The unlocking process for the popular metaverse coin project Axie Infinity (AXS) has begun. The unlocking process resulted in a drop in price. Here are the details…

Metaverse coin project drops after unlock

Axie Infinity’s AXS cryptocurrency continues its losses ahead of the multi-million dollar blockchain-based, win-to-play project unlocking tokens scheduled on Sunday. According to the data, the AXS price at the time of writing was down 12 percent week on week to $8.22. The cryptocurrency has a total valuation of $941.7 million, making it the third largest coin in the play-to-win and gaming industry, after market leader Decentraland’s MANA and The Sandbox’s SAND.

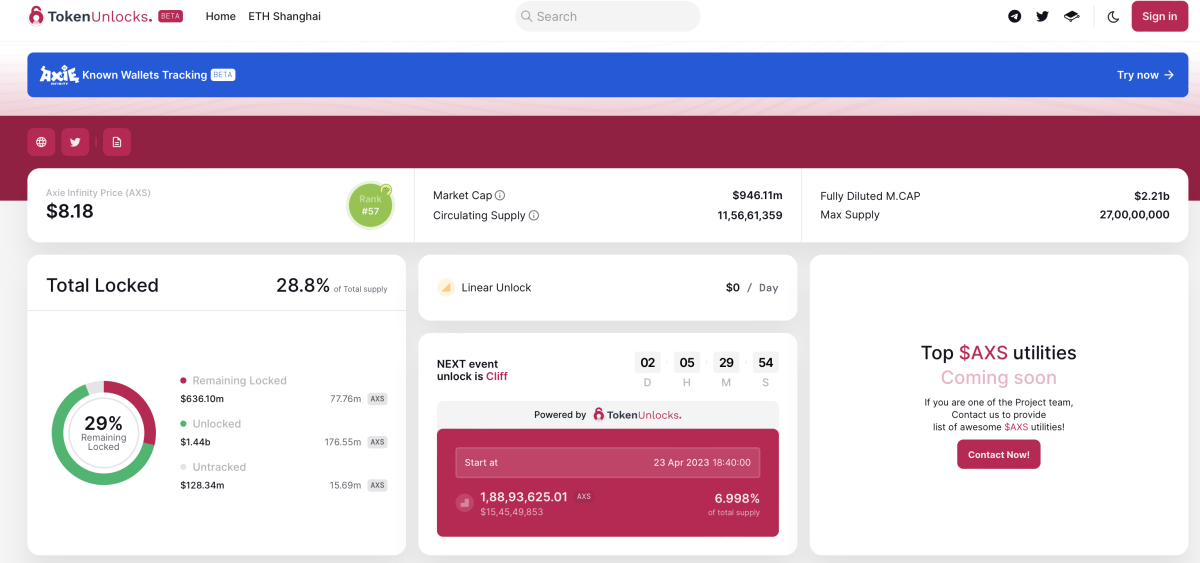

According to data from TokenUnlocks, Axie will release 18.89 million tokens on April 23, which corresponds to 7 percent of the cryptocurrency’s total supply of 270 million and is worth $155.27 million at current exchange rates. Axie unlocked a staggered 65-month token in 2020, and 176.55 million tokens have been made available so far. The remaining 77.76 million tokens will be available by the end of 2025.

Axie Infinity is a blockchain-based trading and war game partially owned and operated by its players. Inspired by popular games like Pokémon and Tamagotchi, Axie Infinity allows players to collect, breed, breed, fight and trade token-based creatures known as Axies. These Axies can take various forms.

What is the importance of unlocking?

cryptocoin.com As we’ve reported, unlocking is widely regarded as a fall catalyst. This is because holders who take advantage of the unlock have the potential to increase the supply in the market by having the opportunity to sell their coins. It is common for early-stage projects to lock up tokens to prevent large holders, often early investors or project team members, from selling their coins all at once and causing a price drop.

Bitcoin and Ethereum also lost value

Still, unlocking doesn’t always lead to lower prices, and in the past AXS has risen on its way to unlock activity. Also, the broader crypto market faced selling pressure this week, with top cryptocurrencies Bitcoin (BTC) and Ethereum (ETH) falling 8 percent and 10 percent respectively. Most play-to-win and gaming tokens have dropped between 5 percent and 10 percent.

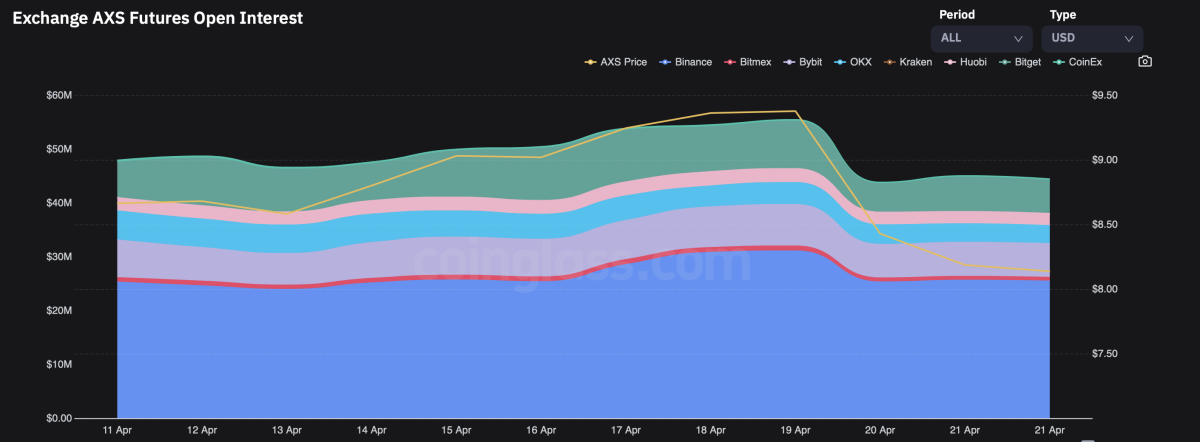

In other words, AXS’s decline appears to be at least partly due to broader risk aversion. Amid AXS’s price drop, the dollar value locked in token-linked futures has dropped nearly 20 percent this week to $44 million, according to data tracked by Coinglass. The decline in both price and open interest indicates that the decline was due to closing bullish positions rather than direct short selling or bearish bets.