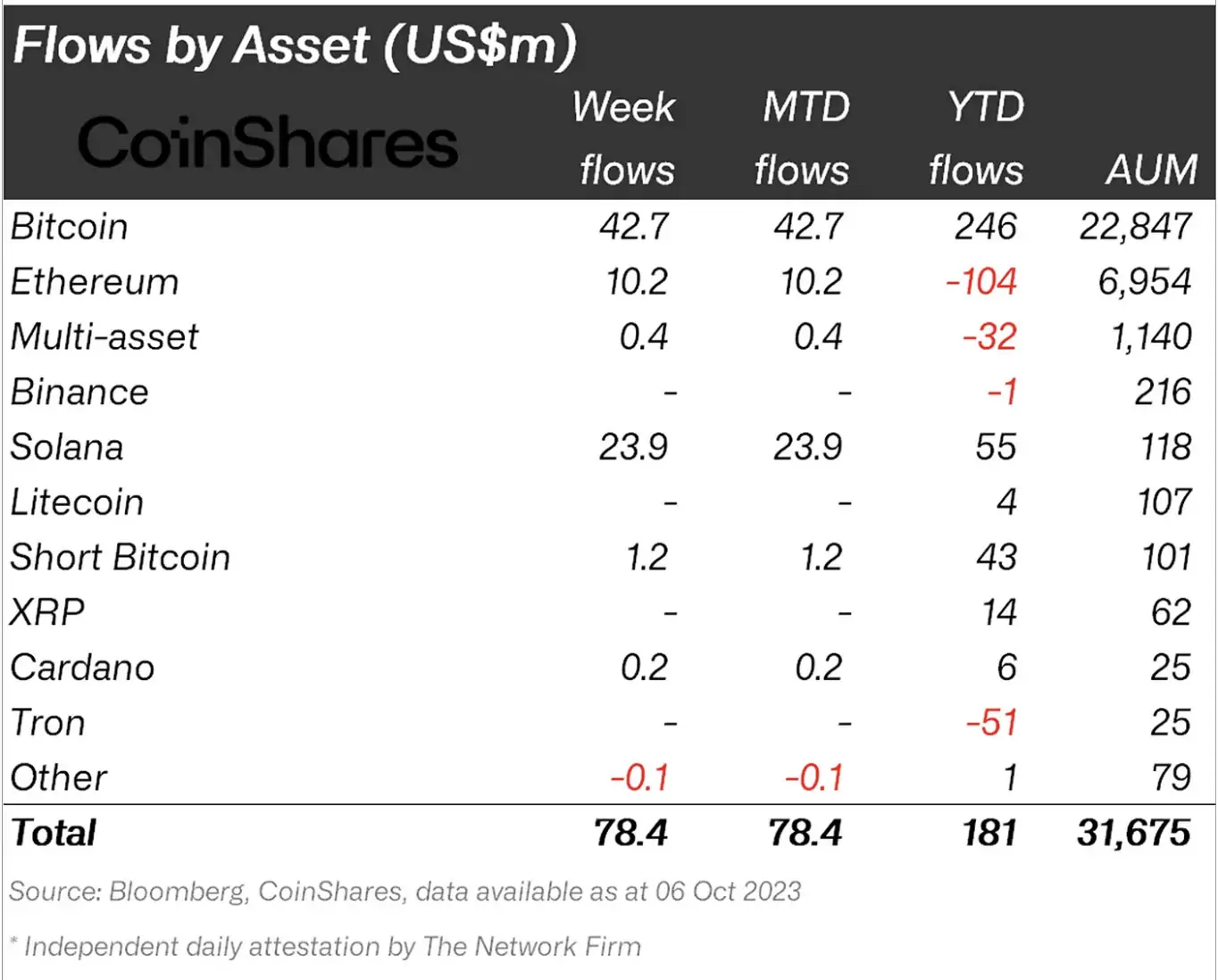

Ethereum’s persistent weakness against Bitcoin is also reflected in institutional capital flow data. For example, as of October 6, Bitcoin-specific investment funds have attracted $246 million year-to-date (YTD), according to CoinShares. On the other hand, Ethereum funds witnessed outflows worth $104 million during the same period. In other words, the leading altcoin lost capital.

Net flows into crypto funds (by asset). Source: CoinShares

Net flows into crypto funds (by asset). Source: CoinSharesMeanwhile, rumors are growing about a potential spot Bitcoin exchange-traded product (ETF) approval in the US. This discrepancy is most likely due to this. Trading experts suggest that a spot Bitcoin ETF launch would attract $600 billion. In addition, cryptokoin.com As you follow from, Bitcoin will have its fourth halving event on April 24, 2024. This acts as a tailwind against the altcoin market. The halving will reduce the block reward for Bitcoin miners from 6.25 BTC to 3,125 BTC. This too will be a bullish case based on historical precedents that halve new supply.

To be informed about the latest developments, follow us twitter ‘ in, Facebook in and Instagram Follow on and Telegram And YouTube Join our channel!