For thousands of years, cultures around the world, from the Incas to the Egyptians, have viewed gold as a storehouse of value because of its unique properties and relative scarcity. But these days, it faces some competition from Bitcoin, a new kid on the yellow metal block.

Recently, Bitcoin is not behaving like gold at all

The cryptocurrency often described by its supporters as “digital gold” has some of the characteristics that make gold one of the most important capital savers in history. . It’s hard to mine, it’s scarce, and perhaps most importantly, it has a loyal following that believes it’s valuable.

But lately, Bitcoin hasn’t been behaving like gold at all. In fact, it acts more like a tech stock. The price of the digital asset has fallen by more than 38% to date, while gold prices have increased by 3% over the same period. It also continues to show a correlation with the tech-heavy Nasdaq, which has lost 25% since the beginning of the year.

“Bitcoin has significant upside potential”

Still, the recent drop in Bitcoin has had a way to do this. Even if it does get a margin loan, it hasn’t stopped its supporters from buying the cryptocurrency. And now Bitcoin is getting much-needed support from some of the big names on Wall Street, including JPMorgan Chase.

strategists at the investment bank led by Nikolaos Panigirtzoglou say in a note Wednesday that they believe Bitcoin has “significant upside potential” after this year’s plunge.

“Both Bitcoin and gold played their alternative role after the virus crisis”

Panigirtzoglou and his team, an ‘alternative’ similar to Bitcoin’s gold He argues that by becoming a currency, many of his supporters can make their dreams come true. Strategists make the following assessment:

After the Lehman crisis, gold played the role of an ‘alternative’ currency. After the virus crisis, both Bitcoin and gold played this role.

Good news for bitcoin bulls?

JPMorgan argues that as Bitcoin survived the ‘long winter’ of 2018 when prices fell more than 70%, institutional investors now have ‘increased confidence’ that there will be a market for digital currency .

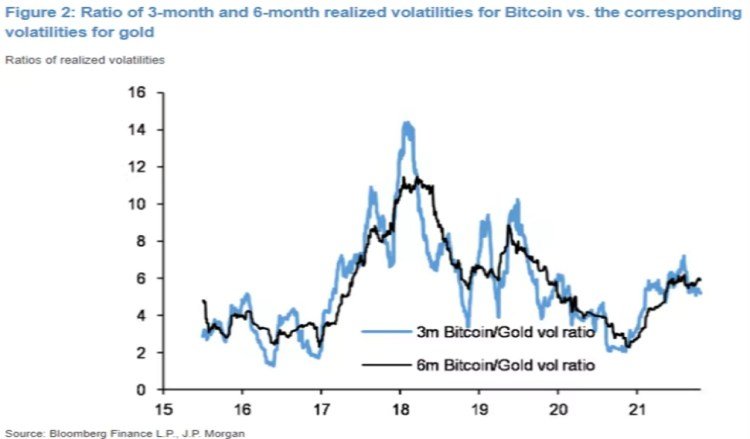

Investment bank strategists add that the total market value of Bitcoin and gold may eventually equalize as they serve the same purpose. However, according to strategists, since volatility is so critical when it comes to risk management of institutional investors, the market value of Bitcoin held by institutions will likely not reach the gold level until volatility subsides. Good news for Bitcoin bulls? Strategists point out that this is already happening and show the graph below.

3-month and 6-month rates / Bitcoin volatility ratio against Gold volatility

3-month and 6-month rates / Bitcoin volatility ratio against Gold volatility Anti-BTC Nouriel Roubini creates his own digital currency!

Of course, Bitcoin always has its bad guys. Due to his pessimistic views, Dr. Economist Nouriel Roubini, an NYU professor known as Doom, describes Bitcoin as the ‘mother of all bubbles’ and ‘the most overrated and least useful technology in human history’. He argues that it represents pure market speculation as it is not backed by anything.

Now, though, oddly enough, Roubini is working on its own digital currency, the USG, which it calls the ‘United Sovereign Governance Gold-Optimized Dollar’ or tokenized dollar exchange. With Dubai-based Atlas Capital Team LP, of which he co-founded two years ago, the professor strives to create what he sees as a more robust ‘global store of value’.

“Needs something to replace treasures”

Similar to bitcoiners, the US government ‘prints too much money’ and argues that this will ultimately lead to currency devaluation. As a result, he says, there is a need for “something to replace the treasures.” However, Nouriel Roubini’s token will be backed by real estate assets, gold and US government bonds.

Whether a token like Nouriel Roubini’s will begin to evolve and exclude Bitcoin is up for debate. But clearly institutions and economists in general are changing their views on the potential of digital assets, which could accelerate adoption.

“This development could lead to the collapse of the entire industry, including BTC”

However, some experts believe that cryptocurrencies should continue to decline. warns about Jay Hatfield, chief investment officer of Infrastructure Capital Management, says crypto backers may sooner or later face various regulations, as reported in Kriptokoin.com news, which could lead to the collapse of the entire industry. Hatfield explains:

Since Article One of the Constitution expressly prohibits the creation of competing currencies, crypto tokens can be issued as unregistered securities, posing a significant liability for crypto supporters. In fact, the EU securities regulator called for the speedy conclusion of investor protection regulations this morning.

Jay Hatfield, who also shared his price prediction for the leading crypto, expects Bitcoin to drop below $20,000 this year.